Form 33 - Idaho Estate And Transfer Tax Return

ADVERTISEMENT

IA00521

Page 2

11-14-00

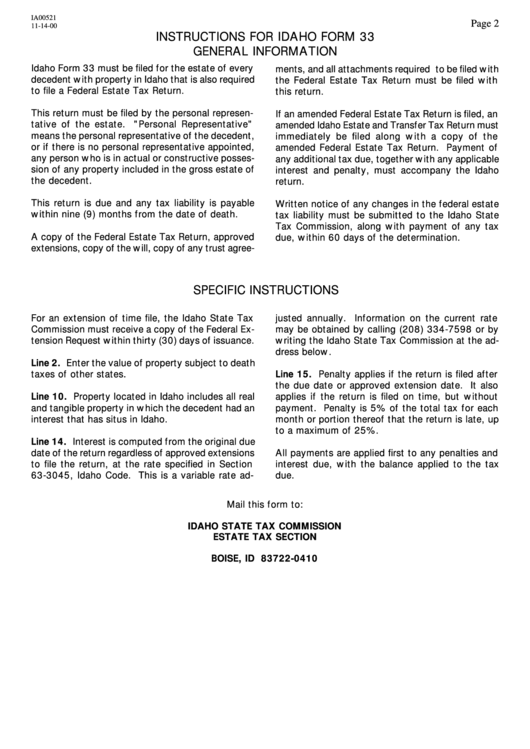

INSTRUCTIONS FOR IDAHO FORM 33

GENERAL INFORMATION

Idaho Form 33 must be filed for the estate of every

ments, and all attachments required to be filed with

decedent with property in Idaho that is also required

the Federal Estate Tax Return must be filed with

to file a Federal Estate Tax Return.

this return.

This return must be filed by the personal represen-

If an amended Federal Estate Tax Return is filed, an

tative of the estate. "Personal Representative"

amended Idaho Estate and Transfer Tax Return must

means the personal representative of the decedent,

immediately be filed along with a copy of the

or if there is no personal representative appointed,

amended Federal Estate Tax Return. Payment of

any person who is in actual or constructive posses-

any additional tax due, together with any applicable

sion of any property included in the gross estate of

interest and penalty, must accompany the Idaho

the decedent.

return.

This return is due and any tax liability is payable

Written notice of any changes in the federal estate

within nine (9) months from the date of death.

tax liability must be submitted to the Idaho State

Tax Commission, along with payment of any tax

A copy of the Federal Estate Tax Return, approved

due, within 60 days of the determination.

extensions, copy of the will, copy of any trust agree-

SPECIFIC INSTRUCTIONS

For an extension of time file, the Idaho State Tax

justed annually. Information on the current rate

Commission must receive a copy of the Federal Ex-

may be obtained by calling (208) 334-7598 or by

tension Request within thirty (30) days of issuance.

writing the Idaho State Tax Commission at the ad-

dress below.

Line 2. Enter the value of property subject to death

taxes of other states.

Line 15. Penalty applies if the return is filed after

the due date or approved extension date. It also

Line 10. Property located in Idaho includes all real

applies if the return is filed on time, but without

and tangible property in which the decedent had an

payment. Penalty is 5% of the total tax for each

interest that has situs in Idaho.

month or portion thereof that the return is late, up

to a maximum of 25%.

Line 14. Interest is computed from the original due

date of the return regardless of approved extensions

All payments are applied first to any penalties and

to file the return, at the rate specified in Section

interest due, with the balance applied to the tax

63-3045, Idaho Code. This is a variable rate ad-

due.

Mail this form to:

IDAHO STATE TAX COMMISSION

ESTATE TAX SECTION

P.O. BOX 36

BOISE, ID 83722-0410

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1