Form Crl-29 - Real Estate Brokers Affidavit And Schedule In Support Of Gross Receipts Deduction

ADVERTISEMENT

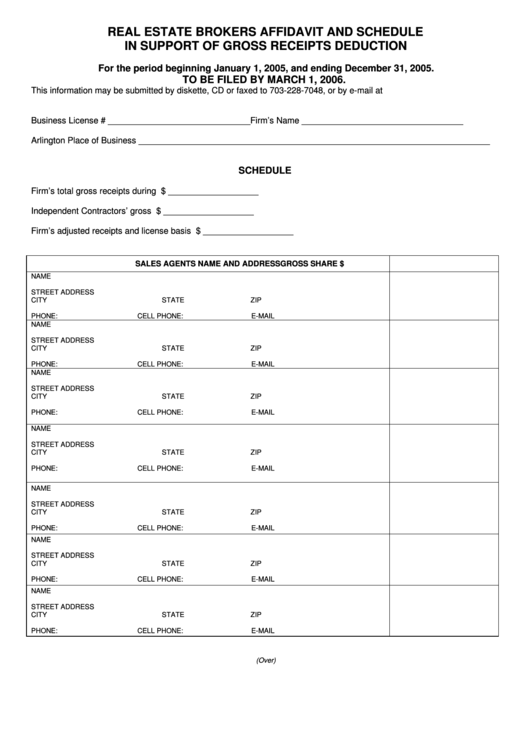

REAL ESTATE BROKERS AFFIDAVIT AND SCHEDULE

IN SUPPORT OF GROSS RECEIPTS DEDUCTION

For the period beginning January 1, 2005, and ending December 31, 2005.

TO BE FILED BY MARCH 1, 2006.

This information may be submitted by diskette, CD or faxed to 703-228-7048, or by e-mail at business@arlingtonva.us.

Business License # ______________________________

Firm’s Name __________________________________

Arlington Place of Business __________________________________________________________________________

SCHEDULE

Firm’s total gross receipts during 2005 ............................................................................................$ ___________________

Independent Contractors’ gross receipts ......................................................................................... $ ___________________

Firm’s adjusted receipts and license basis ...................................................................................... $ ___________________

SALES AGENTS NAME AND ADDRESS

GROSS SHARE $

NAME

STREET ADDRESS

CITY

STATE

ZIP

PHONE:

CELL PHONE:

E-MAIL

NAME

STREET ADDRESS

CITY

STATE

ZIP

PHONE:

CELL PHONE:

E-MAIL

NAME

STREET ADDRESS

CITY

STATE

ZIP

PHONE:

CELL PHONE:

E-MAIL

NAME

STREET ADDRESS

CITY

STATE

ZIP

PHONE:

CELL PHONE:

E-MAIL

NAME

STREET ADDRESS

CITY

STATE

ZIP

PHONE:

CELL PHONE:

E-MAIL

NAME

STREET ADDRESS

CITY

STATE

ZIP

PHONE:

CELL PHONE:

E-MAIL

NAME

STREET ADDRESS

CITY

STATE

ZIP

PHONE:

CELL PHONE:

E-MAIL

(Over)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2