Form Ct-612 - Claim For Remediated Brownfield Credit For Real Property Taxes

ADVERTISEMENT

Staple forms here

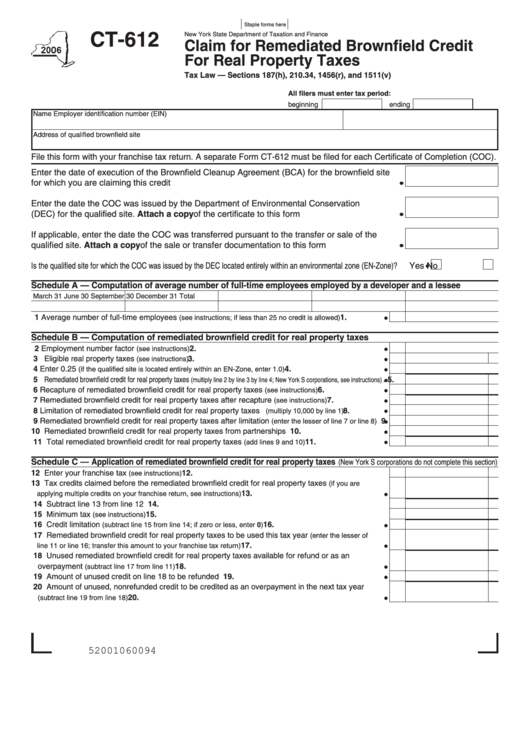

CT-612

New York State Department of Taxation and Finance

Claim for Remediated Brownfield Credit

For Real Property Taxes

Tax Law — Sections 187(h), 210.34, 1456(r), and 1511(v)

All filers must enter tax period:

beginning

ending

Name

Employer identification number (EIN)

Address of qualified brownfield site

File this form with your franchise tax return. A separate Form CT-612 must be filed for each Certificate of Completion (COC).

Enter the date of execution of the Brownfield Cleanup Agreement (BCA) for the brownfield site

for which you are claiming this credit ..............................................................................................

Enter the date the COC was issued by the Department of Environmental Conservation

(DEC) for the qualified site. Attach a copy of the certificate to this form .......................................

If applicable, enter the date the COC was transferred pursuant to the transfer or sale of the

qualified site. Attach a copy of the sale or transfer documentation to this form ............................

Is the qualified site for which the COC was issued by the DEC located entirely within an environmental zone (EN-Zone)?

Yes

No

Schedule A — Computation of average number of full-time employees employed by a developer and a lessee

March 31

June 30

September 30

December 31

Total

1 Average number of full-time employees

1.

..................

(see instructions; if less than 25 no credit is allowed)

Schedule B — Computation of remediated brownfield credit for real property taxes

2 Employment number factor

.......................................................................................

2.

(see instructions)

3 Eligible real property taxes

3.

.........................................................................................

(see instructions)

4 Enter 0.25

4.

...........................................

(if the qualified site is located entirely within an EN-Zone, enter 1.0)

5 Remediated brownfield credit for real property taxes

5.

.

(multiply line 2 by line 3 by line 4; New York S corporations, see instructions)

6 Recapture of remediated brownfield credit for real property taxes

...........................

6.

(see instructions)

7 Remediated brownfield credit for real property taxes after recapture

.......................

7.

(see instructions)

8 Limitation of remediated brownfield credit for real property taxes

..................

8.

(multiply 10,000 by line 1)

9 Remediated brownfield credit for real property taxes after limitation

9.

(enter the lesser of line 7 or line 8)

10 Remediated brownfield credit for real property taxes from partnerships ............................................

10.

11 Total remediated brownfield credit for real property taxes

.....................................

11.

(add lines 9 and 10)

Schedule C — Application of remediated brownfield credit for real property taxes

(New York S corporations do not complete this section)

12 Enter your franchise tax

.............................................................................................. 12.

(see instructions)

13 Tax credits claimed before the remediated brownfield credit for real property taxes

(if you are

13.

...........................................................

applying multiple credits on your franchise return, see instructions)

14 Subtract line 13 from line 12 ................................................................................................................. 14.

15 Minimum tax

................................................................................................................ 15.

(see instructions)

16 Credit limitation

........................................................

16.

(subtract line 15 from line 14; if zero or less, enter 0)

17 Remediated brownfield credit for real property taxes to be used this tax year

(enter the lesser of

17.

...........................................................

line 11 or line 16; transfer this amount to your franchise tax return)

18 Unused remediated brownfield credit for real property taxes available for refund or as an

overpayment

.........................................................................................

18.

(subtract line 17 from line 11)

19 Amount of unused credit on line 18 to be refunded ............................................................................

19.

20 Amount of unused, nonrefunded credit to be credited as an overpayment in the next tax year

20.

...............................................................................................................

(subtract line 19 from line 18)

52001060094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2