Occupancy Tax Report Form

ADVERTISEMENT

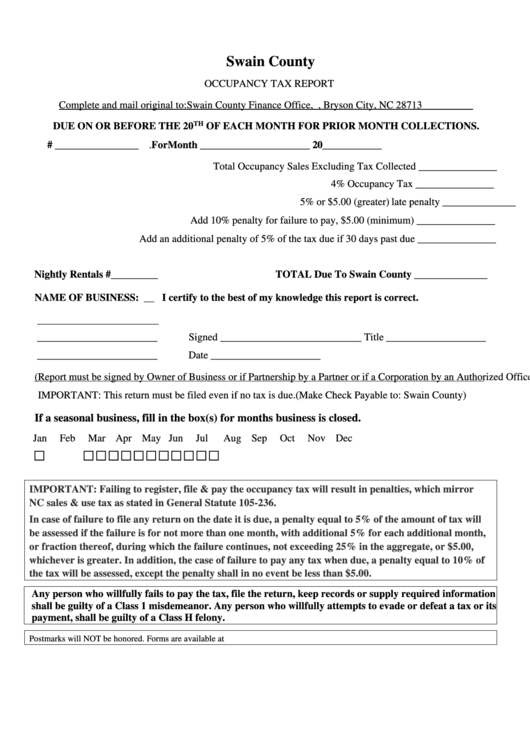

Swain County

OCCUPANCY TAX REPORT

Complete and mail original to: Swain County Finance Office, P.O. Box 2321, Bryson City, NC 28713

TH

DUE ON OR BEFORE THE 20

OF EACH MONTH FOR PRIOR MONTH COLLECTIONS.

I.D. # ________________ .

For Month _____________________ 20____________

Total Occupancy Sales Excluding Tax Collected _______________

4% Occupancy Tax _______________

5% or $5.00 (greater) late penalty ______________

Add 10% penalty for failure to pay, $5.00 (minimum) _______________

Add an additional penalty of 5% of the tax due if 30 days past due _______________

Nightly Rentals #_________

TOTAL Due To Swain County ______________

NAME OF BUSINESS: __

I certify to the best of my knowledge this report is correct.

_____________________

_______________________

Signed ___________________________ Title ___________________

_______________________

Date _____________________

(Report must be signed by Owner of Business or if Partnership by a Partner or if a Corporation by an Authorized Officer.)

IMPORTANT: This return must be filed even if no tax is due.

(Make Check Payable to: Swain County)

If a seasonal business, fill in the box(s) for months business is closed.

Jan

Feb

Mar Apr May Jun

Jul

Aug Sep

Oct

Nov Dec

□ □ □ □ □ □ □ □ □ □ □ □

IMPORTANT: Failing to register, file & pay the occupancy tax will result in penalties, which mirror

NC sales & use tax as stated in General Statute 105-236.

In case of failure to file any return on the date it is due, a penalty equal to 5% of the amount of tax will

be assessed if the failure is for not more than one month, with additional 5% for each additional month,

or fraction thereof, during which the failure continues, not exceeding 25% in the aggregate, or $5.00,

whichever is greater. In addition, the case of failure to pay any tax when due, a penalty equal to 10% of

the tax will be assessed, except the penalty shall in no event be less than $5.00.

Any person who willfully fails to pay the tax, file the return, keep records or supply required information

shall be guilty of a Class 1 misdemeanor. Any person who willfully attempts to evade or defeat a tax or its

payment, shall be guilty of a Class H felony.

Postmarks will NOT be honored. Forms are available at swaincountync.gov

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1