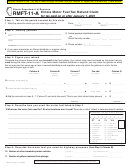

Form Rmft - 11 - Illinois Motor Fuel Tax Refund Claim Instructions Page 2

ADVERTISEMENT

Step 4: Describe how you used the motor fuel

Specific Instructions

listed in Step 3

Line 10 - Indicate both the location where you used the motor

Step 1: Identify the period covered by this claim

fuel and the purpose for which it was used.

Line 1 - Print the month and year that your refund claim covers.

If you need additional space, please attach a separate sheet to

your refund claim.

Line 2 - If you previously filed a refund claim, please tell us the

date you filed the refund claim.

Step 5: Describe the motor fuel you used for

highway purposes

Step 2: Identify yourself

Line 11 - For gasoline and undyed diesel fuel, print the total

Line 3 - Print your name or your business name and your

number of highway miles traveled by your motor vehicles during

address.

the claim period.

Line 4 - Print your federal employer identification number (FEIN).

Line 12 - If you have stored gallons of gasoline or undyed diesel

If you do not have a FEIN, print your Social Security number

fuel, print the total gallonage of each on the appropriate lines.

(SSN) on the line provided.

Step 6: Describe the gasoline you used for

Line 5 - Print your telephone number.

nonhighway purposes

Line 6 - If you are currently licensed as an Illinois distributor or

supplier of motor fuel, print your license number.

Lines 13 - 25 - Follow the instructions on the form.

Step 3: Figure your refund

Step 7: Describe the undyed diesel fuel you

used for nonhighway purposes

Note: If you need to claim a refund of tax paid on combustible

gases or gasohol, report this information on the form under

Lines 26 - 35 - Follow the instructions on the form.

gasoline.

Step 8: Itemize your equipment

For Lines 7, 8a, and 8b, use the following instructions.

Column A - Complete this column only if you are not a licensed

List in detail the equipment in which you used the motor fuel on

distributor or supplier. If you are filing a refund claim for motor fuel

which this refund claim is based. Each piece of equipment

gallons on which you paid the tax over a year ago, but not more

requires a separate entry. Attach an extra sheet if necessary.

than two years ago, you may claim only 80% of the total amount

• Use a checkmark to indicate the type of equipment used.

of motor fuel gallons. Print this gallonage amount in Column A.

Use the "Misc" column for any type of equipment that is

not already listed.

Column B - If you are filing a refund claim for motor fuel gallons

on which you paid the tax less than one year ago, you may claim

• Print the description of the equipment (make, year, etc.).

100% of the total amount of motor fuel gallons. Print this gallonage

• Check the motor fuel type used by each piece of equipment.

amount in Column B.

• Print the motor fuel gallons used by each piece of equip-

ment.

Column C - Add the amounts in Column A and B, print the result

amount in Column C. If you have amounts in only one of the

Step 9: Sign below

columns, enter this amount in Column C.

Your refund claim must be signed and dated.

Column D - Tax paid on highway motor fuel gallons is not

refundable. You must enter in Column D the motor fuel gallons

Step 10: Mail your refund claim

that were used by motor vehicles traveling on highways and

recreational-type watercraft on the waters of this state.

When you have completed your refund claim, make two copies;

one for your records and one to be mailed. Mail your completed,

Column E - Subtract Column D from Column C and enter the

original refund claim and one copy to the address below.

result in Column E. These are the net motor fuel gallons you are

claiming for refund.

MOTOR FUEL TAX REFUND SECTION

ILLINOIS DEPARTMENT OF REVENUE

Column F - Multiply the amount in Column E with the tax rate

PO BOX 19019

and write the amount.

SPRINGFIELD IL 62794-19019

Line 9 - Add the amounts in Column F for Lines 7, 8a, and 8b,

If you have any questions, call 217 782-7797.

and print the result in Column F, Line 10. This is your total

refund claim amount.

RMFT-11 instructions back (R-1/2000)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2