Declaration Of Estimated Tax Robert C. Schirack And Quarterly Estimated Payments Form

ADVERTISEMENT

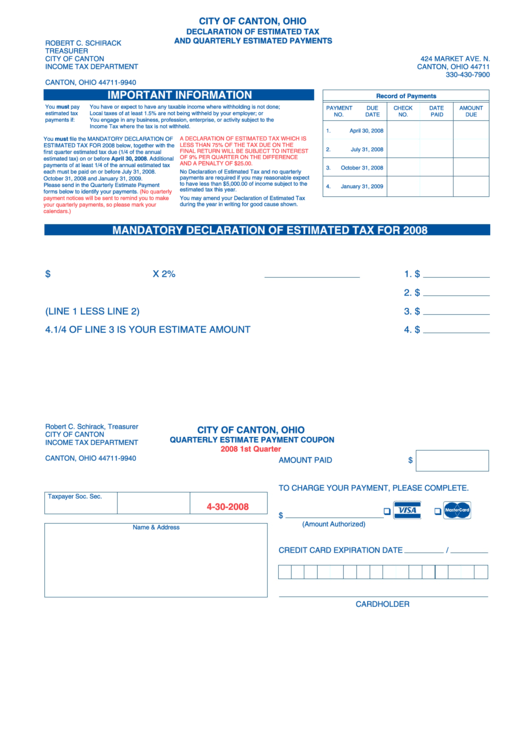

CITY OF CANTON, OHIO

DECLARATION OF ESTIMATED TAX

AND QUARTERLY ESTIMATED PAYMENTS

ROBERT C. SCHIRACK

TREASURER

CITY OF CANTON

424 MARKET AVE. N.

INCOME TAX DEPARTMENT

CANTON, OHIO 44711

P.O. BOX 9940

330-430-7900

CANTON, OHIO 44711-9940

IMPORTANT INFORMATION

Record of Payments

You must pay

You have or expect to have any taxable income where withholding is not done;

PAYMENT

DUE

CHECK

DATE

AMOUNT

estimated tax

Local taxes of at least 1.5% are not being withheld by your employer; or

NO.

DATE

NO.

PAID

DUE

payments if:

You engage in any business, profession, enterprise, or activity subject to the

Income Tax where the tax is not withheld.

1.

April 30, 2008

You must file the MANDATORY DECLARATION OF

A DECLARATION OF ESTIMATED TAX WHICH IS

LESS THAN 75% OF THE TAX DUE ON THE

ESTIMATED TAX FOR 2008 below, together with the

2.

July 31, 2008

FINAL RETURN WILL BE SUBJECT TO INTEREST

first quarter estimated tax due (1/4 of the annual

OF 9% PER QUARTER ON THE DIFFERENCE

estimated tax) on or before April 30, 2008. Additional

AND A PENALTY OF $25.00.

payments of at least 1/4 of the annual estimated tax

3.

October 31, 2008

each must be paid on or before July 31, 2008.

No Declaration of Estimated Tax and no quarterly

payments are required if you may reasonable expect

October 31, 2008 and January 31, 2009.

to have less than $5,000.00 of income subject to the

Please send in the Quarterly Estimate Payment

4.

January 31, 2009

estimated tax this year.

forms below to identify your payments.

(No quarterly

payment notices will be sent to remind you to make

You may amend your Declaration of Estimated Tax

during the year in writing for good cause shown.

your quarterly payments, so please mark your

calendars.)

MANDATORY DECLARATION OF ESTIMATED TAX FOR 2008

1. TOTAL INCOME SUBJECT TO CANTON TAX $

X 2%

1. $

2. LESS CREDITS

2. $

3. NET TAX DUE (LINE 1 LESS LINE 2)

3. $

4. 1/4 OF LINE 3 IS YOUR ESTIMATE AMOUNT

4. $

Robert C. Schirack, Treasurer

CITY OF CANTON, OHIO

CITY OF CANTON

QUARTERLY ESTIMATE PAYMENT COUPON

INCOME TAX DEPARTMENT

2008 1st Quarter

P.O. BOX 9940

CANTON, OHIO 44711-9940

AMOUNT PAID

$

TO CHARGE YOUR PAYMENT, PLEASE COMPLETE.

Taxpayer Soc. Sec. No.

Account Number

Due on or Before

4-30-2008

$

(Amount Authorized)

Name & Address

CREDIT CARD EXPIRATION DATE

/

CARDHOLDER

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2