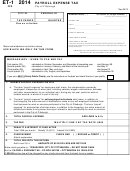

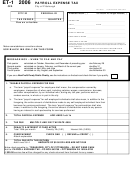

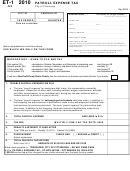

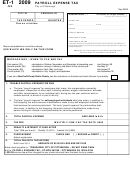

Form Et-1 - Payroll Expense Tax - City Of Pittsburgh - 2015

ADVERTISEMENT

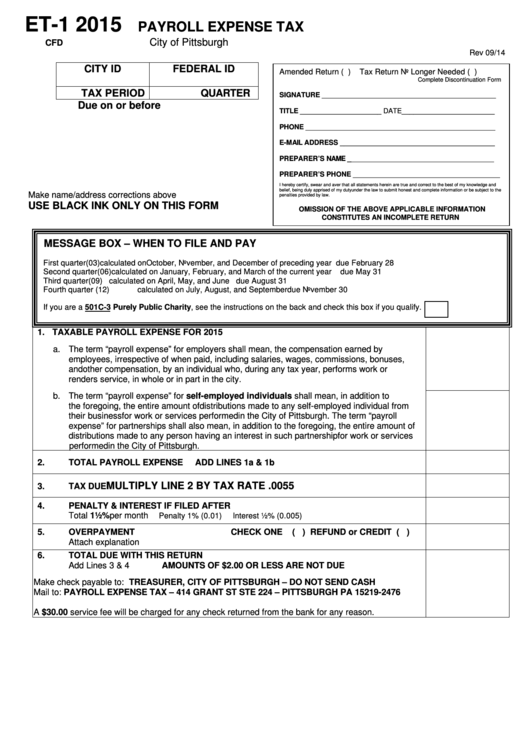

ET-1 2015

PAYROLL EXPENSE TAX

City of Pittsburgh

CFD

Rev 09/14

CITY ID

FEDERAL ID

Amended Return ( )

Tax Return No Longer Needed ( )

Complete Discontinuation Form

TAX PERIOD

QUARTER

SIGNATURE _____________________________________________

Due on or before

TITLE _____________________ DATE ________________________

PHONE _________________________________________________

E-MAIL ADDRESS ________________________________________

PREPARER’S NAME ______________________________________

PREPARER’S PHONE ______________________________________

I hereby certify, swear and aver that all statements herein are true and correct to the best of my knowledge and

belief, being duly apprised of my duty under the law to submit honest and complete information or be subject to the

Make name/address corrections above

penalties provided by law.

USE BLACK INK ONLY ON THIS FORM

OMISSION OF THE ABOVE APPLICABLE INFORMATION

CONSTITUTES AN INCOMPLETE RETURN

MESSAGE BOX – WHEN TO FILE AND PAY

First quarter (03)

calculated on October, November, and December of preceding year

due February 28

Second quarter (06)

calculated on January, February, and March of the current year

due May 31

Third quarter (09)

calculated on April, May, and June

due August 31

Fourth quarter (12)

calculated on July, August, and September

due November 30

If you are a 501C-3 Purely Public Charity, see the instructions on the back and check this box if you qualify.

1. TAXABLE PAYROLL EXPENSE FOR 2015

a. The term “payroll expense” for employers shall mean, the compensation earned by

employees, irrespective of when paid, including salaries, wages, commissions, bonuses,

and other compensation, by an individual who, during any tax year, performs work or

renders service, in whole or in part in the city.

b. The term “payroll expense” for self-employed individuals shall mean, in addition to

the foregoing, the entire amount of distributions made to any self-employed individual from

their business for work or services performed in the City of Pittsburgh. The term “payroll

expense” for partnerships shall also mean, in addition to the foregoing, the entire amount of

distributions made to any person having an interest in such partnership for work or services

performed in the City of Pittsburgh.

2.

TOTAL PAYROLL EXPENSE

ADD LINES 1a & 1b

MULTIPLY LINE 2 BY TAX RATE .0055

3.

TAX DUE

4.

PENALTY & INTEREST IF FILED AFTER

Total 1½% per month

Penalty 1% (0.01)

Interest ½% (0.005)

5.

OVERPAYMENT

CHECK ONE

( ) REFUND or CREDIT ( )

Attach explanation

6.

TOTAL DUE WITH THIS RETURN

Add Lines 3 & 4

AMOUNTS OF $2.00 OR LESS ARE NOT DUE

Make check payable to: TREASURER, CITY OF PITTSBURGH – DO NOT SEND CASH

Mail to: PAYROLL EXPENSE TAX – 414 GRANT ST STE 224 – PITTSBURGH PA 15219-2476

A $30.00 service fee will be charged for any check returned from the bank for any reason.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2