Form Wv/mft-509b Home - Motor Fuel Excise Tax Refund Application For Consumers Of Clear Kerosene Used For Heating Of Public/private Dwellings

ADVERTISEMENT

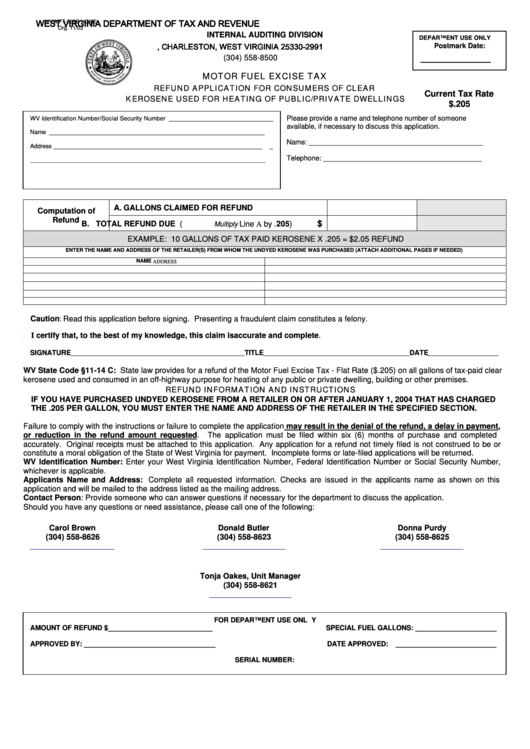

WEST VIRGINIA DEPARTMENT OF TAX AND REVENUE

WV/MFT-509B HOME

Org. 11/03

INTERNAL AUDITING DIVISION

DEPARTMENT USE ONLY

P.O. BOX 2991, CHARLESTON, WEST VIRGINIA 25330-2991

Postmark Date:

(304) 558-8500

MOTOR FUEL EXCISE TAX

REFUND APPLICATION FOR CONSUMERS OF CLEAR

Current Tax Rate

KEROSENE USED FOR HEATING OF PUBLIC/PRIVATE DWELLINGS

$.205

Please provide a name and telephone number of someone

WV Identification Number/Social Security Number _______________________________

available, if necessary to discuss this application.

Name __________________________________________________________________

Name: _____________________________________________

Address _________________________________________________________________

Telephone: _________________________________________

________________________________________________________________________

A.

GALLONS CLAIMED FOR REFUND

Computation of

Refund

$

B. TOTAL REFUND DUE (

Line A by .205)

Multiply

EXAMPLE: 10 GALLONS OF TAX PAID KEROSENE X .205 = $2.05 REFUND

ENTER THE NAME AND ADDRESS OF THE RETAILER(S) FROM WHOM THE UNDYED KEROSENE WAS PURCHASED (ATTACH ADDITIONAL PAGES IF NEEDED)

NAME

ADDRESS

Caution

Read this application before signing. Presenting a fraudulent claim constitutes a felony.

:

I I certify that, to the best of my knowledge, this claim is accurate and complete.

SIGNATURE__________________________________________________TITLE__________________________________________DATE

__________________

WV State Code §11-14 C: State law provides for a refund of the Motor Fuel Excise Tax - Flat Rate ($.205) on all gallons of tax-paid clear

kerosene used and consumed in an off-highway purpose for heating of any public or private dwelling, building or other premises.

REFUND INFORMATION AND INSTRUCTIONS

IF YOU HAVE PURCHASED UNDYED KEROSENE FROM A RETAILER ON OR AFTER JANUARY 1, 2004 THAT HAS CHARGED

THE .205 PER GALLON, YOU MUST ENTER THE NAME AND ADDRESS OF THE RETAILER IN THE SPECIFIED SECTION.

Failure to comply with the instructions or failure to complete the application may result in the denial of the refund, a delay in payment,

or reduction in the refund amount requested.

The application must be filed within six (6) months of purchase and completed

accurately. Original receipts must be attached to this application. Any application for a refund not timely filed is not construed to be or

constitute a moral obligation of the State of West Virginia for payment. Incomplete forms or late-filed applications will be returned.

WV Identification Number: Enter your West Virginia Identification Number, Federal Identification Number or Social Security Number,

whichever is applicable.

Applicants Name and Address: Complete all requested information. Checks are issued in the applicants name as shown on this

application and will be mailed to the address listed as the mailing address.

Contact Person: Provide someone who can answer questions if necessary for the department to discuss the application.

Should you have any questions or need assistance, please call one of the following:

Carol Brown

Donald Butler

Donna Purdy

(304) 558-8626

(304) 558-8623

(304) 558-8625

cbrown@tax.state.wv.us

dbutler@tax.state.wv.us

dpurdy@tax.state.wv.us

Tonja Oakes, Unit Manager

(304) 558-8621

toakes@tax.state.wv.us

FOR DEPARTMENT USE ONLY

AMOUNT OF REFUND $___________________________

SPECIAL FUEL GALLONS: _____________________

APPROVED BY: __________________________________

DATE APPROVED:

__________________________

SERIAL NUMBER:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1