Form Trd-31109 - Employer'S Quarterly Wage, Withholding And Workers' Compensation Fee Report

ADVERTISEMENT

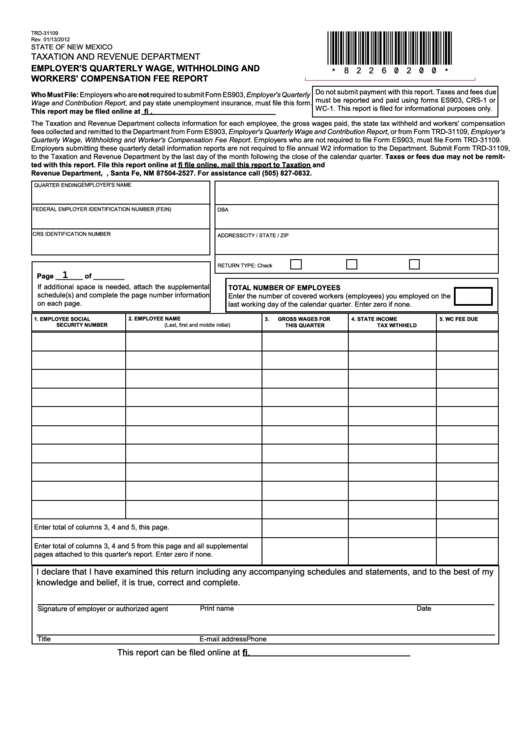

TRD-31109

*82260200*

Rev. 01/13/2012

STATE OF NEW MEXICO

TAXATION AND REVENUE DEPARTMENT

EMPLOYER'S QUARTERLY WAGE, WITHHOLDING AND

WORKERS' COMPENSATION FEE REPORT

Do not submit payment with this report. Taxes and fees due

Who Must File: Employers who are not required to submit Form ES903, Employer's Quarterly

must be reported and paid using forms ES903, CRS-1 or

Wage and Contribution Report, and pay state unemployment insurance, must file this form.

WC-1. This report is filed for informational purposes only.

This report may be filed online at https://efile.state.nm.us/uls2/Logon.aspx.

The Taxation and Revenue Department collects information for each employee, the gross wages paid, the state tax withheld and workers' compensation

fees collected and remitted to the Department from Form ES903, Employer's Quarterly Wage and Contribution Report, or from Form TRD-31109, Employer's

Quarterly Wage, Withholding and Worker's Compensation Fee Report. Employers who are not required to file Form ES903, must file Form TRD-31109.

Employers submitting these quarterly detail information reports are not required to file annual W2 information to the Department. Submit Form TRD-31109,

to the Taxation and Revenue Department by the last day of the month following the close of the calendar quarter. Taxes or fees due may not be remit-

ted with this report. File this report online at https://efile.state.nm.us/uls2/Logon.aspx. If you cannot file online, mail this report to Taxation and

Revenue Department, P.O. Box 2527, Santa Fe, NM 87504-2527. For assistance call (505) 827-0832.

EMPLOYER'S NAME

QUARTER ENDING

FEDERAL EMPLOYER IDENTIFICATION NUMBER (FEIN)

DBA

CRS IDENTIFICATION NUMBER

ADDRESS

CITY / STATE / ZIP

RETURN TYPE: Check one.

ORIGINAL

AMENDED

SUPPLEMENTAL

1

Page _______ of ________

If additional space is needed, attach the supplemental

TOTAL NUMBER OF EMPLOYEES

schedule(s) and complete the page number information

Enter the number of covered workers (employees) you employed on the

on each page.

last working day of the calendar quarter. Enter zero if none.

1.

EMPLOYEE SOCIAL

2.

EMPLOYEE NAME

5.

WC FEE DUE

3.

GROSS WAGES FOR

4.

STATE INCOME

SECURITY NUMBER

(Last, first and middle initial)

THIS QUARTER

TAX WITHHELD

Enter total of columns 3, 4 and 5, this page.

Enter total of columns 3, 4 and 5 from this page and all supplemental

pages attached to this quarter's report. Enter zero if none.

I declare that I have examined this return including any accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct and complete.

Print name

Date

Signature of employer or authorized agent

E-mail address

Phone

Title

This report can be filed online at https://efile.state.nm.us/uls2/Logon.aspx.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2