Form Ga-9465 - Installment Payment Agreement Request

ADVERTISEMENT

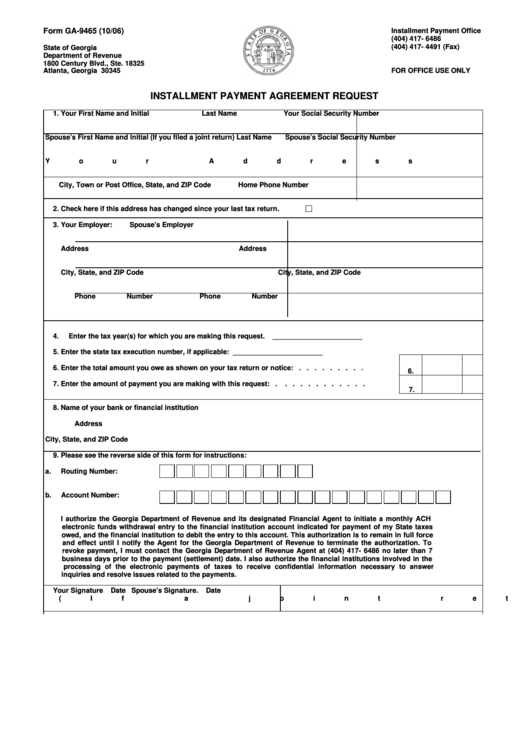

Installment Payment Office

Form GA-9465 (10/06)

(404) 417- 6486

(404) 417- 4491 (Fax)

State of Georgia

ipa@dor.ga.gov

Department of Revenue

1800 Century Blvd., Ste. 18325

FOR OFFICE USE ONLY

Atlanta, Georgia 30345

INSTALLMENT PAYMENT AGREEMENT REQUEST

1.

Your First Name and Initial

Last Name

Your Social Security Number

Spouse’s First Name and Initial (If you filed a joint return)

Last Name

Spouse’s Social Security Number

Your Address

Apartment Number

City, Town or Post Office, State, and ZIP Code

Home Phone Number

2.

Check here if this address has changed since your last tax return.

3.

Your Employer:

Spouse’s Employer

Address

Address

City, State, and ZIP Code

City, State, and ZIP Code

Phone Number

Phone Number

4.

Enter the tax year(s) for which you are making this request.

_______________________

5.

Enter the state tax execution number, if applicable:

_______________________

6.

Enter the total amount you owe as shown on your tax return or notice: . . . . . . . . .

6.

7.

Enter the amount of payment you are making with this request: .

. . . . . . . . . . .

7.

8.

Name of your bank or financial institution

Address

City, State, and ZIP Code

9.

Please see the reverse side of this form for instructions:

a.

Routing Number:

b.

Account Number:

I authorize the Georgia Department of Revenue and its designated Financial Agent to initiate a monthly ACH

electronic funds withdrawal entry to the financial institution account indicated for payment of my State taxes

owed, and the financial institution to debit the entry to this account. This authorization is to remain in full force

and effect until I notify the Agent for the Georgia Department of Revenue to terminate the authorization. To

revoke payment, I must contact the Georgia Department of Revenue Agent at (404) 417- 6486 no later than 7

business days prior to the payment (settlement) date. I also authorize the financial institutions involved in the

processing of the electronic payments of taxes to receive confidential information necessary to answer

inquiries and resolve issues related to the payments.

Your Signature

Date

Spouse’s Signature.

Date

(If a joint return, both must sign.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1