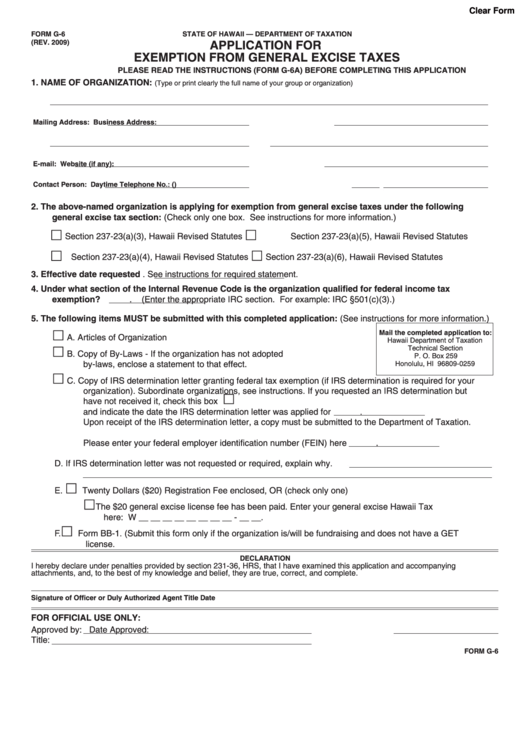

Clear Form

FORM G-6

STATE OF HAWAII — DEPARTMENT OF TAXATION

APPLICATION FOR

(REV. 2009)

EXEMPTION FROM GENERAL EXCISE TAXES

PLEASE READ THE INSTRUCTIONS (FORM G-6A) BEFORE COMPLETING THIS APPLICATION

1.

NAME OF ORGANIZATION:

(Type or print clearly the full name of your group or organization)

Mailing Address:

Business Address:

E-mail:

Website (if any):

Contact Person:

Daytime Telephone No.: (

)

2.

The above-named organization is applying for exemption from general excise taxes under the following

general excise tax section: (Check only one box. See instructions for more information.)

Section 237-23(a)(3), Hawaii Revised Statutes

Section 237-23(a)(5), Hawaii Revised Statutes

Section 237-23(a)(4), Hawaii Revised Statutes

Section 237-23(a)(6), Hawaii Revised Statutes

3.

Effective date requested

. See instructions for required statement.

4.

Under what section of the Internal Revenue Code is the organization qualified for federal income tax

exemption?

.

(Enter the appropriate IRC section. For example: IRC §501(c)(3).)

5.

The following items MUST be submitted with this completed application: (See instructions for more information.)

Mail the completed application to:

A. Articles of Organization

Hawaii Department of Taxation

Technical Section

B. Copy of By-Laws - If the organization has not adopted

P. O. Box 259

by-laws, enclose a statement to that effect.

Honolulu, HI 96809-0259

C. Copy of IRS determination letter granting federal tax exemption (if IRS determination is required for your

organization). Subordinate organizations, see instructions. If you requested an IRS determination but

have not received it, check this box ..........................................................................................................

and indicate the date the IRS determination letter was applied for

.

Upon receipt of the IRS determination letter, a copy must be submitted to the Department of Taxation.

Please enter your federal employer identification number (FEIN) here

.

D. If IRS determination letter was not requested or required, explain why.

E.

Twenty Dollars ($20) Registration Fee enclosed, OR (check only one)

The $20 general excise license fee has been paid. Enter your general excise Hawaii Tax I.D. Number

here: W __ __ __ __ __ __ __ __ - __ __.

F.

Form BB-1. (Submit this form only if the organization is/will be fundraising and does not have a GET

license.

DECLARATION

I hereby declare under penalties provided by section 231-36, HRS, that I have examined this application and accompanying

attachments, and, to the best of my knowledge and belief, they are true, correct, and complete.

Signature of Officer or Duly Authorized Agent

Title

Date

FOR OFFICIAL USE ONLY:

Approved by:

Date Approved:

Title:

FORM G-6

1

1 2

2 3

3 4

4