Form Cf2568 - Child Care Subsidy Self-Employment Form - Ministry Of Children And Family Development - British Columbia

ADVERTISEMENT

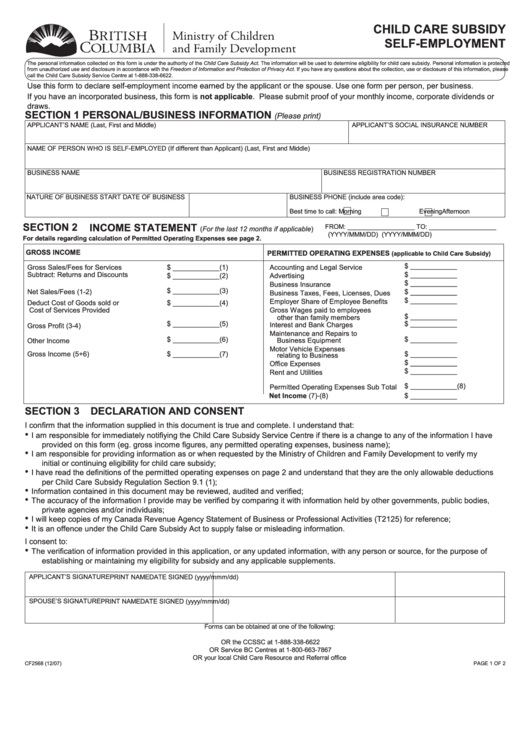

CHILD CARE SUBSIDY

SELF-EMPLOYMENT

The personal information collected on this form is under the authority of the Child Care Subsidy Act. The information will be used to determine eligibility for child care subsidy. Personal information is protected

from unauthorized use and disclosure in accordance with the Freedom of Information and Protection of Privacy Act. If you have any questions about the collection, use or disclosure of this information, please

call the Child Care Subsidy Service Centre at 1-888-338-6622.

Use this form to declare self-employment income earned by the applicant or the spouse. Use one form per person, per business.

If you have an incorporated business, this form is not applicable. Please submit proof of your monthly income, corporate dividends or

draws.

SECTION 1

PERSONAL/BUSINESS INFORMATION

(Please print)

APPLICANT’S NAME (Last, First and Middle)

APPLICANT’S SOCIAL INSURANCE NUMBER

NAME OF PERSON WHO IS SELF-EMPLOYED (If different than Applicant) (Last, First and Middle)

BUSINESS NAME

BUSINESS REGISTRATION NUMBER

NATURE OF BUSINESS

START DATE OF BUSINESS

BUSINESS PHONE (include area code):

Morning

Best time to call:

Afternoon

Evening

SECTION 2

INCOME STATEMENT

FROM: ___________________ TO: ___________________

(For the last 12 months if applicable)

(YYYY/MMM/DD)

(YYYY/MMM/DD)

For details regarding calculation of Permitted Operating Expenses see page 2.

GROSS INCOME

PERMITTED OPERATING EXPENSES

(applicable to Child Care Subsidy)

$ ____________

Gross Sales/Fees for Services

$ ____________(1)

Accounting and Legal Service

Subtract: Returns and Discounts

$ ____________

$ ____________(2)

Advertising

$ ____________

Business Insurance

$ ____________(3)

Net Sales/Fees (1-2)

$ ____________

Business Taxes, Fees, Licenses, Dues

$ ____________

Employer Share of Employee Benefits

Deduct Cost of Goods sold or

$ ____________(4)

Cost of Services Provided

Gross Wages paid to employees

$ ____________

other than family members

$ ____________(5)

$ ____________

Interest and Bank Charges

Gross Profit (3-4)

Maintenance and Repairs to

$ ____________

$ ____________(6)

Business Equipment

Other Income

Motor Vehicle Expenses

Gross Income (5+6)

$ ____________(7)

$ ____________

relating to Business

$ ____________

Office Expenses

$ ____________

Rent and Utilities

$ ____________(8)

Permitted Operating Expenses Sub Total

Net Income (7)-(8)

$ ____________

SECTION 3

DECLARATION AND CONSENT

I confirm that the information supplied in this document is true and complete. I understand that:

•

I am responsible for immediately notifiying the Child Care Subsidy Service Centre if there is a change to any of the information I have

provided on this form (eg. gross income figures, any permitted operating expenses, business name);

•

I am responsible for providing information as or when requested by the Ministry of Children and Family Development to verify my

initial or continuing eligibility for child care subsidy;

•

I have read the definitions of the permitted operating expenses on page 2 and understand that they are the only allowable deductions

per Child Care Subsidy Regulation Section 9.1 (1);

•

Information contained in this document may be reviewed, audited and verified;

•

The accuracy of the information I provide may be verified by comparing it with information held by other governments, public bodies,

private agencies and/or individuals;

•

I will keep copies of my Canada Revenue Agency Statement of Business or Professional Activities (T2125) for reference;

•

It is an offence under the Child Care Subsidy Act to supply false or misleading information.

I consent to:

•

The verification of information provided in this application, or any updated information, with any person or source, for the purpose of

establishing or maintaining my eligibility for subsidy and any applicable supplements.

APPLICANT’S SIGNATURE

PRINT NAME

DATE SIGNED (yyyy/mmm/dd)

SPOUSE’S SIGNATURE

PRINT NAME

DATE SIGNED (yyyy/mmm/dd)

Forms can be obtained at one of the following:

OR the CCSSC at 1-888-338-6622

OR Service BC Centres at 1-800-663-7867

OR your local Child Care Resource and Referral office

CF2568 (12/07)

PAGE 1 OF 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2