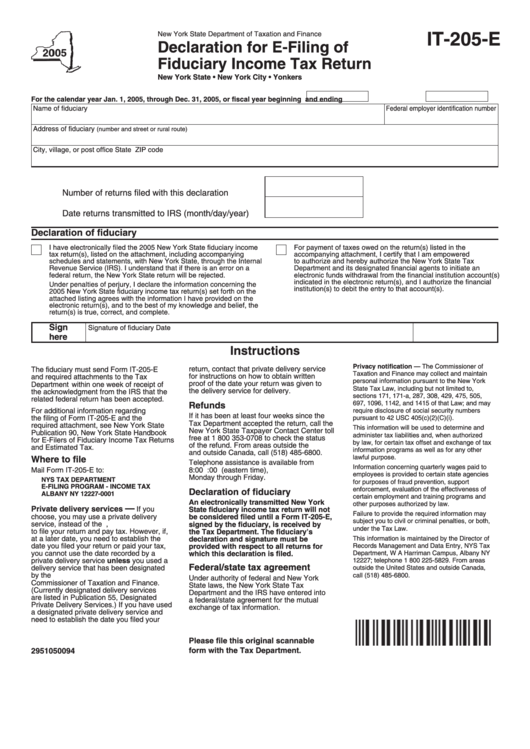

IT-205-E

New York State Department of Taxation and Finance

Declaration for E-Filing of

Fiduciary Income Tax Return

New York State • New York City • Yonkers

For the calendar year Jan. 1, 2005, through Dec. 31, 2005, or fiscal year beginning

and ending

Name of fiduciary

Federal employer identification number

Address of fiduciary

(number and street or rural route)

City, village, or post office

State

ZIP code

Number of returns filed with this declaration

..............

Date returns transmitted to IRS (month/day/year)

....

Declaration of fiduciary

I have electronically filed the 2005 New York State fiduciary income

For payment of taxes owed on the return(s) listed in the

tax return(s), listed on the attachment, including accompanying

accompanying attachment, I certify that I am empowered

schedules and statements, with New York State, through the Internal

to authorize and hereby authorize the New York State Tax

Revenue Service (IRS). I understand that if there is an error on a

Department and its designated financial agents to initiate an

federal return, the New York State return will be rejected.

electronic funds withdrawal from the financial institution account(s)

indicated in the electronic return(s), and I authorize the financial

Under penalties of perjury, I declare the information concerning the

institution(s) to debit the entry to that account(s).

2005 New York State fiduciary income tax return(s) set forth on the

attached listing agrees with the information I have provided on the

electronic return(s), and to the best of my knowledge and belief, the

return(s) is true, correct, and complete.

Sign

Signature of fiduciary

Date

here

Instructions

Privacy notification — The Commissioner of

return, contact that private delivery service

The fiduciary must send Form IT-205-E

Taxation and Finance may collect and maintain

for instructions on how to obtain written

and required attachments to the Tax

personal information pursuant to the New York

proof of the date your return was given to

Department within one week of receipt of

State Tax Law, including but not limited to,

the delivery service for delivery.

the acknowledgment from the IRS that the

sections 171, 171-a, 287, 308, 429, 475, 505,

related federal return has been accepted.

697, 1096, 1142, and 1415 of that Law; and may

Refunds

For additional information regarding

require disclosure of social security numbers

If it has been at least four weeks since the

the filing of Form IT-205-E and the

pursuant to 42 USC 405(c)(2)(C)(i).

Tax Department accepted the return, call the

required attachment, see New York State

This information will be used to determine and

New York State Taxpayer Contact Center toll

Publication 90, New York State Handbook

administer tax liabilities and, when authorized

free at 1 800 353-0708 to check the status

for E-Filers of Fiduciary Income Tax Returns

by law, for certain tax offset and exchange of tax

of the refund. From areas outside the U.S.

and Estimated Tax.

information programs as well as for any other

and outside Canada, call (518) 485-6800.

lawful purpose.

Where to file

Telephone assistance is available from

Information concerning quarterly wages paid to

Mail Form IT-205-E to:

8:00 a.m. to 5:00 p.m. (eastern time),

employees is provided to certain state agencies

Monday through Friday.

NYS TAX DEPARTMENT

for purposes of fraud prevention, support

E-FILING PROGRAM - INCOME TAX

enforcement, evaluation of the effectiveness of

Declaration of fiduciary

ALBANY NY 12227-0001

certain employment and training programs and

An electronically transmitted New York

other purposes authorized by law.

—

Private delivery services

If you

State fiduciary income tax return will not

Failure to provide the required information may

choose, you may use a private delivery

be considered filed until a Form IT-205-E,

subject you to civil or criminal penalties, or both,

service, instead of the U.S. Postal Service,

signed by the fiduciary, is received by

under the Tax Law.

to file your return and pay tax. However, if,

the Tax Department. The fiduciary’s

at a later date, you need to establish the

declaration and signature must be

This information is maintained by the Director of

date you filed your return or paid your tax,

provided with respect to all returns for

Records Management and Data Entry, NYS Tax

you cannot use the date recorded by a

which this declaration is filed.

Department, W A Harriman Campus, Albany NY

private delivery service unless you used a

12227; telephone 1 800 225-5829. From areas

Federal/state tax agreement

delivery service that has been designated

outside the United States and outside Canada,

by the U.S. Secretary of the Treasury or the

call (518) 485-6800.

Under authority of federal and New York

Commissioner of Taxation and Finance.

State laws, the New York State Tax

(Currently designated delivery services

Department and the IRS have entered into

are listed in Publication 55, Designated

a federal/state agreement for the mutual

Private Delivery Services.) If you have used

exchange of tax information.

a designated private delivery service and

need to establish the date you filed your

Please file this original scannable

form with the Tax Department.

2951050094

1

1