City Of Vienna, Wv - Business And Occupation Tax Return Form - City Of Vienna, Wv

ADVERTISEMENT

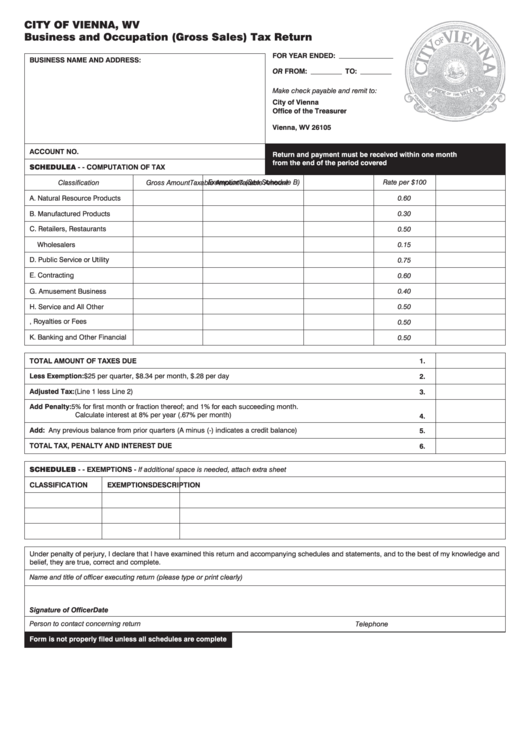

CITY OF VIENNA, WV

Business and Occupation (Gross Sales) Tax Return

FOR YEAR ENDED:

BUSINESS NAME AND ADDRESS:

OR FROM:

TO:

Make check payable and remit to:

City of Vienna

Office of the Treasurer

P .O. Box 5097

Vienna, WV 26105

ACCOUNT NO.

Return and payment must be received within one month

from the end of the period covered

SCHEDULE A - - COMPUTATION OF TAX

Exemptions (See Schedule B)

Rate per $100

Classification

Gross Amount

Taxable Amount

Taxable Amount

A. Natural Resource Products

0.60

B. Manufactured Products

0.30

C. Retailers, Restaurants

0.50

Wholesalers

0.15

D. Public Service or Utility

0.75

E. Contracting

0.60

G. Amusement Business

0.40

0.50

H. Service and All Other

I. Rents, Royalties or Fees

0.50

K. Banking and Other Financial

0.50

TOTAL AMOUNT OF TAXES DUE

1.

Less Exemption: $25 per quarter, $8.34 per month, $.28 per day

2.

Adjusted Tax: (Line 1 less Line 2)

3.

Add Penalty: 5% for first month or fraction thereof; and 1% for each succeeding month.

Calculate interest at 8% per year (.67% per month)

4.

Add: Any previous balance from prior quarters (A minus (-) indicates a credit balance)

5.

TOTAL TAX, PENALTY AND INTEREST DUE

6.

SCHEDULE B - - EXEMPTIONS - If additional space is needed, attach extra sheet

CLASSIFICATION

EXEMPTIONS

DESCRIPTION

Under penalty of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and

belief, they are true, correct and complete.

Name and title of officer executing return (please type or print clearly)

Signature of Officer

Date

Person to contact concerning return

Telephone

Form is not properly filed unless all schedules are complete

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1