Tax Liability Bond Form

ADVERTISEMENT

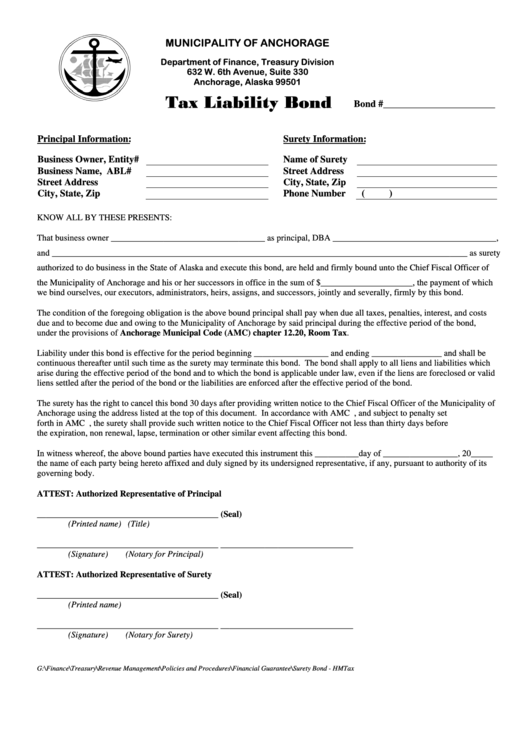

MUNICIPALITY OF ANCHORAGE

Department of Finance, Treasury Division

632 W. 6th Avenue, Suite 330

Anchorage, Alaska 99501

Tax Liability Bond

Bond #_______________________

Principal Information:

Surety Information:

Business Owner, Entity#

Name of Surety

Business Name, ABL#

Street Address

Street Address

City, State, Zip

City, State, Zip

Phone Number

(

)

KNOW ALL BY THESE PRESENTS:

That business owner ___________________________________ as principal, DBA _____________________________________,

and ______________________________________________________________________________________________ as surety

authorized to do business in the State of Alaska and execute this bond, are held and firmly bound unto the Chief Fiscal Officer of

the Municipality of Anchorage and his or her successors in office in the sum of $_____________________, the payment of which

we bind ourselves, our executors, administrators, heirs, assigns, and successors, jointly and severally, firmly by this bond.

The condition of the foregoing obligation is the above bound principal shall pay when due all taxes, penalties, interest, and costs

due and to become due and owing to the Municipality of Anchorage by said principal during the effective period of the bond,

under the provisions of Anchorage Municipal Code (AMC) chapter 12.20, Room Tax.

Liability under this bond is effective for the period beginning _________________ and ending ________________ and shall be

continuous thereafter until such time as the surety may terminate this bond. The bond shall apply to all liens and liabilities which

arise during the effective period of the bond and to which the bond is applicable under law, even if the liens are foreclosed or valid

liens settled after the period of the bond or the liabilities are enforced after the effective period of the bond.

The surety has the right to cancel this bond 30 days after providing written notice to the Chief Fiscal Officer of the Municipality of

Anchorage using the address listed at the top of this document. In accordance with AMC 12.20.035.B., and subject to penalty set

forth in AMC 12.20.110.G., the surety shall provide such written notice to the Chief Fiscal Officer not less than thirty days before

the expiration, non renewal, lapse, termination or other similar event affecting this bond.

In witness whereof, the above bound parties have executed this instrument this __________day of _________________, 20_____

the name of each party being hereto affixed and duly signed by its undersigned representative, if any, pursuant to authority of its

governing body.

ATTEST: Authorized Representative of Principal

_________________________________________

(Seal)

(Printed name)

(Title)

_________________________________________

______________________________

(Signature)

(Notary for Principal)

ATTEST: Authorized Representative of Surety

_________________________________________

(Seal)

(Printed name)

_________________________________________

______________________________

(Signature)

(Notary for Surety)

G:\Finance\Treasury\Revenue Management\Policies and Procedures\Financial Guarantee\Surety Bond - HMTax v5.doc

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1