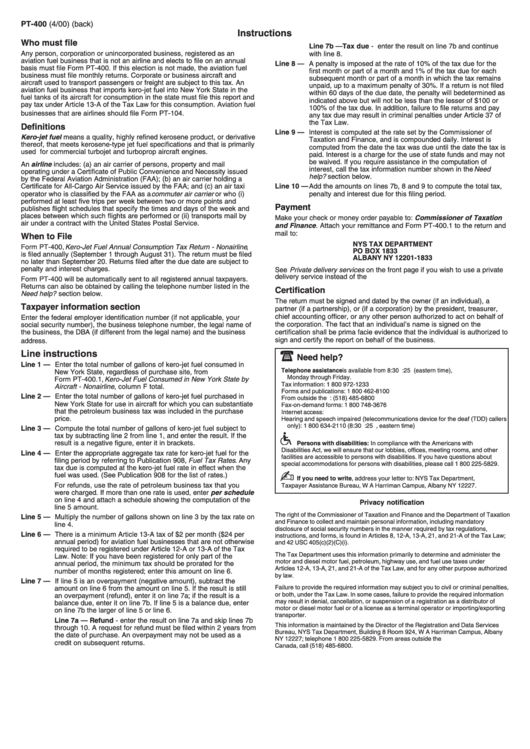

Form Pt-400 - Instructions

ADVERTISEMENT

PT-400 (4/00) (back)

Instructions

Who must file

Line 7b — Tax due - enter the result on line 7b and continue

Any person, corporation or unincorporated business, registered as an

with line 8.

aviation fuel business that is not an airline and elects to file on an annual

Line 8 — A penalty is imposed at the rate of 10% of the tax due for the

basis must file Form PT-400. If this election is not made, the aviation fuel

first month or part of a month and 1% of the tax due for each

business must file monthly returns. Corporate or business aircraft and

subsequent month or part of a month in which the tax remains

aircraft used to transport passengers or freight are subject to this tax. An

unpaid, up to a maximum penalty of 30%. If a return is not filed

aviation fuel business that imports kero-jet fuel into New York State in the

within 60 days of the due date, the penalty will be determined as

fuel tanks of its aircraft for consumption in the state must file this report and

indicated above but will not be less than the lesser of $100 or

pay tax under Article 13-A of the Tax Law for this consumption. Aviation fuel

100% of the tax due. In addition, failure to file returns and pay

businesses that are airlines should file Form PT-104.

any tax due may result in criminal penalties under Article 37 of

the Tax Law.

Definitions

Line 9 — Interest is computed at the rate set by the Commissioner of

Kero-jet fuel means a quality, highly refined kerosene product, or derivative

Taxation and Finance, and is compounded daily. Interest is

thereof, that meets kerosene-type jet fuel specifications and that is primarily

computed from the date the tax was due until the date the tax is

used for commercial turbojet and turboprop aircraft engines.

paid. Interest is a charge for the use of state funds and may not

be waived. If you require assistance in the computation of

An airline includes: (a) an air carrier of persons, property and mail

interest, call the tax information number shown in the Need

operating under a Certificate of Public Convenience and Necessity issued

help? section below.

by the Federal Aviation Administration (FAA); (b) an air carrier holding a

Certificate for All-Cargo Air Service issued by the FAA; and (c) an air taxi

Line 10 — Add the amounts on lines 7b, 8 and 9 to compute the total tax,

operator who is classified by the FAA as a commuter air carrier or who (i)

penalty and interest due for this filing period.

performed at least five trips per week between two or more points and

Payment

publishes flight schedules that specify the times and days of the week and

places between which such flights are performed or (ii) transports mail by

Make your check or money order payable to: Commissioner of Taxation

air under a contract with the United States Postal Service.

and Finance . Attach your remittance and Form PT-400.1 to the return and

mail to:

When to File

NYS TAX DEPARTMENT

Form PT-400, Kero-Jet Fuel Annual Consumption Tax Return - Nonairline ,

PO BOX 1833

is filed annually (September 1 through August 31). The return must be filed

ALBANY NY 12201-1833

no later than September 20. Returns filed after the due date are subject to

penalty and interest charges.

See Private delivery services on the front page if you wish to use a private

delivery service instead of the U.S. Postal Service.

Form PT-400 will be automatically sent to all registered annual taxpayers.

Returns can also be obtained by calling the telephone number listed in the

Certification

Need help? section below.

The return must be signed and dated by the owner (if an individual), a

Taxpayer information section

partner (if a partnership), or (if a corporation) by the president, treasurer,

chief accounting officer, or any other person authorized to act on behalf of

Enter the federal employer identification number (if not applicable, your

the corporation. The fact that an individual’s name is signed on the

social security number), the business telephone number, the legal name of

the business, the DBA (if different from the legal name) and the business

certification shall be prima facie evidence that the individual is authorized to

sign and certify the report on behalf of the business.

address.

Line instructions

Need help?

Line 1 — Enter the total number of gallons of kero-jet fuel consumed in

Telephone assistance is available from 8:30 a.m. to 4:25 p.m. (eastern time),

New York State, regardless of purchase site, from

Monday through Friday.

Form PT-400.1, Kero-Jet Fuel Consumed in New York State by

Tax information: 1 800 972-1233

Aircraft - Nonairline, column F total.

Forms and publications: 1 800 462-8100

Line 2 — Enter the total number of gallons of kero-jet fuel purchased in

From outside the U.S. and outside Canada: (518) 485-6800

New York State for use in aircraft for which you can substantiate

Fax-on-demand forms: 1 800 748-3676

that the petroleum business tax was included in the purchase

Internet access:

price.

Hearing and speech impaired (telecommunications device for the deaf (TDD) callers

only): 1 800 634-2110 (8:30 a.m. to 4:25 p.m., eastern time)

Line 3 — Compute the total number of gallons of kero-jet fuel subject to

tax by subtracting line 2 from line 1, and enter the result. If the

result is a negative figure, enter it in brackets.

Persons with disabilities: In compliance with the Americans with

Disabilities Act, we will ensure that our lobbies, offices, meeting rooms, and other

Line 4 — Enter the appropriate aggregate tax rate for kero-jet fuel for the

facilities are accessible to persons with disabilities. If you have questions about

filing period by referring to Publication 908, Fuel Tax Rates . Any

special accommodations for persons with disabilities, please call 1 800 225-5829.

tax due is computed at the kero-jet fuel rate in effect when the

fuel was used. (See Publication 908 for the list of rates.)

If you need to write, address your letter to: NYS Tax Department,

For refunds, use the rate of petroleum business tax that you

Taxpayer Assistance Bureau, W A Harriman Campus, Albany NY 12227.

were charged. If more than one rate is used, enter per schedule

on line 4 and attach a schedule showing the computation of the

Privacy notification

line 5 amount.

The right of the Commissioner of Taxation and Finance and the Department of Taxation

Line 5 — Multiply the number of gallons shown on line 3 by the tax rate on

and Finance to collect and maintain personal information, including mandatory

line 4.

disclosure of social security numbers in the manner required by tax regulations,

Line 6 — There is a minimum Article 13-A tax of $2 per month ($24 per

instructions, and forms, is found in Articles 8, 12-A, 13-A, 21, and 21-A of the Tax Law;

annual period) for aviation fuel businesses that are not otherwise

and 42 USC 405(c)(2)(C)(i).

required to be registered under Article 12-A or 13-A of the Tax

The Tax Department uses this information primarily to determine and administer the

Law. Note: If you have been registered for only part of the

motor and diesel motor fuel, petroleum, highway use, and fuel use taxes under

annual period, the minimum tax should be prorated for the

Articles 12-A, 13-A, 21, and 21-A of the Tax Law, and for any other purpose authorized

number of months registered; enter this amount on line 6.

by law.

Line 7 — If line 5 is an overpayment (negative amount), subtract the

Failure to provide the required information may subject you to civil or criminal penalties,

amount on line 6 from the amount on line 5. If the result is still

or both, under the Tax Law. In some cases, failure to provide the required information

an overpayment (refund), enter it on line 7a; if the result is a

may result in denial, cancellation, or suspension of a registration as a distributor of

balance due, enter it on line 7b. If line 5 is a balance due, enter

motor or diesel motor fuel or of a license as a terminal operator or importing/exporting

on line 7b the larger of line 5 or line 6.

transporter.

Line 7a — Refund - enter the result on line 7a and skip lines 7b

This information is maintained by the Director of the Registration and Data Services

through 10. A request for refund must be filed within 2 years from

Bureau, NYS Tax Department, Building 8 Room 924, W A Harriman Campus, Albany

the date of purchase. An overpayment may not be used as a

NY 12227; telephone 1 800 225-5829. From areas outside the U.S. and outside

credit on subsequent returns.

Canada, call (518) 485-6800.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1