Form Sba 177 - Affidavit Of Debt Paid

ADVERTISEMENT

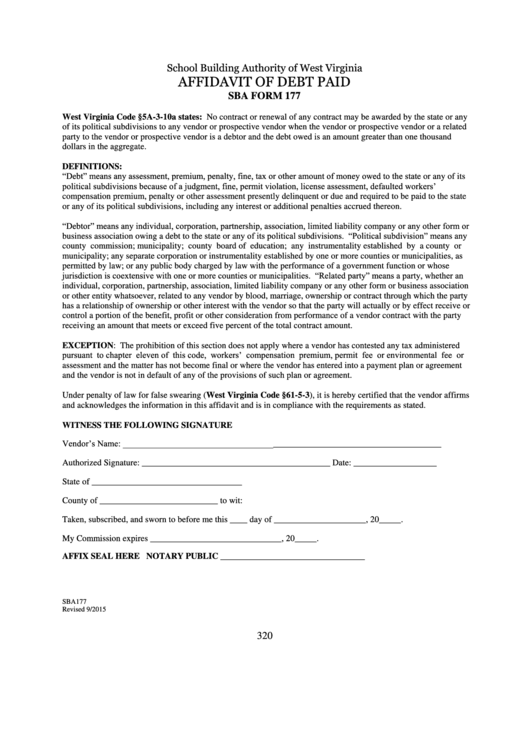

School Building Authority of West Virginia

AFFIDAVIT OF DEBT PAID

SBA FORM 177

West Virginia Code §5A-3-10a states: No contract or renewal of any contract may be awarded by the state or any

of its political subdivisions to any vendor or prospective vendor when the vendor or prospective vendor or a related

party to the vendor or prospective vendor is a debtor and the debt owed is an amount greater than one thousand

dollars in the aggregate.

DEFINITIONS:

“Debt” means any assessment, premium, penalty, fine, tax or other amount of money owed to the state or any of its

political subdivisions because of a judgment, fine, permit violation, license assessment, defaulted workers’

compensation premium, penalty or other assessment presently delinquent or due and required to be paid to the state

or any of its political subdivisions, including any interest or additional penalties accrued thereon.

“Debtor” means any individual, corporation, partnership, association, limited liability company or any other form or

business association owing a debt to the state or any of its political subdivisions. “Political subdivision” means any

county commission; municipality; county board of education; any instrumentality established by a county or

municipality; any separate corporation or instrumentality established by one or more counties or municipalities, as

permitted by law; or any public body charged by law with the performance of a government function or whose

jurisdiction is coextensive with one or more counties or municipalities. “Related party” means a party, whether an

individual, corporation, partnership, association, limited liability company or any other form or business association

or other entity whatsoever, related to any vendor by blood, marriage, ownership or contract through which the party

has a relationship of ownership or other interest with the vendor so that the party will actually or by effect receive or

control a portion of the benefit, profit or other consideration from performance of a vendor contract with the party

receiving an amount that meets or exceed five percent of the total contract amount.

EXCEPTION: The prohibition of this section does not apply where a vendor has contested any tax administered

pursuant to chapter eleven of this code, workers’ compensation premium, permit fee or environmental fee or

assessment and the matter has not become final or where the vendor has entered into a payment plan or agreement

and the vendor is not in default of any of the provisions of such plan or agreement.

Under penalty of law for false swearing (West Virginia Code §61-5-3), it is hereby certified that the vendor affirms

and acknowledges the information in this affidavit and is in compliance with the requirements as stated.

WITNESS THE FOLLOWING SIGNATURE

Vendor’s Name: ________________________________________________________________________

Authorized Signature: ___________________________________________ Date: ___________________

State of __________________________________

County of ___________________________ to wit:

Taken, subscribed, and sworn to before me this ____ day of _____________________, 20_____.

My Commission expires ______________________________, 20_____.

AFFIX SEAL HERE

NOTARY PUBLIC _________________________________

SBA177

Revised 9/2015

320

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1