Form Nys-100a - New York State Employer Registration For Unemployment Insurance, Withholding, And Wage Reporting For Agricultural Employment - Instructions

ADVERTISEMENT

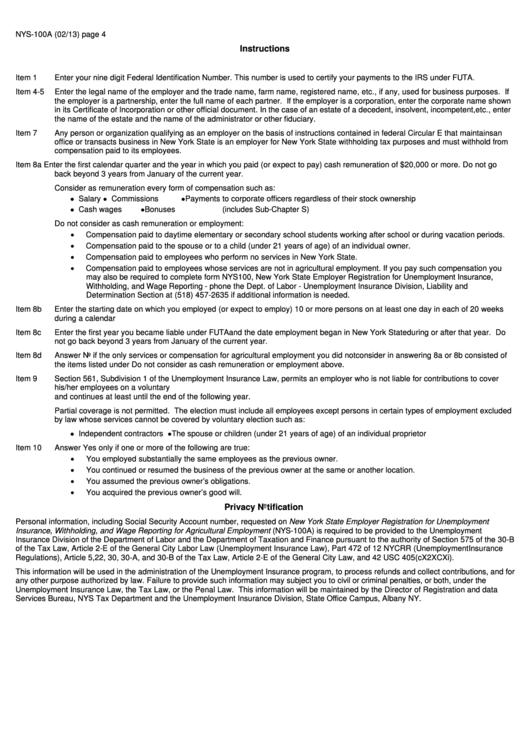

NYS-100A (02/13) page 4

Instructions

Item 1

Enter your nine digit Federal Identification Number. This number is used to certify your payments to the IRS under FUTA.

Item 4-5

Enter the legal name of the employer and the trade name, farm name, registered name, etc., if any, used for business purposes. If

the employer is a partnership, enter the full name of each partner. If the employer is a corporation, enter the corporate name shown

in its Certificate of Incorporation or other official document. In the case of an estate of a decedent, insolvent, incompetent, etc., enter

the name of the estate and the name of the administrator or other fiduciary.

Item 7

Any person or organization qualifying as an employer on the basis of instructions contained in federal Circular E that maintains an

office or transacts business in New York State is an employer for New York State withholding tax purposes and must withhold from

compensation paid to its employees.

Item 8a

Enter the first calendar quarter and the year in which you paid (or expect to pay) cash remuneration of $20,000 or more. Do not go

back beyond 3 years from January of the current year.

Consider as remuneration every form of compensation such as:

●

●

●

Salary

Commissions

Payments to corporate officers regardless of their stock ownership

●

●

Cash wages

Bonuses

(includes Sub-Chapter S)

Do not consider as cash remuneration or employment:

•

Compensation paid to daytime elementary or secondary school students working after school or during vacation periods.

•

Compensation paid to the spouse or to a child (under 21 years of age) of an individual owner.

•

Compensation paid to employees who perform no services in New York State.

•

Compensation paid to employees whose services are not in agricultural employment. If you pay such compensation you

may also be required to complete form NYS100, New York State Employer Registration for Unemployment Insurance,

Withholding, and Wage Reporting - phone the Dept. of Labor - Unemployment Insurance Division, Liability and

Determination Section at (518) 457-2635 if additional information is needed.

Item 8b

Enter the starting date on which you employed (or expect to employ) 10 or more persons on at least one day in each of 20 weeks

during a calendar year. Do not go back beyond 4 years from January of the current year.

Item 8c

Enter the first year you became liable under FUTA and the date employment began in New York State during or after that year. Do

not go back beyond 3 years from January of the current year.

Item 8d

Answer No if the only services or compensation for agricultural employment you did not consider in answering 8a or 8b consisted of

the items listed under Do not consider as cash remuneration or employment above.

Item 9

Section 561, Subdivision 1 of the Unemployment Insurance Law, permits an employer who is not liable for contributions to cover

his/her employees on a voluntary basis. Liability begins the first day of the calendar quarter in which an approved application is filed

and continues at least until the end of the following year.

Partial coverage is not permitted. The election must include all employees except persons in certain types of employment excluded

by law whose services cannot be covered by voluntary election such as:

●

●

Independent contractors

The spouse or children (under 21 years of age) of an individual proprietor

Item 10

Answer Yes only if one or more of the following are true:

•

You employed substantially the same employees as the previous owner.

•

You continued or resumed the business of the previous owner at the same or another location.

•

You assumed the previous owner’s obligations.

•

You acquired the previous owner’s good will.

Privacy Notification

Personal information, including Social Security Account number, requested on New York State Employer Registration for Unemployment

Insurance, Withholding, and Wage Reporting for Agricultural Employment (NYS-100A) is required to be provided to the Unemployment

Insurance Division of the Department of Labor and the Department of Taxation and Finance pursuant to the authority of Section 575 of the 30-B

of the Tax Law, Article 2-E of the General City Labor Law (Unemployment Insurance Law), Part 472 of 12 NYCRR (Unemployment Insurance

Regulations), Article 5,22, 30, 30-A, and 30-B of the Tax Law, Article 2-E of the General City Law, and 42 USC 405(cX2XCXi).

This information will be used in the administration of the Unemployment Insurance program, to process refunds and collect contributions, and for

any other purpose authorized by law. Failure to provide such information may subject you to civil or criminal penalties, or both, under the

Unemployment Insurance Law, the Tax Law, or the Penal Law. This information will be maintained by the Director of Registration and data

Services Bureau, NYS Tax Department and the Unemployment Insurance Division, State Office Campus, Albany NY.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1