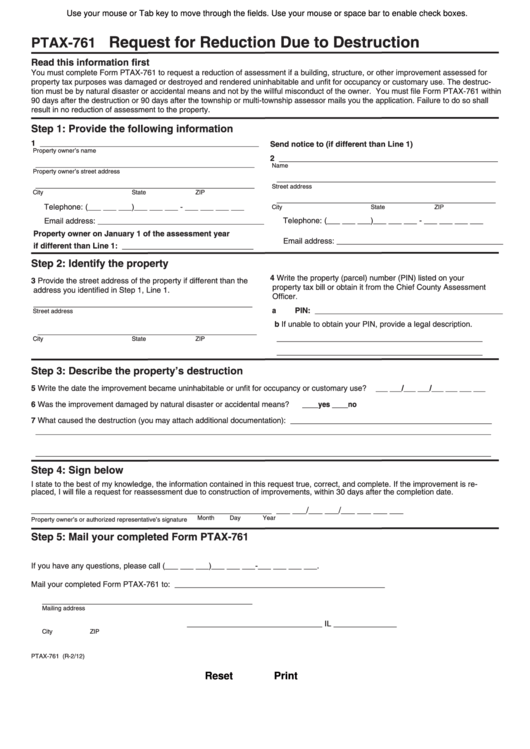

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Request for Reduction Due to Destruction

PTAX-761

Read this information first

You must complete Form PTAX-761 to request a reduction of assessment if a building, structure, or other improvement assessed for

property tax purposes was damaged or destroyed and rendered uninhabitable and unfit for occupancy or customary use. The destruc-

tion must be by natural disaster or accidental means and not by the willful misconduct of the owner. You must file Form PTAX-761 within

90 days after the destruction or 90 days after the township or multi-township assessor mails you the application. Failure to do so shall

result in no reduction of assessment to the property.

Step 1: Provide the following information

1

__________________________________________________

Send notice to (if different than Line 1)

Property owner’s name

2

__________________________________________________

__________________________________________________

Name

Property owner’s street address

__________________________________________________

__________________________________________________

Street address

City

State

ZIP

__________________________________________________

Telephone: (___ ___ ___)___ ___ ___ - ___ ___ ___ ___

City

State

ZIP

Telephone: (___ ___ ___)___ ___ ___ - ___ ___ ___ ___

Email address: ______________________________________

Property owner on January 1 of the assessment year

Email address: ______________________________________

if different than Line 1: ______________________________

Step 2: Identify the property

4

Write the property (parcel) number (PIN) listed on your

3

Provide the street address of the property if different than the

property tax bill or obtain it from the Chief County Assessment

address you identified in Step 1, Line 1.

Officer.

__________________________________________________

a

PIN: _______________________________________

Street address

b If unable to obtain your PIN, provide a legal description.

__________________________________________________

_______________________________________________

City

State

ZIP

_______________________________________________

Step 3: Describe the property’s destruction

5

Write the date the improvement became uninhabitable or unfit for occupancy or customary use? ___ ___/___ ___/___ ___ ___ ___

6

Was the improvement damaged by natural disaster or accidental means? ____yes

____no

7

What caused the destruction (you may attach additional documentation): ______________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

Step 4: Sign below

I state to the best of my knowledge, the information contained in this request true, correct, and complete. If the improvement is re-

placed, I will file a request for reassessment due to construction of improvements, within 30 days after the completion date.

____________________________________________________

___ ___/___ ___/___ ___ ___ ___

Month

Day

Year

Property owner’s or authorized representative’s signature

Step 5: Mail your completed Form PTAX-761

If you have any questions, please call (___ ___ ___)___ ___ ___-___ ___ ___ ___.

Mail your completed Form PTAX-761 to:

________________________________________________

________________________________________________

Mailing address

______________________________ IL ______________

City

ZIP

PTAX-761 (R-2/12)

Reset

Print

1

1