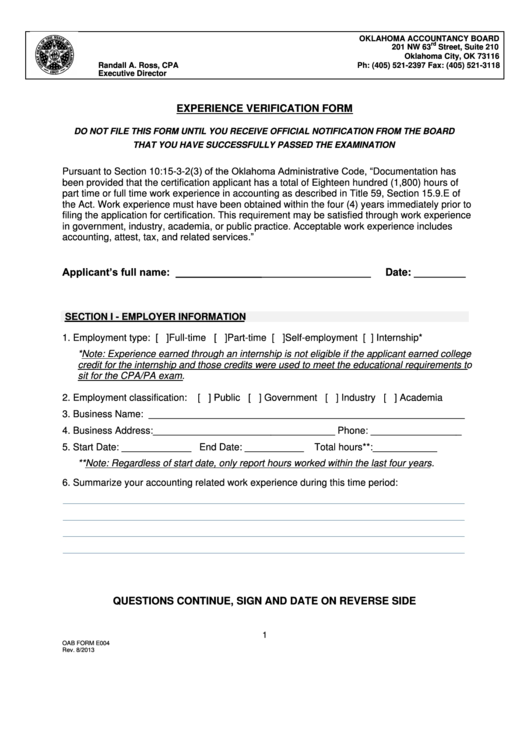

Oab Form E004 - Experience Verification Form

ADVERTISEMENT

OKLAHOMA ACCOUNTANCY BOARD

rd

201 NW 63

Street, Suite 210

Oklahoma City, OK 73116

Randall A. Ross, CPA

Ph: (405) 521-2397 Fax: (405) 521-3118

Executive Director

EXPERIENCE VERIFICATION FORM

DO NOT FILE THIS FORM UNTIL YOU RECEIVE OFFICIAL NOTIFICATION FROM THE BOARD

THAT YOU HAVE SUCCESSFULLY PASSED THE EXAMINATION

Pursuant to Section 10:15-3-2(3) of the Oklahoma Administrative Code, “Documentation has

been provided that the certification applicant has a total of Eighteen hundred (1,800) hours of

part time or full time work experience in accounting as described in Title 59, Section 15.9.E of

the Act. Work experience must have been obtained within the four (4) years immediately prior to

filing the application for certification. This requirement may be satisfied through work experience

in government, industry, academia, or public practice. Acceptable work experience includes

accounting, attest, tax, and related services.”

Applicant’s full name: __________________________________

Date: _________

SECTION I - EMPLOYER INFORMATION

1. Employment type: [ ]Full-time [ ]Part-time [ ]Self-employment [ ] Internship*

*Note: Experience earned through an internship is not eligible if the applicant earned college

credit for the internship and those credits were used to meet the educational requirements to

sit for the CPA/PA exam.

2. Employment classification:

[ ] Public [ ] Government [ ] Industry [ ] Academia

3. Business Name: ___________________________________________________________

4. Business Address:__________________________________ Phone: _________________

5. Start Date: _____________

End Date: ___________

Total hours**:____________

**Note: Regardless of start date, only report hours worked within the last four years.

6. Summarize your accounting related work experience during this time period:

QUESTIONS CONTINUE, SIGN AND DATE ON REVERSE SIDE

1

OAB FORM E004

Rev. 8/2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2