Form Rmft - 11 - Illinois Motor Fuel Tax Refund Claim Instructions

ADVERTISEMENT

Illinois Department of Revenue

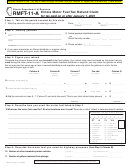

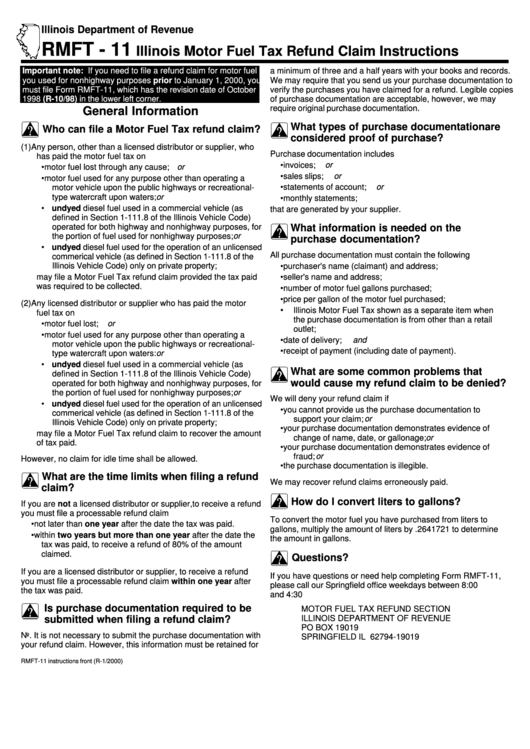

RMFT - 11

Illinois Motor Fuel Tax Refund Claim Instructions

Important note: If you need to file a refund claim for motor fuel

a minimum of three and a half years with your books and records.

you used for nonhighway purposes prior to January 1, 2000, you

We may require that you send us your purchase documentation to

must file Form RMFT-11, which has the revision date of October

verify the purchases you have claimed for a refund. Legible copies

1998 (R-10/98) in the lower left corner.

of purchase documentation are acceptable, however, we may

require original purchase documentation.

General Information

What types of purchase documentation are

Who can file a Motor Fuel Tax refund claim?

considered proof of purchase?

(1) Any person, other than a licensed distributor or supplier, who

Purchase documentation includes

has paid the motor fuel tax on

invoices; or

•

• motor fuel lost through any cause; or

sales slips; or

•

• motor fuel used for any purpose other than operating a

•

statements of account; or

motor vehicle upon the public highways or recreational-

type watercraft upon waters; or

•

monthly statements;

• undyed diesel fuel used in a commercial vehicle (as

that are generated by your supplier.

defined in Section 1-111.8 of the Illinois Vehicle Code)

operated for both highway and nonhighway purposes, for

What information is needed on the

the portion of fuel used for nonhighway purposes; or

purchase documentation?

• undyed diesel fuel used for the operation of an unlicensed

All purchase documentation must contain the following

commerical vehicle (as defined in Section 1-111.8 of the

Illinois Vehicle Code) only on private property;

•

purchaser's name (claimant) and address;

may file a Motor Fuel Tax refund claim provided the tax paid

•

seller's name and address;

was required to be collected.

•

number of motor fuel gallons purchased;

•

price per gallon of the motor fuel purchased;

(2) Any licensed distributor or supplier who has paid the motor

•

Illinois Motor Fuel Tax shown as a separate item when

fuel tax on

the purchase documentation is from other than a retail

• motor fuel lost; or

outlet;

• motor fuel used for any purpose other than operating a

•

date of delivery; and

motor vehicle upon the public highways or recreational-

•

receipt of payment (including date of payment).

type watercraft upon waters: or

• undyed diesel fuel used in a commercial vehicle (as

What are some common problems that

defined in Section 1-111.8 of the Illinois Vehicle Code)

would cause my refund claim to be denied?

operated for both highway and nonhighway purposes, for

the portion of fuel used for nonhighway purposes; or

We will deny your refund claim if

• undyed diesel fuel used for the operation of an unlicensed

•

you cannot provide us the purchase documentation to

commerical vehicle (as defined in Section 1-111.8 of the

support your claim; or

Illinois Vehicle Code) only on private property;

•

your purchase documentation demonstrates evidence of

may file a Motor Fuel Tax refund claim to recover the amount

change of name, date, or gallonage; or

of tax paid.

•

your purchase documentation demonstrates evidence of

fraud; or

However, no claim for idle time shall be allowed.

•

the purchase documentation is illegible.

What are the time limits when filing a refund

We may recover refund claims erroneously paid.

claim?

How do I convert liters to gallons?

If you are not a licensed distributor or supplier, to receive a refund

you must file a processable refund claim

To convert the motor fuel you have purchased from liters to

• not later than one year after the date the tax was paid.

gallons, multiply the amount of liters by .2641721 to determine

• within two years but more than one year after the date the

the amount in gallons.

tax was paid, to receive a refund of 80% of the amount

claimed.

Questions?

If you are a licensed distributor or supplier, to receive a refund

If you have questions or need help completing Form RMFT-11,

you must file a processable refund claim within one year after

please call our Springfield office weekdays between 8:00 a.m.

the tax was paid.

and 4:30 p.m. at 217 782-7797 or write us at

Is purchase documentation required to be

MOTOR FUEL TAX REFUND SECTION

ILLINOIS DEPARTMENT OF REVENUE

submitted when filing a refund claim?

PO BOX 19019

No. It is not necessary to submit the purchase documentation with

SPRINGFIELD IL 62794-19019

your refund claim. However, this information must be retained for

RMFT-11 instructions front (R-1/2000)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2