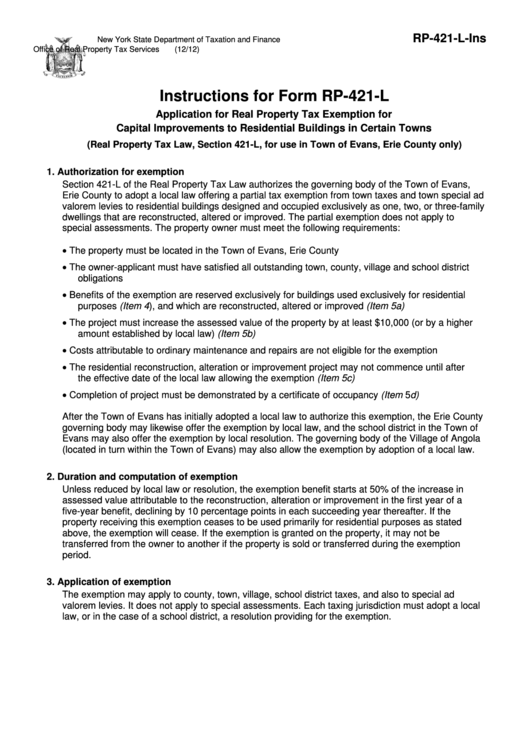

Instructions For Form Rp-421-L - Application For Real Property Tax Exemption For Capital Improvements To Residential Buildings In Certain Towns

ADVERTISEMENT

RP-421-L-Ins

New York State Department of Taxation and Finance

Office of Real Property Tax Services

(12/12)

Instructions for Form RP-421-L

Application for Real Property Tax Exemption for

Capital Improvements to Residential Buildings in Certain Towns

(Real Property Tax Law, Section 421-L, for use in Town of Evans, Erie County only)

1. Authorization for exemption

Section 421-L of the Real Property Tax Law authorizes the governing body of the Town of Evans,

Erie County to adopt a local law offering a partial tax exemption from town taxes and town special ad

valorem levies to residential buildings designed and occupied exclusively as one, two, or three-family

dwellings that are reconstructed, altered or improved. The partial exemption does not apply to

special assessments. The property owner must meet the following requirements:

•

The property must be located in the Town of Evans, Erie County

•

The owner-applicant must have satisfied all outstanding town, county, village and school district

obligations

•

Benefits of the exemption are reserved exclusively for buildings used exclusively for residential

purposes (Item 4), and which are reconstructed, altered or improved (Item 5a)

•

The project must increase the assessed value of the property by at least $10,000 (or by a higher

amount established by local law) (Item 5b)

•

Costs attributable to ordinary maintenance and repairs are not eligible for the exemption

•

The residential reconstruction, alteration or improvement project may not commence until after

the effective date of the local law allowing the exemption (Item 5c)

•

Completion of project must be demonstrated by a certificate of occupancy (Item 5d)

After the Town of Evans has initially adopted a local law to authorize this exemption, the Erie County

governing body may likewise offer the exemption by local law, and the school district in the Town of

Evans may also offer the exemption by local resolution. The governing body of the Village of Angola

(located in turn within the Town of Evans) may also allow the exemption by adoption of a local law.

2. Duration and computation of exemption

Unless reduced by local law or resolution, the exemption benefit starts at 50% of the increase in

assessed value attributable to the reconstruction, alteration or improvement in the first year of a

five-year benefit, declining by 10 percentage points in each succeeding year thereafter. If the

property receiving this exemption ceases to be used primarily for residential purposes as stated

above, the exemption will cease. If the exemption is granted on the property, it may not be

transferred from the owner to another if the property is sold or transferred during the exemption

period.

3. Application of exemption

The exemption may apply to county, town, village, school district taxes, and also to special ad

valorem levies. It does not apply to special assessments. Each taxing jurisdiction must adopt a local

law, or in the case of a school district, a resolution providing for the exemption.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2

![Instructions For Form Rp-421-j-ins [cohoes] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Instructions For Form Rp-421-j-ins [cohoes] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/362/3622/362237/page_1_thumb.png)

![Instructions For Form Rp-421-i-ins [buffalo] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Instructions For Form Rp-421-i-ins [buffalo] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/362/3622/362242/page_1_thumb.png)