Application For Property Tax Reduction - Idaho County Assessor - 2008

ADVERTISEMENT

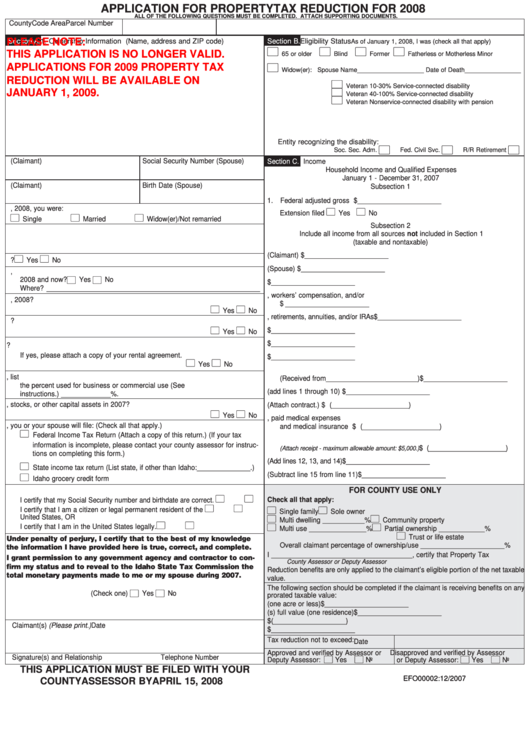

APPLICATION FOR PROPERTY TAX REDUCTION FOR 2008

ALL OF THE FOLLOWING QUESTIONS MUST BE COMPLETED. ATTACH SUPPORTING DOCUMENTS.

County

Code Area

Parcel Number

PLEASE NOTE:

Section A.

1. Ownership Information (Name, address and ZIP code)

Section B.

Eligibility Status

As of January 1, 2008, I was (check all that apply)

L

L

L

L

THIS APPLICATION IS NO LONGER VALID.

65 or older

Blind

Former P.O.W.

Fatherless or Motherless Minor

L

APPLICATIONS FOR 2009 PROPERTY TAX

Widow(er): Spouse Name___________________ Date of Death________________

REDUCTION WILL BE AVAILABLE ON

L

Veteran 10-30% Service-connected disability

L

JANUARY 1, 2009.

Veteran 40-100% Service-connected disability

L

Veteran Nonservice-connected disability with pension

Entity recognizing the disability:

L

L

L

Soc. Sec. Adm.

Fed. Civil Svc.

R/R Retirement

2. Social Security Number (Claimant)

Social Security Number (Spouse)

Section C.

Income

Household Income and Qualified Expenses

January 1 - December 31, 2007

3. Birth Date (Claimant)

Birth Date (Spouse)

Subsection 1

1. Federal adjusted gross income.......................... $ ______________________

4. As of January 1, 2008, you were:

L

L

Extension filed

Yes

No

L

L

L

Single

Married

Widow(er)/Not remarried

Subsection 2

5. Physical address of the property if different than ownership information.

Include all income from all sources not included in Section 1

(taxable and nontaxable)

2. Social Security income/SSI (Claimant) .............. $ ______________________

L

L

6. Are you a new applicant?

Yes

No

3. Social Security income/SSI (Spouse) ................ $ ______________________

7. Have you filed a claim on a different primary residence between January 1,

L

L

2008 and now?

Yes

No

4. Capital gains ...................................................... $ ______________________

Where? ________________________________________________________

5. Wages, workers’ compensation, and/or

8. Did you occupy your home as your primary residence before April 15, 2008?

unemployment .................................................. $ ______________________

L

L

Yes

No

6. Pensions, retirements, annuities, and/or IRAs

$ ______________________

9. Did you or your spouse stay in a care facility in 2007?

L

L

7. VA pension or compensation ............................ $ ______________________

Yes

No

8. Interest and dividends........................................ $ ______________________

10. Did you receive rental income for all or any part of this property in 2007?

If yes, please attach a copy of your rental agreement.

9. Railroad retirement ............................................ $ ______________________

L

L

Yes

No

10. Other income

11. If you used any part of this property for business or commercial use in 2007, list

(Received from ________________________) $ ______________________

the percent used for business or commercial use (See

11. Subtotal (add lines 1 through 10) ...................... $ ______________________

instructions.) _____________%.

12. Did you sell real estate, stocks, or other capital assets in 2007?

12. Principal of annuity (Attach contract.) ................ $ (_____________________)

L

L

Yes

No

13. Total of nonreimbursed, paid medical expenses

13. This year, you or your spouse will file: (Check all that apply.)

and medical insurance premiums ...................... $ (_____________________)

L

Federal Income Tax Return (Attach a copy of this return.) (If your tax

14. Total of paid or prepaid funeral expenses

information is incomplete, please contact your county assessor for instruc-

$ (_____________________)

(Attach receipt - maximum allowable amount: $5,000.)

tions on completing this form.)

15. Subtotal of deductions (Add lines 12, 13, and 14) $ ______________________

L

State income tax return (List state, if other than Idaho:______________.)

16. Total net income (Subtract line 15 from line 11) $ ______________________

L

Idaho grocery credit form

14.

Claimant Spouse

FOR COUNTY USE ONLY

L

L

I certify that my Social Security number and birthdate are correct.

Check all that apply:

L

L

L

L

I certify that I am a citizen or legal permanent resident of the

Single family

Sole owner

L

L

United States, OR

Multi dwelling ___________%

Community property

L

L

L

L

I certify that I am in the United States legally.

Multi use _______________%

Partial ownership ____________%

L

Trust or life estate

Under penalty of perjury, I certify that to the best of my knowledge

Overall claimant percentage of ownership/use ______________________%

the information I have provided here is true, correct, and complete.

I _____________________________________, certify that Property Tax

I grant permission to any government agency and contractor to con-

County Assessor or Deputy Assessor

firm my status and to reveal to the Idaho State Tax Commission the

Reduction benefits are only applied to the claimant’s eligible portion of the net taxable

total monetary payments made to me or my spouse during 2007.

value.

The following section should be completed if the claimant is receiving benefits on any

L

L

(Check one)

Yes

No

prorated taxable value:

1. Land taxable value (one acre or less)

$ ______________________

2. Improvement(s) full value (one residence)

$ ______________________

3. Homestead exemption

$ (___________________)

Claimant(s) (Please print.)

Date

4. Net taxable

$ ______________________

Tax reduction not to exceed:

Date

Approved and verified by Assessor or

Disapproved and verified by Assessor

Signature(s) and Relationship

Telephone Number

L

L

L

L

Deputy Assessor:

Yes

No

or Deputy Assessor:

Yes

No

THIS APPLICATION MUST BE FILED WITH YOUR

EFO00002:12/2007

COUNTY ASSESSOR BY APRIL 15, 2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1