Print and Reset Form

Reset Form

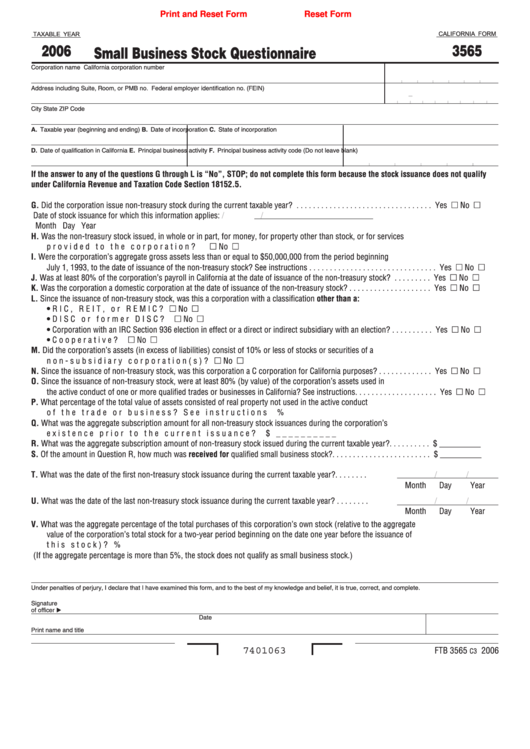

CALIFORNIA FORM

TAXABLE YEAR

2006

3565

Small Business Stock Questionnaire

Corporation name

California corporation number

-

Address including Suite, Room, or PMB no.

Federal employer identification no. (FEIN)

City

State

ZIP Code

A. Taxable year (beginning and ending)

B. Date of incorporation

C. State of incorporation

D. Date of qualification in California

E. Principal business activity

F. Principal business activity code (Do not leave blank)

If the answer to any of the questions G through L is “No”, STOP; do not complete this form because the stock issuance does not qualify

under California Revenue and Taxation Code Section 18152.5.

G. Did the corporation issue non-treasury stock during the current taxable year? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

Date of stock issuance for which this information applies:

/

/

Month

Day

Year

H. Was the non-treasury stock issued, in whole or in part, for money, for property other than stock, or for services

provided to the corporation? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

I.

Were the corporation’s aggregate gross assets less than or equal to $50,000,000 from the period beginning

July 1, 1993, to the date of issuance of the non-treasury stock? See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

J.

Was at least 80% of the corporation’s payroll in California at the date of issuance of the non-treasury stock? . . . . . . . . .

Yes No

K. Was the corporation a domestic corporation at the date of issuance of the non-treasury stock? . . . . . . . . . . . . . . . . . . . .

Yes No

L.

Since the issuance of non-treasury stock, was this a corporation with a classification other than a:

• RIC, REIT, or REMIC? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

• DISC or former DISC? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

• Corporation with an IRC Section 936 election in effect or a direct or indirect subsidiary with an election? . . . . . . . . . .

Yes No

• Cooperative? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

M. Did the corporation’s assets (in excess of liabilities) consist of 10% or less of stocks or securities of a

non-subsidiary corporation(s)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

N. Since the issuance of non-treasury stock, was this corporation a C corporation for California purposes? . . . . . . . . . . . . .

Yes No

O. Since the issuance of non-treasury stock, were at least 80% (by value) of the corporation’s assets used in

the active conduct of one or more qualified trades or businesses in California? See instructions . . . . . . . . . . . . . . . . . . . .

Yes No

P.

What percentage of the total value of assets consisted of real property not used in the active conduct

of the trade or business? See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

__________%

Q. What was the aggregate subscription amount for all non-treasury stock issuances during the corporation’s

existence prior to the current issuance? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ __________

R. What was the aggregate subscription amount of non-treasury stock issued during the current taxable year? . . . . . . . . . .

$ __________

S. Of the amount in Question R, how much was received for qualified small business stock? . . . . . . . . . . . . . . . . . . . . . . . .

$ __________

T.

What was the date of the first non-treasury stock issuance during the current taxable year? . . . . . . . .

/

/

Month

Day

Year

U. What was the date of the last non-treasury stock issuance during the current taxable year? . . . . . . . .

/

/

Month

Day

Year

V.

What was the aggregate percentage of the total purchases of this corporation’s own stock (relative to the aggregate

value of the corporation’s total stock for a two-year period beginning on the date one year before the issuance of

this stock)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

__________%

(If the aggregate percentage is more than 5%, the stock does not qualify as small business stock .)

Under penalties of perjury, I declare that I have examined this form, and to the best of my knowledge and belief, it is true, correct, and complete.

Signature

of officer

Date

Print name and title

FTB 3565

2006

7401063

C3

1

1