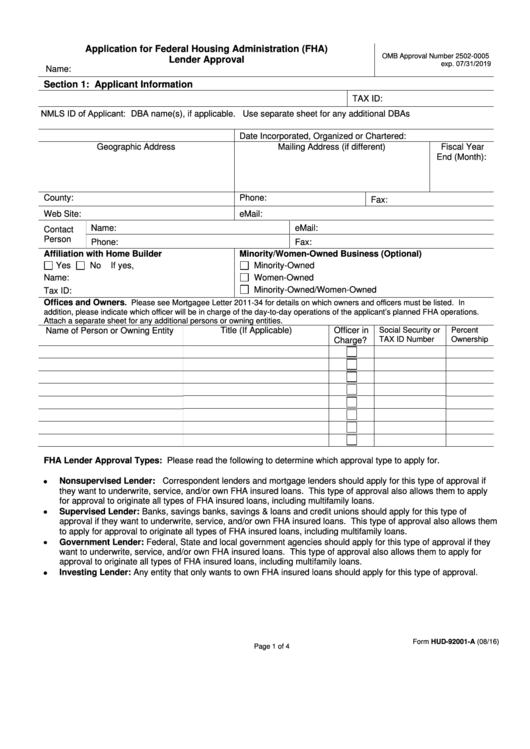

Application for Federal Housing Administration (FHA)

OMB Approval Number 2502-0005

Lender Approval

exp. 07/31/2019

Name:

U.S. Department of Housing and Urban Development

Section 1: Applicant Information

TAX ID:

NMLS ID of Applicant:

DBA name(s), if applicable. Use separate sheet for any additional DBAs

Date Incorporated, Organized or Chartered:

Geographic Address

Mailing Address (if different)

Fiscal Year

End (Month):

County:

Phone:

Fax:

Web Site:

eMail:

Name:

eMail:

Contact

Person

Phone:

Fax:

Affiliation with Home Builder

Minority/Women-Owned Business (Optional)

Yes

No

If yes,

Minority-Owned

Women-Owned

Name:

Minority-Owned/Women-Owned

Tax ID:

Offices and Owners

. Please see Mortgagee Letter 2011-34 for details on which owners and officers must be listed. In

addition, please indicate which officer will be in charge of the day-to-day operations of the applicant’s planned FHA operations.

Attach a separate sheet for any additional persons or owning entities.

Name of Person or Owning Entity

Title (If Applicable)

Officer in

Social Security or

Percent

TAX ID Number

Ownership

Charge?

FHA Lender Approval Types: Please read the following to determine which approval type to apply for.

Nonsupervised Lender: Correspondent lenders and mortgage lenders should apply for this type of approval if

they want to underwrite, service, and/or own FHA insured loans. This type of approval also allows them to apply

for approval to originate all types of FHA insured loans, including multifamily loans.

Supervised Lender: Banks, savings banks, savings & loans and credit unions should apply for this type of

approval if they want to underwrite, service, and/or own FHA insured loans. This type of approval also allows them

to apply for approval to originate all types of FHA insured loans, including multifamily loans.

Government Lender: Federal, State and local government agencies should apply for this type of approval if they

want to underwrite, service, and/or own FHA insured loans. This type of approval also allows them to apply for

approval to originate all types of FHA insured loans, including multifamily loans.

Investing Lender: Any entity that only wants to own FHA insured loans should apply for this type of approval.

Form HUD-92001-A (08/16)

Page 1 of 4

1

1 2

2 3

3 4

4