Summary Decision - Homeowners And Renters Property Tax Assistance Appeal Form

ADVERTISEMENT

1

2

3

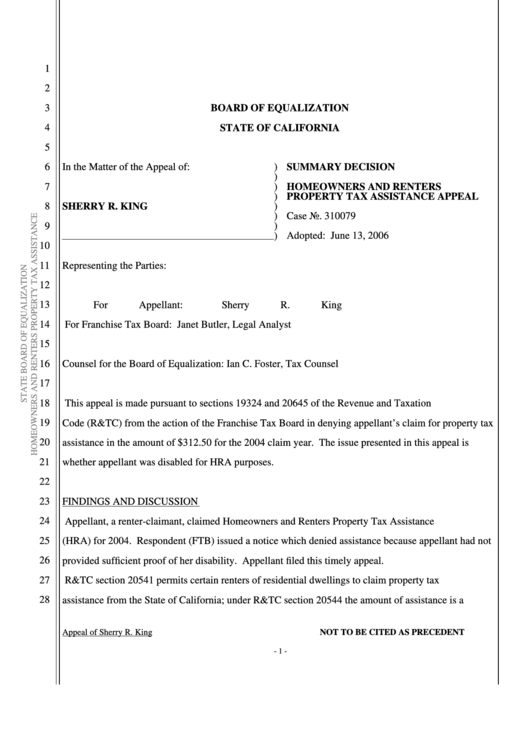

BOARD OF EQUALIZATION

4

STATE OF CALIFORNIA

5

6

In the Matter of the Appeal of:

)

SUMMARY DECISION

)

7

)

HOMEOWNERS AND RENTERS

)

PROPERTY TAX ASSISTANCE APPEAL

8

)

SHERRY R. KING

)

Case No. 310079

)

9

)

Adopted: June 13, 2006

10

11

Representing the Parties:

12

13

For Appellant:

Sherry R. King

14

For Franchise Tax Board:

Janet Butler, Legal Analyst

15

16

Counsel for the Board of Equalization:

Ian C. Foster, Tax Counsel

17

18

This appeal is made pursuant to sections 19324 and 20645 of the Revenue and Taxation

19

Code (R&TC) from the action of the Franchise Tax Board in denying appellant’s claim for property tax

20

assistance in the amount of $312.50 for the 2004 claim year. The issue presented in this appeal is

21

whether appellant was disabled for HRA purposes.

22

23

FINDINGS AND DISCUSSION

24

Appellant, a renter-claimant, claimed Homeowners and Renters Property Tax Assistance

25

(HRA) for 2004. Respondent (FTB) issued a notice which denied assistance because appellant had not

26

provided sufficient proof of her disability. Appellant filed this timely appeal.

27

R&TC section 20541 permits certain renters of residential dwellings to claim property tax

28

assistance from the State of California; under R&TC section 20544 the amount of assistance is a

Appeal of Sherry R. King

NOT TO BE CITED AS PRECEDENT

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3