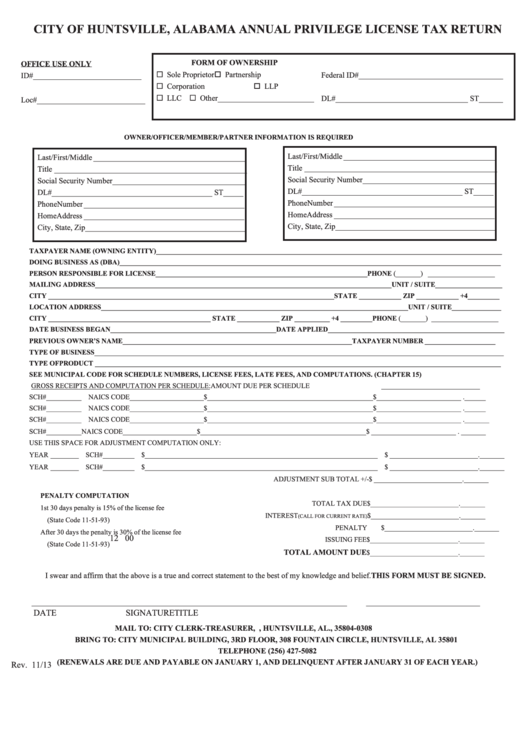

CITY OF HUNTSVILLE, ALABAMA ANNUAL PRIVILEGE LICENSE TAX RETURN

FORM OF OWNERSHIP

OFFICE USE ONLY

¨ Sole Proprietor

o Partnership

Federal ID#____________________________________

ID#___________________________

¨ Corporation

o LLP

¨ LLC ¨ Other________________________

DL#_________________________________ ST______

Loc#___________________________

OWNER/OFFICER/MEMBER/PARTNER INFORMATION IS REQUIRED

Last/First/Middle ______________________________________

Last/First/Middle ______________________________________

Title ________________________________________________

Title ________________________________________________

Social Security Number_________________________________

Social Security Number_________________________________

DL#________________________________________ ST _____

DL#________________________________________ ST _____

Phone Number ________________________________________

Phone Number ________________________________________

Home Address ________________________________________

Home Address ________________________________________

City, State, Zip________________________________________

City, State, Zip________________________________________

TAXPAYER NAME (OWNING ENTITY)__________________________________________________________________________________________________

DOING BUSINESS AS (DBA)____________________________________________________________________________________________________________

PERSON RESPONSIBLE FOR LICENSE____________________________________________________________ PHONE (_______) ___________________

MAILING ADDRESS____________________________________________________________________________________UNIT / SUITE ___________________

CITY _________________________________________________________________________________STATE ____________ ZIP ____________ +4 _________

LOCATION ADDRESS_______________________________________________________________________________________UNIT / SUITE ______________

CITY ______________________________________________ STATE ____________ ZIP __________ +4 _________ PHONE (_______) ___________________

DATE BUSINESS BEGAN_______________________________________________DATE APPLIED__________________________________________________

PREVIOUS OWNER’S NAME_________________________________________________________________ TAXPAYER NUMBER ____________________

TYPE OF BUSINESS ____________________________________________________________________________________________________________________

TYPE OF PRODUCT ___________________________________________________________________________________________________________________

SEE MUNICIPAL CODE FOR SCHEDULE NUMBERS, LICENSE FEES, LATE FEES, AND COMPUTATIONS. (CHAPTER 15)

GROSS RECEIPTS AND COMPUTATION PER SCHEDULE:

AMOUNT DUE PER SCHEDULE

SCH#__________ NAICS CODE_____________________ $ _______________________________________________ $ ________________________ .______

SCH#__________ NAICS CODE_____________________ $ _______________________________________________ $ ________________________ .______

SCH#__________ NAICS CODE_____________________ $ _______________________________________________ $ ________________________ ._______

SCH#__________ NAICS CODE_____________________ $ _______________________________________________ $ ________________________ . _______

USE THIS SPACE FOR ADJUSTMENT COMPUTATION ONLY:

YEAR ________ SCH#_________ $__________________________________________________________________ $ _________________________._______

YEAR ________ SCH#_________ $__________________________________________________________________ $ _________________________._______

ADJUSTMENT SUB TOTAL +/-

$ _________________________._______

PENALTY COMPUTATION

TOTAL TAX DUE

$_________________________._______

1st 30 days penalty is 15% of the license fee

INTEREST

$_________________________._______

(CALL FOR CURRENT RATE)

(State Code 11-51-93)

PENALTY

$_________________________._______

After 30 days the penalty is 30% of the license fee

12 00

ISSUING FEE

$_________________________._______

(State Code 11-51-93)

TOTAL AMOUNT DUE

$_________________________._______

I swear and affirm that the above is a true and correct statement to the best of my knowledge and belief. THIS FORM MUST BE SIGNED.

_________________

_______________________________________________________

__________________________

DATE

SIGNATURE

TITLE

MAIL TO: CITY CLERK-TREASURER, P.O. BOX 308, HUNTSVILLE, AL., 35804-0308

BRING TO: CITY MUNICIPAL BUILDING, 3RD FLOOR, 308 FOUNTAIN CIRCLE, HUNTSVILLE, AL 35801

TELEPHONE (256) 427-5082

(RENEWALS ARE DUE AND PAYABLE ON JANUARY 1, AND DELINQUENT AFTER JANUARY 31 OF EACH YEAR.)

Rev. 11/13

1

1