Qualified Fund Annual Report Form

Download a blank fillable Qualified Fund Annual Report Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Qualified Fund Annual Report Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

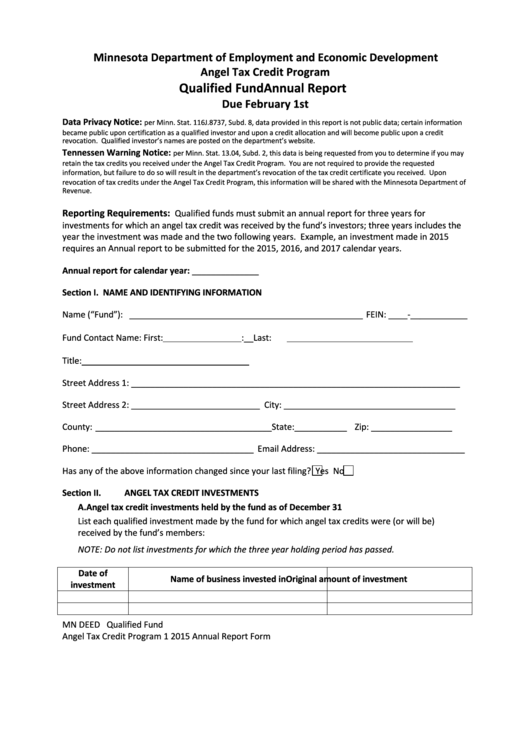

Minnesota Department of Employment and Economic Development

Angel Tax Credit Program

Qualified Fund Annual Report

Due February 1st

Data Privacy Notice:

per Minn. Stat. 116J.8737, Subd. 8, data provided in this report is not public data; certain information

became public upon certification as a qualified investor and upon a credit allocation and will become public upon a credit

revocation. Qualified investor’s names are posted on the department’s website.

Tennessen Warning Notice:

per Minn. Stat. 13.04, Subd. 2, this data is being requested from you to determine if you may

retain the tax credits you received under the Angel Tax Credit Program. You are not required to provide the requested

information, but failure to do so will result in the department’s revocation of the tax credit certificate you received. Upon

revocation of tax credits under the Angel Tax Credit Program, this information will be shared with the Minnesota Department of

Revenue.

Reporting Requirements:

Qualified funds must submit an annual report for three years for

investments for which an angel tax credit was received by the fund’s investors; three years includes the

year the investment was made and the two following years. Example, an investment made in 2015

requires an Annual report to be submitted for the 2015, 2016, and 2017 calendar years.

Annual report for calendar year: ______________

Section I.

NAME AND IDENTIFYING INFORMATION

Name (“Fund”): _________________________________________________ FEIN: ____-____________

Fund Contact Name: First:

M.I.:__Last:

Title: __________________________________

Street Address 1: _____________________________________________________________________

Street Address 2: ___________________________ City: ____________________________________

County: _____________________________________ State: ___________ Zip: _________________

Phone: __________________________________ Email Address: _______________________________

Has any of the above information changed since your last filing?

Yes

No

Section II.

ANGEL TAX CREDIT INVESTMENTS

A.

Angel tax credit investments held by the fund as of December 31

List each qualified investment made by the fund for which angel tax credits were (or will be)

received by the fund’s members:

NOTE: Do not list investments for which the three year holding period has passed.

Date of

Name of business invested in

Original amount of investment

investment

MN DEED

Qualified Fund

Angel Tax Credit Program

1

2015 Annual Report Form

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2