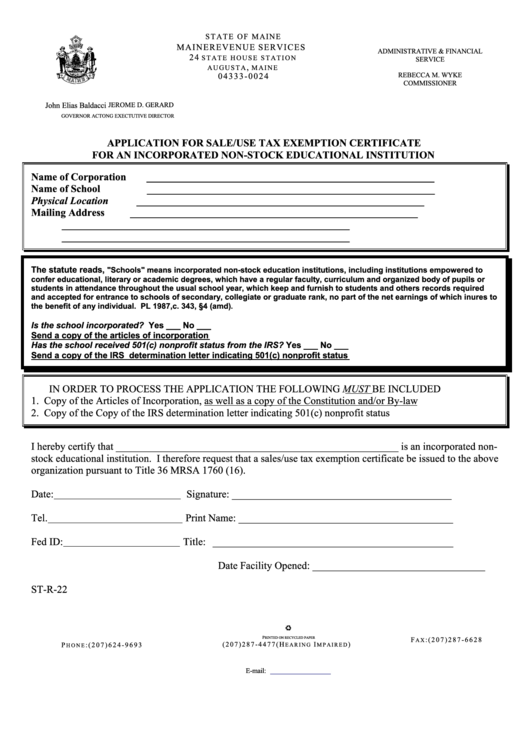

Form St-R-22 - Application For Sale/use Tax Exemption Certificate For An Incorporated Non-Stock Educational Institution

ADVERTISEMENT

S T A T E O F M A I N E

M A I N E R E V E N U E S E R V I C E S

ADMINISTRATIVE & FINANCIAL

2 4

S T A T E H O U S E S T A T I O N

SERVICE

,

A U G U S T A

M A I N E

REBECCA M. WYKE

0 4 3 3 3 - 0 0 24

COMMISSIONER

John Elias Baldacci

JEROME D. GERARD

GOVERNOR

ACTONG EXECTUTIVE DIRECTOR

APPLICATION FOR SALE/USE TAX EXEMPTION CERTIFICATE

FOR AN INCORPORATED NON-STOCK EDUCATIONAL INSTITUTION

Name of Corporation

_______________________________________________________

Name of School

_______________________________________________________

Physical Location

_______________________________________________________

Mailing Address

_______________________________________________________

_______________________________________________________

_______________________________________________________

The statute reads,

"Schools" means incorporated non-stock education institutions, including institutions empowered to

confer educational, literary or academic degrees, which have a regular faculty, curriculum and organized body of pupils or

students in attendance throughout the usual school year, which keep and furnish to students and others records required

and accepted for entrance to schools of secondary, collegiate or graduate rank, no part of the net earnings of which inures to

the benefit of any individual. PL 1987,c. 343, §4 (amd)

.

Is the school incorporated? Yes ___ No ___

Send a copy of the articles of incorporation

Has the school received 501(c) nonprofit status from the IRS? Yes ___ No ___

Send a copy of the IRS determination letter indicating 501(c) nonprofit status

IN ORDER TO PROCESS THE APPLICATION THE FOLLOWING MUST BE INCLUDED

1. Copy of the Articles of Incorporation, as well as a copy of the Constitution and/or By-law

2. Copy of the Copy of the IRS determination letter indicating 501(c) nonprofit status

I hereby certify that ______________________________________________________ is an incorporated non-

stock educational institution. I therefore request that a sales/use tax exemption certificate be issued to the above

organization pursuant to Title 36 MRSA 1760 (16).

Date:

Signature: __________________________________________

Tel.

Print Name: _________________________________________

Fed ID:

Title: ______________________________________________

Date Facility Opened: _________________________________

ST-R-22

P

RINTED ON RECYCLED PAPER

F

: ( 2 0 7 ) 2 8 7 - 6 6 2 8

A X

( 2 0 7 ) 2 8 7 - 4 4 7 7 ( H

I

)

P

: ( 2 0 7 ) 6 2 4 - 9 6 9 3

E A R I N G

M P A I R E D

H O N E

E-mail:

sales.tax@state.me.us

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1