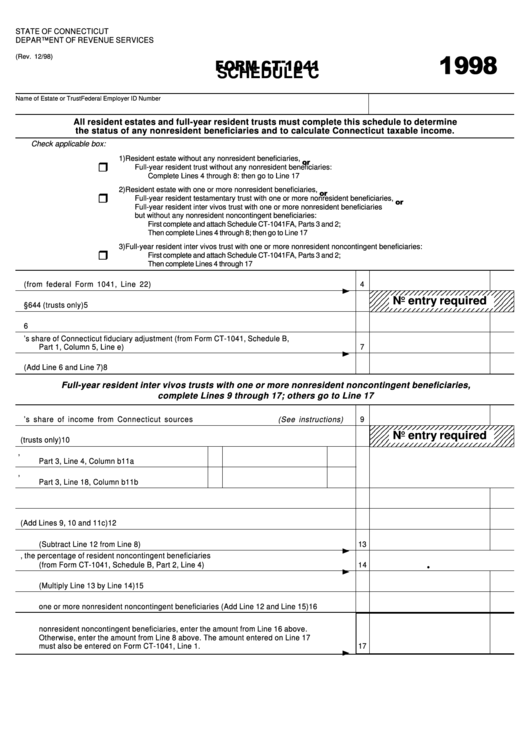

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

(Rev. 12/98)

SCHEDULE C

Name of Estate or Trust

Federal Employer ID Number

All resident estates and full-year resident trusts must complete this schedule to determine

the status of any nonresident beneficiaries and to calculate Connecticut taxable income.

Check applicable box:

1)

Resident estate without any nonresident beneficiaries,

Full-year resident trust without any nonresident beneficiaries:

Complete Lines 4 through 8: then go to Line 17

2)

Resident estate with one or more nonresident beneficiaries,

Full-year resident testamentary trust with one or more nonresident beneficiaries,

Full-year resident inter vivos trust with one or more nonresident beneficiaries

but without any nonresident noncontingent beneficiaries:

First complete and attach Schedule CT-1041FA, Parts 3 and 2;

Then complete Lines 4 through 8; then go to Line 17

3)

Full-year resident inter vivos trust with one or more nonresident noncontingent beneficiaries:

First complete and attach Schedule CT-1041FA, Parts 3 and 2;

Then complete Lines 4 through 17

4.

Federal taxable income of fiduciary (from federal Form 1041, Line 22)

4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

No entry required

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

5.

Includible gain pursuant to Internal Revenue Code §644 (trusts only)

5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

6.

Add Line 4 and Line 5

6

7.

Fiduciary’s share of Connecticut fiduciary adjustment (from Form CT-1041, Schedule B,

Part 1, Column 5, Line e)

7

8.

Gross taxable income of fiduciary as modified (Add Line 6 and Line 7)

8

Full-year resident inter vivos trusts with one or more nonresident noncontingent beneficiaries,

complete Lines 9 through 17; others go to Line 17

9.

Enter the fiduciary’s share of income from Connecticut sources (See instructions)

9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

No entry required

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

10.

Enter the amount from Line 5 above derived from Connecticut sources (trusts only)

10

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

11a. Enter the amount from Schedule CT-1041FA,

Part 3, Line 4, Column b

11a

11b. Enter the amount from Schedule CT-1041FA,

Part 3, Line 18, Column b

11b

11c. Subtract Line 11b from Line 11a

11c

12.

Income from Connecticut sources of fiduciary as modified (Add Lines 9, 10 and 11c)

12

13.

Connecticut taxable income of fiduciary from non-Connecticut sources as modified

(Subtract Line 12 from Line 8)

13

14.

Enter as a decimal, the percentage of resident noncontingent beneficiaries

(from Form CT-1041, Schedule B, Part 2, Line 4)

1 4

•

15.

Connecticut taxable portion of non-Connecticut source income of fiduciary

(Multiply Line 13 by Line 14)

15

16.

Connecticut taxable income of fiduciary of a resident inter vivos trust with

one or more nonresident noncontingent beneficiaries (Add Line 12 and Line 15)

16

17.

Connecticut taxable income of fiduciary. If an inter vivos trust with one or more

nonresident noncontingent beneficiaries, enter the amount from Line 16 above.

Otherwise, enter the amount from Line 8 above. The amount entered on Line 17

must also be entered on Form CT-1041, Line 1.

17

1

1