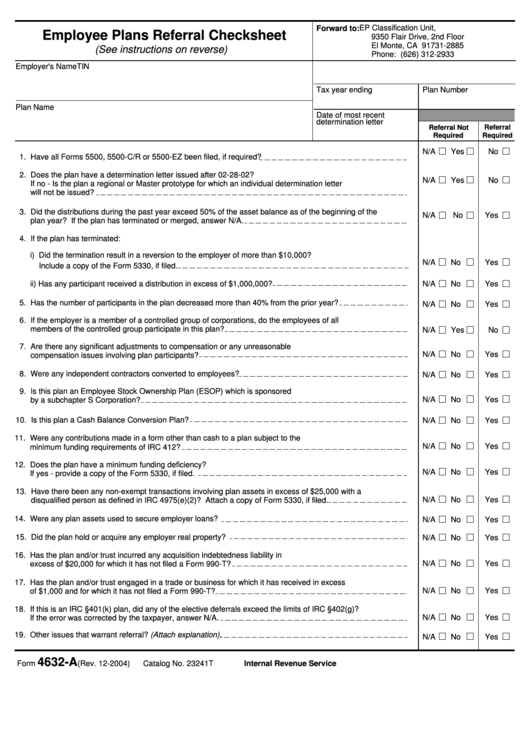

EP Classification Unit,

Forward to:

Employee Plans Referral Checksheet

9350 Flair Drive, 2nd Floor

El Monte, CA 91731-2885

(See instructions on reverse)

Phone: (626) 312-2933

Employer's Name

TIN

Tax year ending

Plan Number

Plan Name

Date of most recent

determination letter

Referral Not

Referral

Required

Required

N/A

Yes

No

1. Have all Forms 5500, 5500-C/R or 5500-EZ been filed, if required?

2. Does the plan have a determination letter issued after 02-28-02?

N/A

Yes

No

If no - Is the plan a regional or Master prototype for which an individual determination letter

will not be issued?

3. Did the distributions during the past year exceed 50% of the asset balance as of the beginning of the

N/A

No

Yes

plan year? If the plan has terminated or merged, answer N/A.

4. If the plan has terminated:

i) Did the termination result in a reversion to the employer of more than $10,000?

N/A

No

Yes

Include a copy of the Form 5330, if filed.

ii) Has any participant received a distribution in excess of $1,000,000?

N/A

No

Yes

5. Has the number of participants in the plan decreased more than 40% from the prior year?

N/A

No

Yes

6. If the employer is a member of a controlled group of corporations, do the employees of all

members of the controlled group participate in this plan?

N/A

Yes

No

7. Are there any significant adjustments to compensation or any unreasonable

N/A

No

Yes

compensation issues involving plan participants?

8. Were any independent contractors converted to employees?

N/A

No

Yes

9. Is this plan an Employee Stock Ownership Plan (ESOP) which is sponsored

N/A

No

Yes

by a subchapter S Corporation?

10. Is this plan a Cash Balance Conversion Plan?

N/A

No

Yes

11. Were any contributions made in a form other than cash to a plan subject to the

N/A

No

Yes

minimum funding requirements of IRC 412?

12. Does the plan have a minimum funding deficiency?

N/A

No

Yes

If yes - provide a copy of the Form 5330, if filed.

13. Have there been any non-exempt transactions involving plan assets in excess of $25,000 with a

N/A

No

Yes

disqualified person as defined in IRC 4975(e)(2)? Attach a copy of Form 5330, if filed.

14. Were any plan assets used to secure employer loans?

N/A

No

Yes

15. Did the plan hold or acquire any employer real property?

N/A

No

Yes

16. Has the plan and/or trust incurred any acquisition indebtedness liability in

N/A

No

Yes

excess of $20,000 for which it has not filed a Form 990-T?

17. Has the plan and/or trust engaged in a trade or business for which it has received in excess

N/A

No

Yes

of $1,000 and for which it has not filed a Form 990-T?

18. If this is an IRC §401(k) plan, did any of the elective deferrals exceed the limits of IRC §402(g)?

N/A

No

Yes

If the error was corrected by the taxpayer, answer N/A.

19. Other issues that warrant referral? (Attach explanation).

N/A

No

Yes

4632-A

Form

(Rev. 12-2004)

Catalog No. 23241T

publish.no.irs.gov

Department of the Treasury-Internal Revenue Service

1

1 2

2