Instructions For Form M-4868 - Income Tax Return - Massachusetts Department Of Revenue

ADVERTISEMENT

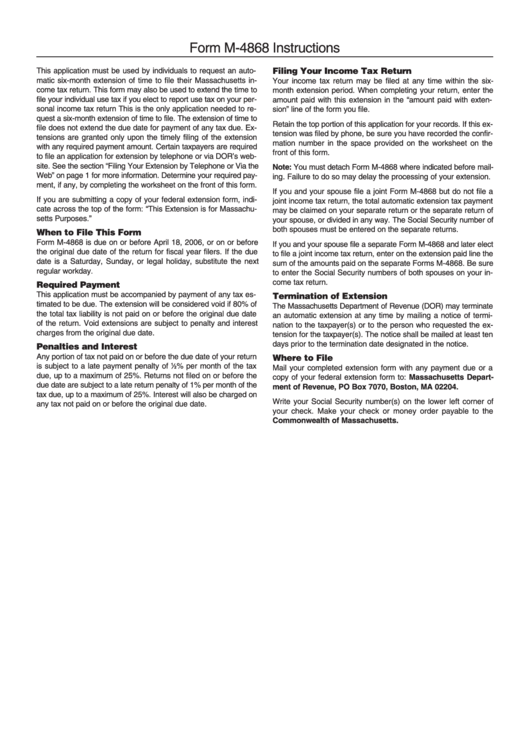

Form M-4868 Instructions

This application must be used by individuals to request an auto-

Filing Your Income Tax Return

matic six-month extension of time to file their Massachusetts in-

Your income tax return may be filed at any time within the six-

come tax return. This form may also be used to extend the time to

month extension period. When completing your return, enter the

file your individual use tax if you elect to report use tax on your per-

amount paid with this extension in the “amount paid with exten-

sonal income tax return This is the only application needed to re-

sion” line of the form you file.

quest a six-month extension of time to file. The extension of time to

Retain the top portion of this application for your records. If this ex-

file does not extend the due date for payment of any tax due. Ex-

tension was filed by phone, be sure you have recorded the confir-

tensions are granted only upon the timely filing of the extension

mation number in the space provided on the worksheet on the

with any required payment amount. Certain taxpayers are required

front of this form.

to file an application for extension by telephone or via DOR’s web-

site. See the section “Filing Your Extension by Telephone or Via the

Note: You must detach Form M-4868 where indicated before mail-

Web” on page 1 for more information. Determine your required pay-

ing. Failure to do so may delay the processing of your extension.

ment, if any, by completing the worksheet on the front of this form.

If you and your spouse file a joint Form M-4868 but do not file a

If you are submitting a copy of your federal extension form, indi-

joint income tax return, the total automatic extension tax payment

cate across the top of the form: “This Extension is for Massachu-

may be claimed on your separate return or the separate return of

setts Purposes.”

your spouse, or divided in any way. The Social Security number of

both spouses must be entered on the separate returns.

When to File This Form

Form M-4868 is due on or before April 18, 2006, or on or before

If you and your spouse file a separate Form M-4868 and later elect

the original due date of the return for fiscal year filers. If the due

to file a joint income tax return, enter on the extension paid line the

date is a Saturday, Sunday, or legal holiday, substitute the next

sum of the amounts paid on the separate Forms M-4868. Be sure

regular workday.

to enter the Social Security numbers of both spouses on your in-

come tax return.

Required Payment

This application must be accompanied by payment of any tax es-

Termination of Extension

timated to be due. The extension will be considered void if 80% of

The Massachusetts Department of Revenue (DOR) may terminate

the total tax liability is not paid on or before the original due date

an automatic extension at any time by mailing a notice of termi-

of the return. Void extensions are subject to penalty and interest

nation to the taxpayer(s) or to the person who requested the ex-

charges from the original due date.

tension for the taxpayer(s). The notice shall be mailed at least ten

days prior to the termination date designated in the notice.

Penalties and Interest

Any portion of tax not paid on or before the due date of your return

Where to File

is subject to a late payment penalty of

1

% per month of the tax

⁄

Mail your completed extension form with any payment due or a

2

due, up to a maximum of 25%. Returns not filed on or before the

copy of your federal extension form to: Massachusetts Depart-

due date are subject to a late return penalty of 1% per month of the

ment of Revenue, PO Box 7070, Boston, MA 02204.

tax due, up to a maximum of 25%. Interest will also be charged on

Write your Social Security number(s) on the lower left corner of

any tax not paid on or before the original due date.

your check. Make your check or money order payable to the

Commonwealth of Massachusetts.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1