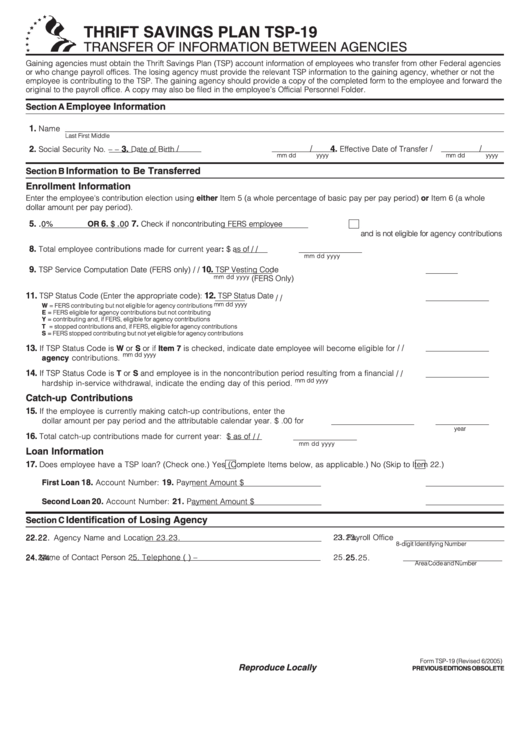

Form Tsp-19 - Transfer Of Information Between Agencies - Thrift Savings Plan

ADVERTISEMENT

THRIFT SAVINGS PLAN

TSP-19

TRANSFER OF INFORMATION BETWEEN AGENCIES

Gaining agencies must obtain the Thrift Savings Plan (TSP) account information of employees who transfer from other Federal agencies

or who change payroll offices. The losing agency must provide the relevant TSP information to the gaining agency, whether or not the

employee is contributing to the TSP. The gaining agency should provide a copy of the completed form to the employee and forward the

original to the payroll office. A copy may also be filed in the employee’s Official Personnel Folder.

Employee Information

Section A

1.

Name

Last

First

Middle

2.

3.

/

/

4.

/

/

Social Security No.

–

–

Date of Birth

Effective Date of Transfer

mm

dd

yyyy

mm

dd

yyyy

Information to Be Transferred

Section B

Enrollment Information

Enter the employee's contribution election using either Item 5 (a whole percentage of basic pay per pay period) or Item 6 (a whole

dollar amount per pay period).

5.

.

6.

.

7.

0%

OR

$

00

Check if noncontributing FERS employee

and is not eligible for agency contributions

8.

Total employee contributions made for current year:

$

as of

/

/

mm

dd

yyyy

9.

10.

TSP Service Computation Date (FERS only)

/

/

TSP Vesting Code

mm

dd

yyyy

(FERS Only)

11.

12.

TSP Status Code (Enter the appropriate code):

TSP Status Date

/

/

mm

dd

yyyy

W = FERS contributing but not eligible for agency contributions

E = FERS eligible for agency contributions but not contributing

Y = contributing and, if FERS, eligible for agency contributions

T = stopped contributions and, if FERS, eligible for agency contributions

S = FERS stopped contributing but not yet eligible for agency contributions

13.

/

/

If TSP Status Code is W or S or if Item 7 is checked, indicate date employee will become eligible for

mm

dd

yyyy

agency contributions.

14.

If TSP Status Code is T or S and employee is in the noncontribution period resulting from a financial

/

/

mm

dd

yyyy

hardship in-service withdrawal, indicate the ending day of this period.

Catch-up Contributions

15.

If the employee is currently making catch-up contributions, enter the

dollar amount per pay period and the attributable calendar year.

$

.00

for

year

16.

Total catch-up contributions made for current year: $

as of

/

/

mm

dd

yyyy

Loan Information

17.

Does employee have a TSP loan? (Check one.)

Yes (Complete Items below, as applicable.)

No (Skip to Item 22.)

18.

19.

First Loan

Account Number:

Payment Amount $

Second Loan

20.

Account Number:

21.

Payment Amount $

Identification of Losing Agency

Section C

22.

22.

22.

22.

22. Agency Name and Location

23.

23.

23.

23.

23. Payroll Office

8-digit Identifying Number

24. Name of Contact Person

24.

24.

24.

24.

25. Telephone

25.

25.

25.

25.

(

)

–

Area Code and Number

Form TSP-19 (Revised 6/2005)

Reproduce Locally

PREVIOUS EDITIONS OBSOLETE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2