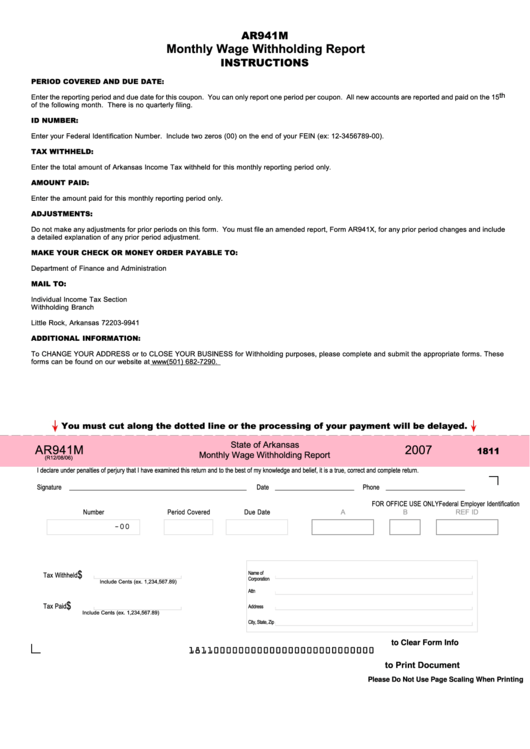

AR941M

Monthly Wage Withholding Report

INSTRUCTIONS

PERIOD COVERED AND DUE DATE:

Enter the reporting period and due date for this coupon. You can only report one period per coupon. All new accounts are reported and paid on the 15 th

of the following month. There is no quarterly filing.

ID NUMBER:

Enter your Federal Identification Number. Include two zeros (00) on the end of your FEIN (ex: 12-3456789-00).

TAX WITHHELD:

Enter the total amount of Arkansas Income Tax withheld for this monthly reporting period only.

AMOUNT PAID:

Enter the amount paid for this monthly reporting period only.

ADJUSTMENTS:

Do not make any adjustments for prior periods on this form. You must file an amended report, Form AR941X, for any prior period changes and include

a detailed explanation of any prior period adjustment.

MAKE YOUR CHECK OR MONEY ORDER PAYABLE TO:

Department of Finance and Administration

MAIL TO:

Individual Income Tax Section

Withholding Branch

P.O. Box 9941

Little Rock, Arkansas 72203-9941

ADDITIONAL INFORMATION:

To CHANGE YOUR ADDRESS or to CLOSE YOUR BUSINESS for Withholding purposes, please complete and submit the appropriate forms. These

forms can be found on our website at or they will be mailed to you by contacting (501) 682-7290.

You must cut along the dotted line or the processing of your payment will be delayed.

State of Arkansas

AR941M

2007

1811

Monthly Wage Withholding Report

(R12/08/06)

I declare under penalties of perjury that I have examined this return and to the best of my knowledge and belief, it is a true, correct and complete return.

Signature

________________________________________________________

Date _________________________

Phone _________________________

Federal Employer Identification

FOR OFFICE USE ONLY

Number

Period Covered

Due Date

A

B

REF ID

71-1234567-00

$

Name of

Tax Withheld

Corporation

Include Cents (ex. 1,234,567.89)

Attn

$

Tax Paid

Address

Include Cents (ex. 1,234,567.89)

City, State, Zip

Click Here to Clear Form Info

181100000000000000000000000000

Click Here to Print Document

Please Do Not Use Page Scaling When Printing

1

1