Instructions For Ohio Form It-1140 Tax Return For Pass-Through Entities & Trusts For Taxable Years Beginning In 2001

ADVERTISEMENT

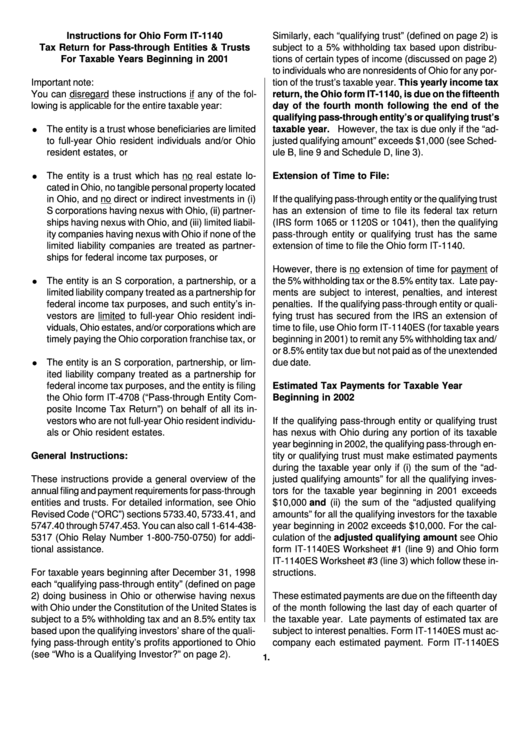

Instructions for Ohio Form IT-1140

Similarly, each “qualifying trust” (defined on page 2) is

Tax Return for Pass-through Entities & Trusts

subject to a 5% withholding tax based upon distribu-

For Taxable Years Beginning in 2001

tions of certain types of income (discussed on page 2)

to individuals who are nonresidents of Ohio for any por-

Important note:

tion of the trust’s taxable year. This yearly income tax

You can disregard these instructions if any of the fol-

return, the Ohio form IT-1140, is due on the fifteenth

lowing is applicable for the entire taxable year:

day of the fourth month following the end of the

qualifying pass-through entity’s or qualifying trust’s

=

The entity is a trust whose beneficiaries are limited

taxable year. However, the tax is due only if the “ad-

to full-year Ohio resident individuals and/or Ohio

justed qualifying amount” exceeds $1,000 (see Sched-

resident estates, or

ule B, line 9 and Schedule D, line 3).

=

The entity is a trust which has no real estate lo-

Extension of Time to File:

cated in Ohio, no tangible personal property located

in Ohio, and no direct or indirect investments in (i)

If the qualifying pass-through entity or the qualifying trust

S corporations having nexus with Ohio, (ii) partner-

has an extension of time to file its federal tax return

ships having nexus with Ohio, and (iii) limited liabil-

(IRS form 1065 or 1120S or 1041), then the qualifying

ity companies having nexus with Ohio if none of the

pass-through entity or qualifying trust has the same

limited liability companies are treated as partner-

extension of time to file the Ohio form IT-1140.

ships for federal income tax purposes, or

However, there is no extension of time for payment of

=

The entity is an S corporation, a partnership, or a

the 5% withholding tax or the 8.5% entity tax. Late pay-

limited liability company treated as a partnership for

ments are subject to interest, penalties, and interest

federal income tax purposes, and such entity’s in-

penalties. If the qualifying pass-through entity or quali-

vestors are limited to full-year Ohio resident indi-

fying trust has secured from the IRS an extension of

viduals, Ohio estates, and/or corporations which are

time to file, use Ohio form IT-1140ES (for taxable years

timely paying the Ohio corporation franchise tax, or

beginning in 2001) to remit any 5% withholding tax and/

or 8.5% entity tax due but not paid as of the unextended

=

The entity is an S corporation, partnership, or lim-

due date.

ited liability company treated as a partnership for

federal income tax purposes, and the entity is filing

Estimated Tax Payments for Taxable Year

the Ohio form IT-4708 (“Pass-through Entity Com-

Beginning in 2002

posite Income Tax Return”) on behalf of all its in-

vestors who are not full-year Ohio resident individu-

If the qualifying pass-through entity or qualifying trust

als or Ohio resident estates.

has nexus with Ohio during any portion of its taxable

year beginning in 2002, the qualifying pass-through en-

General Instructions:

tity or qualifying trust must make estimated payments

during the taxable year only if (i) the sum of the “ad-

These instructions provide a general overview of the

justed qualifying amounts” for all the qualifying inves-

annual filing and payment requirements for pass-through

tors for the taxable year beginning in 2001 exceeds

entities and trusts. For detailed information, see Ohio

$10,000 and (ii) the sum of the “adjusted qualifying

Revised Code (“ORC”) sections 5733.40, 5733.41, and

amounts” for all the qualifying investors for the taxable

5747.40 through 5747.453. You can also call 1-614-438-

year beginning in 2002 exceeds $10,000. For the cal-

5317 (Ohio Relay Number 1-800-750-0750) for addi-

culation of the adjusted qualifying amount see Ohio

tional assistance.

form IT-1140ES Worksheet #1 (line 9) and Ohio form

IT-1140ES Worksheet #3 (line 3) which follow these in-

For taxable years beginning after December 31, 1998

structions.

each “qualifying pass-through entity” (defined on page

2) doing business in Ohio or otherwise having nexus

These estimated payments are due on the fifteenth day

with Ohio under the Constitution of the United States is

of the month following the last day of each quarter of

subject to a 5% withholding tax and an 8.5% entity tax

the taxable year. Late payments of estimated tax are

based upon the qualifying investors’ share of the quali-

subject to interest penalties. Form IT-1140ES must ac-

fying pass-through entity’s profits apportioned to Ohio

company each estimated payment. Form IT-1140ES

(see “Who is a Qualifying Investor?” on page 2).

1.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10