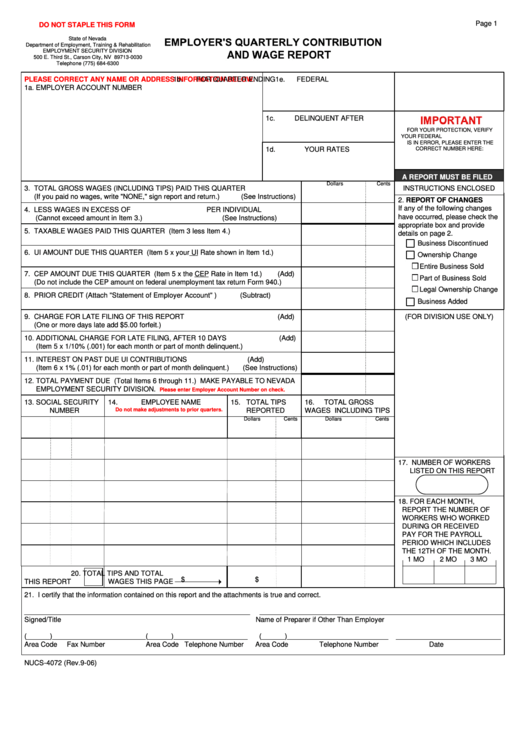

Page 1

DO NOT STAPLE THIS FORM

State of Nevada

Department of Employment, Training & Rehabilitation

EMPLOYMENT SECURITY DIVISION

500 E. Third St., Carson City, NV 89713-0030

Telephone (775) 684-6300

PLEASE CORRECT ANY NAME OR ADDRESS INFORMATION BELOW.

1b.

FOR QUARTER ENDING

1e.

FEDERAL I.D. NO.

1a. EMPLOYER ACCOUNT NUMBER

1c.

DELINQUENT AFTER

FOR YOUR PROTECTION, VERIFY

YOUR FEDERAL I.D. NO. ABOVE. IF IT

IS IN ERROR, PLEASE ENTER THE

1d.

YOUR RATES

CORRECT NUMBER HERE:

A REPORT MUST BE FILED

Dollars

Cents

3. TOTAL GROSS WAGES (INCLUDING TIPS) PAID THIS QUARTER

INSTRUCTIONS ENCLOSED

(If you paid no wages, write "NONE," sign report and return.)

(See Instructions)

2. REPORT OF CHANGES

If any of the following changes

4. LESS WAGES IN EXCESS OF

PER INDIVIDUAL

have occurred, please check the

(Cannot exceed amount in Item 3.)

(See Instructions)

appropriate box and provide

5. TAXABLE WAGES PAID THIS QUARTER (Item 3 less Item 4.)

details on page 2.

Business Discontinued

6. UI AMOUNT DUE THIS QUARTER (Item 5 x your UI Rate shown in Item 1d.)

Ownership Change

Entire Business Sold

7. CEP AMOUNT DUE THIS QUARTER (Item 5 x the CEP Rate in Item 1d.)

(Add)

Part of Business Sold

(Do not include the CEP amount on federal unemployment tax return Form 940.)

Legal Ownership Change

8. PRIOR CREDIT (Attach "Statement of Employer Account" )

(Subtract)

Business Added

9. CHARGE FOR LATE FILING OF THIS REPORT

(Add)

(FOR DIVISION USE ONLY)

(One or more days late add $5.00 forfeit.)

10. ADDITIONAL CHARGE FOR LATE FILING, AFTER 10 DAYS

(Add)

(Item 5 x 1/10% (.001) for each month or part of month delinquent.)

11. INTEREST ON PAST DUE UI CONTRIBUTIONS

(Add)

(Item 6 x 1% (.01) for each month or part of month delinquent.)

(See Instructions)

12. TOTAL PAYMENT DUE (Total Items 6 through 11.) MAKE PAYABLE TO NEVADA

EMPLOYMENT SECURITY DIVISION.

Please enter Employer Account Number on check.

13. SOCIAL SECURITY

14.

EMPLOYEE NAME

15. TOTAL TIPS

16.

TOTAL GROSS

Do not make adjustments to prior quarters.

NUMBER

REPORTED

WAGES INCLUDING TIPS

Dollars

Cents

Dollars

Cents

17. NUMBER OF WORKERS

LISTED ON THIS REPORT

18. FOR EACH MONTH,

REPORT THE NUMBER OF

WORKERS WHO WORKED

DURING OR RECEIVED

PAY FOR THE PAYROLL

PERIOD WHICH INCLUDES

THE 12TH OF THE MONTH.

1 MO

2 MO

3 MO

19.TOTAL PAGES

20. TOTAL TIPS AND TOTAL

$

$

THIS REPORT

WAGES THIS PAGE

21. I certify that the information contained on this report and the attachments is true and correct.

__________________________________________________________

_______________________________________________________________

Signed/Title

Name of Preparer if Other Than Employer

(______)________________________(______)___________________

(______)__________________________

___________________________

Area Code

Fax Number

Area Code Telephone Number

Area Code

Telephone Number

Date

NUCS-4072 (Rev.9-06)

1

1 2

2 3

3