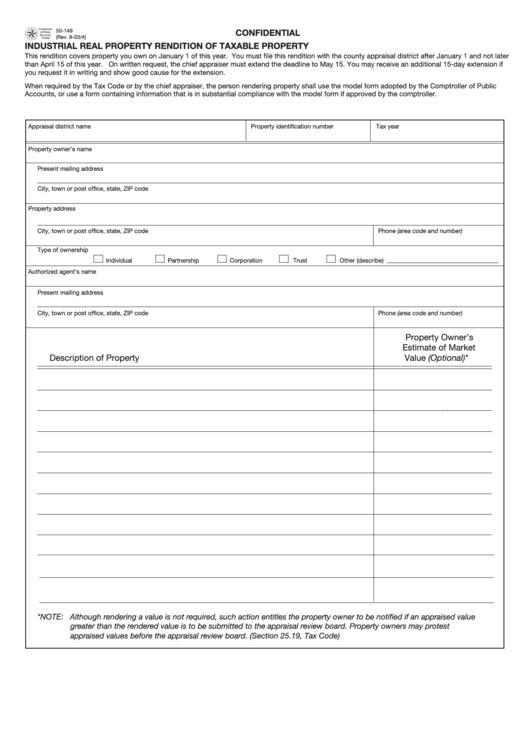

Form 50-149 - Confidential Industrial Real Property Rendition Of Taxable Property - Fixed Machinery And Equipment

ADVERTISEMENT

50-149

CONFIDENTIAL

(Rev. 8-03/4)

INDUSTRIAL REAL PROPERTY RENDITION OF TAXABLE PROPERTY

This rendition covers property you own on January 1 of this year. You must file this rendition with the county appraisal district after January 1 and not later

than April 15 of this year. On written request, the chief appraiser must extend the deadline to May 15. You may receive an additional 15-day extension if

you request it in writing and show good cause for the extension.

When required by the Tax Code or by the chief appraiser, the person rendering property shall use the model form adopted by the Comptroller of Public

Accounts, or use a form containing information that is in substantial compliance with the model form if approved by the comptroller.

Appraisal district name

Property identification number

Tax year

Property owner’s name

Present mailing address

City, town or post office, state, ZIP code

Property address

City, town or post office, state, ZIP code

Phone (area code and number)

Type of ownership

Individual

Partnership

Corporation

Trust

Other (describe)

Authorized agent’s name

Present mailing address

City, town or post office, state, ZIP code

Phone (area code and number)

Property Owner’s

Estimate of Market

Description of Property

Value (Optional)*

*NOTE:

Although rendering a value is not required, such action entitles the property owner to be notified if an appraised value

greater than the rendered value is to be submitted to the appraisal review board. Property owners may protest

appraised values before the appraisal review board. (Section 25.19, Tax Code)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2