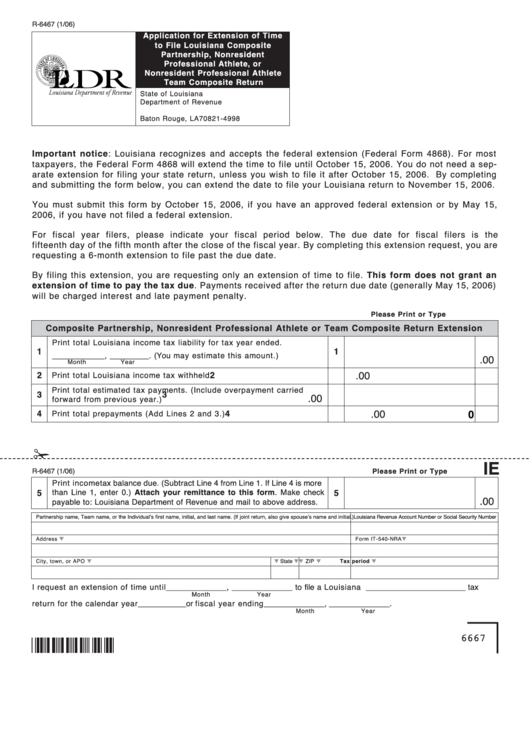

R-6467 (1/06)

Application for Extension of Time

to File Louisiana Composite

Partnership, Nonresident

Professional Athlete, or

Nonresident Professional Athlete

Team Composite Return

State of Louisiana

Department of Revenue

P.O. Box 4998

Baton Rouge, LA 70821-4998

Important notice: Louisiana recognizes and accepts the federal extension (Federal Form 4868). For most

taxpayers, the Federal Form 4868 will extend the time to file until October 15, 2006. You do not need a sep-

arate extension for filing your state return, unless you wish to file it after October 15, 2006. By completing

and submitting the form below, you can extend the date to file your Louisiana return to November 15, 2006.

You must submit this form by October 15, 2006, if you have an approved federal extension or by May 15,

2006, if you have not filed a federal extension.

For fiscal year filers, please indicate your fiscal period below. The due date for fiscal filers is the

fifteenth day of the fifth month after the close of the fiscal year. By completing this extension request, you are

requesting a 6-month extension to file past the due date.

By filing this extension, you are requesting only an extension of time to file. This form does not grant an

extension of time to pay the tax due. Payments received after the return due date (generally May 15, 2006)

will be charged interest and late payment penalty.

Please Print or Type

Composite Partnership, Nonresident Professional Athlete or Team Composite Return Extension

Print total Louisiana income tax liability for tax year ended.

1

1

____________, _________. (You may estimate this amount.)

.00

Month

Year

2

2

.00

Print total Louisiana income tax withheld

Print total estimated tax payments. (Include overpayment carried

3

3

.00

forward from previous year.)

.00

4

Print total prepayments (Add Lines 2 and 3.)

4

0

✁

IE

R-6467 (1/06)

Please Print or Type

Print income tax balance due. (Subtract Line 4 from Line 1. If Line 4 is more

5

than Line 1, enter 0.) Attach your remittance to this form. Make check

5

.00

payable to: Louisiana Department of Revenue and mail to above address.

Partnership name, Team name, or the Individual’s first name, initial, and last name. (If joint return, also give spouse’s name and initial.)

Louisiana Revenue Account Number or Social Security Number

▼

▼

Address

Form IT-540-NRA

▼

▼

▼

▼

▼

▼

City, town, or APO

State

ZIP

Tax period

I request an extension of time until ______________, ______________ to file a Louisiana _______________________ tax

Month

Year

return for the calendar year___________ or fiscal year ending ______________, ______________.

Month

Year

6667

1

1