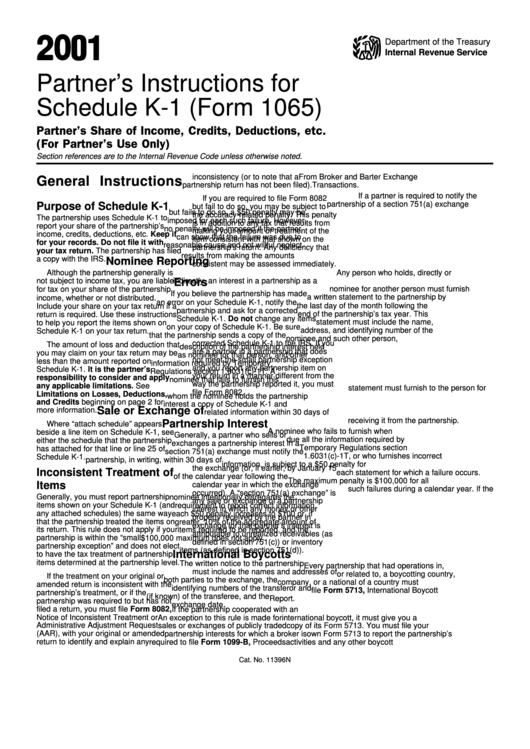

Partner'S Instructions For Schedule K-1 (Form 1065) - Partner'S Share Of Income, Credits, Deductions, Etc. (For Partner'S Use Only) - 2001

ADVERTISEMENT

01

2 0

Department of the Treasury

Internal Revenue Service

Partner’s Instructions for

Schedule K-1 (Form 1065)

Partner’s Share of Income, Credits, Deductions, etc.

(For Partner’s Use Only)

Section references are to the Internal Revenue Code unless otherwise noted.

inconsistency (or to note that a

From Broker and Barter Exchange

General Instructions

partnership return has not been filed).

Transactions.

If a partner is required to notify the

If you are required to file Form 8082

partnership of a section 751(a) exchange

Purpose of Schedule K-1

but fail to do so, you may be subject to

but fails to do so, a $50 penalty may be

the accuracy-related penalty. This penalty

The partnership uses Schedule K-1 to

imposed for each such failure. However,

is in addition to any tax that results from

report your share of the partnership’s

no penalty will be imposed if the partner

making your amount or treatment of the

income, credits, deductions, etc. Keep it

can show that the failure was due to

item consistent with that shown on the

for your records. Do not file it with

reasonable cause and not willful neglect.

partnership’s return. Any deficiency that

your tax return. The partnership has filed

results from making the amounts

a copy with the IRS.

Nominee Reporting

consistent may be assessed immediately.

Although the partnership generally is

Any person who holds, directly or

indirectly, an interest in a partnership as a

not subject to income tax, you are liable

Errors

nominee for another person must furnish

for tax on your share of the partnership

If you believe the partnership has made

income, whether or not distributed.

a written statement to the partnership by

an error on your Schedule K-1, notify the

the last day of the month following the

Include your share on your tax return if a

partnership and ask for a corrected

end of the partnership’s tax year. This

return is required. Use these instructions

Schedule K-1. Do not change any items

statement must include the name,

to help you report the items shown on

on your copy of Schedule K-1. Be sure

address, and identifying number of the

Schedule K-1 on your tax return.

that the partnership sends a copy of the

nominee and such other person,

corrected Schedule K-1 to the IRS. If you

The amount of loss and deduction that

description of the partnership interest held

are a partner in a partnership that does

you may claim on your tax return may be

as nominee for that person, and other

not meet the small partnership exception

less than the amount reported on

information required by Temporary

and you report any partnership item on

Schedule K-1. It is the partner’s

Regulations section 1.6031(c)-1T. A

your return in a manner different from the

responsibility to consider and apply

nominee that fails to furnish this

way the partnership reported it, you must

any applicable limitations. See

statement must furnish to the person for

file Form 8082.

Limitations on Losses, Deductions,

whom the nominee holds the partnership

and Credits beginning on page 2 for

interest a copy of Schedule K-1 and

Sale or Exchange of

more information.

related information within 30 days of

receiving it from the partnership.

Partnership Interest

Where “attach schedule” appears

A nominee who fails to furnish when

beside a line item on Schedule K-1, see

Generally, a partner who sells or

due all the information required by

either the schedule that the partnership

exchanges a partnership interest in a

Temporary Regulations section

has attached for that line or line 25 of

section 751(a) exchange must notify the

1.6031(c)-1T, or who furnishes incorrect

Schedule K-1.

partnership, in writing, within 30 days of

information, is subject to a $50 penalty for

the exchange (or, if earlier, by January 15

Inconsistent Treatment of

each statement for which a failure occurs.

of the calendar year following the

The maximum penalty is $100,000 for all

Items

calendar year in which the exchange

such failures during a calendar year. If the

occurred). A “section 751(a) exchange” is

Generally, you must report partnership

nominee intentionally disregards the

any sale or exchange of a partnership

items shown on your Schedule K-1 (and

requirement to report correct information,

interest in which any money or other

any attached schedules) the same way

each $50 penalty increases to $100 or, if

property received by the partner in

that the partnership treated the items on

greater, 10% of the aggregate amount of

exchange for that partner’s interest is

its return. This rule does not apply if your

items required to be reported, and the

attributable to unrealized receivables (as

partnership is within the “small

$100,000 maximum does not apply.

defined in section 751(c)) or inventory

partnership exception” and does not elect

items (as defined in section 751(d)).

International Boycotts

to have the tax treatment of partnership

items determined at the partnership level.

The written notice to the partnership

Every partnership that had operations in,

must include the names and addresses of

or related to, a boycotting country,

If the treatment on your original or

both parties to the exchange, the

company, or a national of a country must

amended return is inconsistent with the

identifying numbers of the transferor and

file Form 5713, International Boycott

partnership’s treatment, or if the

(if known) of the transferee, and the

Report.

partnership was required to but has not

exchange date.

filed a return, you must file Form 8082,

If the partnership cooperated with an

Notice of Inconsistent Treatment or

An exception to this rule is made for

international boycott, it must give you a

Administrative Adjustment Request

sales or exchanges of publicly traded

copy of its Form 5713. You must file your

(AAR), with your original or amended

partnership interests for which a broker is

own Form 5713 to report the partnership’s

return to identify and explain any

required to file Form 1099-B, Proceeds

activities and any other boycott

Cat. No. 11396N

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11