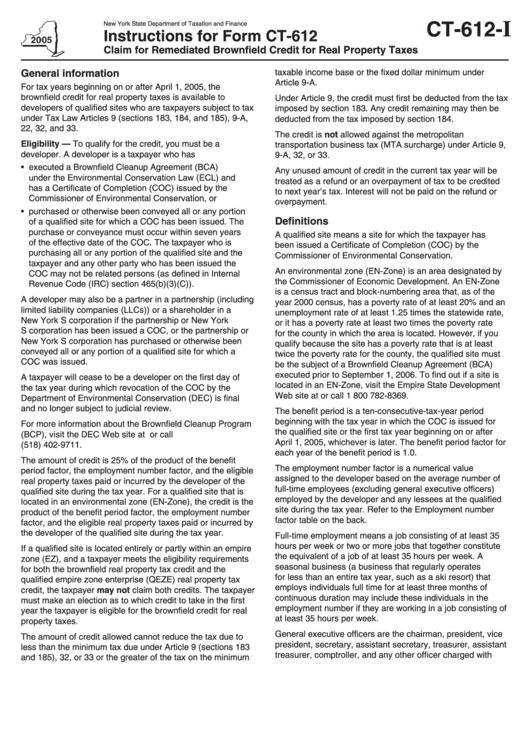

Instructions For Form Ct-612 - Claim For Remediated Brownfield Credit For Real Property Taxes - New York State Department Of Taxation And Finance - 2005

ADVERTISEMENT

I

CT-612-

New York State Department of Taxation and Finance

Instructions for Form CT-612

Claim for Remediated Brownfield Credit for Real Property Taxes

General information

taxable income base or the fixed dollar minimum under

Article 9-A.

For tax years beginning on or after April 1, 2005, the

brownfield credit for real property taxes is available to

Under Article 9, the credit must first be deducted from the tax

developers of qualified sites who are taxpayers subject to tax

imposed by section 183. Any credit remaining may then be

under Tax Law Articles 9 (sections 183, 184, and 185), 9-A,

deducted from the tax imposed by section 184.

22, 32, and 33.

The credit is not allowed against the metropolitan

Eligibility — To qualify for the credit, you must be a

transportation business tax (MTA surcharge) under Article 9,

developer. A developer is a taxpayer who has

9-A, 32, or 33.

• executed a Brownfield Cleanup Agreement (BCA)

Any unused amount of credit in the current tax year will be

under the Environmental Conservation Law (ECL) and

treated as a refund or an overpayment of tax to be credited

has a Certificate of Completion (COC) issued by the

to next year’s tax. Interest will not be paid on the refund or

Commissioner of Environmental Conservation, or

overpayment.

• purchased or otherwise been conveyed all or any portion

Definitions

of a qualified site for which a COC has been issued. The

purchase or conveyance must occur within seven years

A qualified site means a site for which the taxpayer has

of the effective date of the COC. The taxpayer who is

been issued a Certificate of Completion (COC) by the

purchasing all or any portion of the qualified site and the

Commissioner of Environmental Conservation.

taxpayer and any other party who has been issued the

An environmental zone (EN-Zone) is an area designated by

COC may not be related persons (as defined in Internal

the Commissioner of Economic Development. An EN-Zone

Revenue Code (IRC) section 465(b)(3)(C)).

is a census tract and block-numbering area that, as of the

A developer may also be a partner in a partnership (including

year 2000 census, has a poverty rate of at least 20% and an

limited liability companies (LLCs)) or a shareholder in a

unemployment rate of at least 1.25 times the statewide rate,

New York S corporation if the partnership or New York

or it has a poverty rate at least two times the poverty rate

S corporation has been issued a COC, or the partnership or

for the county in which the area is located. However, if you

New York S corporation has purchased or otherwise been

qualify because the site has a poverty rate that is at least

conveyed all or any portion of a qualified site for which a

twice the poverty rate for the county, the qualified site must

COC was issued.

be the subject of a Brownfield Cleanup Agreement (BCA)

executed prior to September 1, 2006. To find out if a site is

A taxpayer will cease to be a developer on the first day of

located in an EN-Zone, visit the Empire State Development

the tax year during which revocation of the COC by the

Web site at or call 1 800 782-8369.

Department of Environmental Conservation (DEC) is final

and no longer subject to judicial review.

The benefit period is a ten-consecutive-tax-year period

beginning with the tax year in which the COC is issued for

For more information about the Brownfield Cleanup Program

the qualified site or the first tax year beginning on or after

(BCP), visit the DEC Web site at or call

April 1, 2005, whichever is later. The benefit period factor for

(518) 402-9711.

each year of the benefit period is 1.0.

The amount of credit is 25% of the product of the benefit

The employment number factor is a numerical value

period factor, the employment number factor, and the eligible

assigned to the developer based on the average number of

real property taxes paid or incurred by the developer of the

full-time employees (excluding general executive officers)

qualified site during the tax year. For a qualified site that is

employed by the developer and any lessees at the qualified

located in an environmental zone (EN-Zone), the credit is the

site during the tax year. Refer to the Employment number

product of the benefit period factor, the employment number

factor table on the back.

factor, and the eligible real property taxes paid or incurred by

the developer of the qualified site during the tax year.

Full-time employment means a job consisting of at least 35

hours per week or two or more jobs that together constitute

If a qualified site is located entirely or partly within an empire

the equivalent of a job of at least 35 hours per week. A

zone (EZ), and a taxpayer meets the eligibility requirements

seasonal business (a business that regularly operates

for both the brownfield real property tax credit and the

for less than an entire tax year, such as a ski resort) that

qualified empire zone enterprise (QEZE) real property tax

employs individuals full time for at least three months of

credit, the taxpayer may not claim both credits. The taxpayer

continuous duration may include these individuals in the

must make an election as to which credit to take in the first

employment number if they are working in a job consisting of

year the taxpayer is eligible for the brownfield credit for real

at least 35 hours per week.

property taxes.

General executive officers are the chairman, president, vice

The amount of credit allowed cannot reduce the tax due to

president, secretary, assistant secretary, treasurer, assistant

less than the minimum tax due under Article 9 (sections 183

treasurer, comptroller, and any other officer charged with

and 185), 32, or 33 or the greater of the tax on the minimum

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3