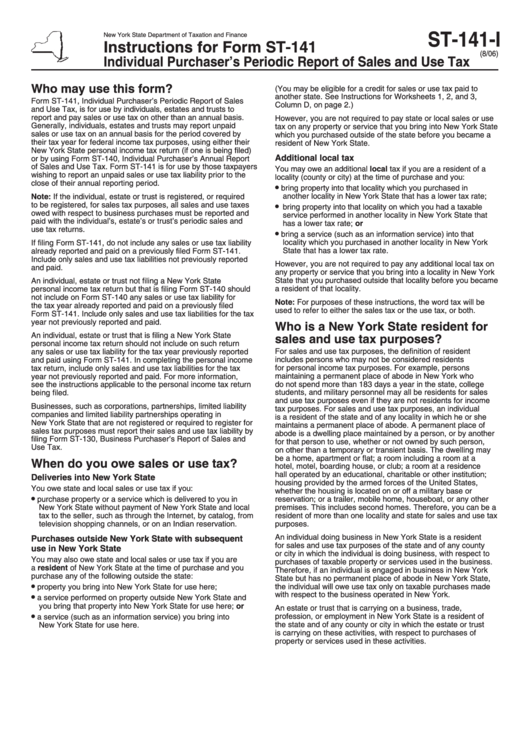

Instructions For Form St-141 - Individual Purchaser'S Periodic Report Of Sales And Use Tax - New York State Department Of Taxation And Finance

ADVERTISEMENT

ST-141-I

New York State Department of Taxation and Finance

Instructions for Form ST-141

(8/06)

Individual Purchaser’s Periodic Report of Sales and Use Tax

Who may use this form?

(You may be eligible for a credit for sales or use tax paid to

another state. See Instructions for Worksheets 1, 2, and 3,

Form ST-141, Individual Purchaser’s Periodic Report of Sales

Column D, on page 2.)

and Use Tax, is for use by individuals, estates and trusts to

report and pay sales or use tax on other than an annual basis.

However, you are not required to pay state or local sales or use

Generally, individuals, estates and trusts may report unpaid

tax on any property or service that you bring into New York State

sales or use tax on an annual basis for the period covered by

which you purchased outside of the state before you became a

their tax year for federal income tax purposes, using either their

resident of New York State.

New York State personal income tax return (if one is being filed)

Additional local tax

or by using Form ST-140, Individual Purchaser’s Annual Report

of Sales and Use Tax. Form ST-141 is for use by those taxpayers

You may owe an additional local tax if you are a resident of a

wishing to report an unpaid sales or use tax liability prior to the

locality (county or city) at the time of purchase and you:

close of their annual reporting period.

•

bring property into that locality which you purchased in

Note: If the individual, estate or trust is registered, or required

another locality in New York State that has a lower tax rate;

to be registered, for sales tax purposes, all sales and use taxes

•

bring property into that locality on which you had a taxable

owed with respect to business purchases must be reported and

service performed in another locality in New York State that

paid with the individual’s, estate’s or trust’s periodic sales and

has a lower tax rate; or

use tax returns.

•

bring a service (such as an information service) into that

locality which you purchased in another locality in New York

If filing Form ST-141, do not include any sales or use tax liability

State that has a lower tax rate.

already reported and paid on a previously filed Form ST-141.

Include only sales and use tax liabilities not previously reported

However, you are not required to pay any additional local tax on

and paid.

any property or service that you bring into a locality in New York

State that you purchased outside that locality before you became

An individual, estate or trust not filing a New York State

a resident of that locality.

personal income tax return but that is filing Form ST-140 should

not include on Form ST-140 any sales or use tax liability for

Note: For purposes of these instructions, the word tax will be

the tax year already reported and paid on a previously filed

used to refer to either the sales tax or the use tax, or both.

Form ST-141. Include only sales and use tax liabilities for the tax

year not previously reported and paid.

Who is a New York State resident for

An individual, estate or trust that is filing a New York State

sales and use tax purposes?

personal income tax return should not include on such return

For sales and use tax purposes, the definition of resident

any sales or use tax liability for the tax year previously reported

includes persons who may not be considered residents

and paid using Form ST-141. In completing the personal income

for personal income tax purposes. For example, persons

tax return, include only sales and use tax liabilities for the tax

maintaining a permanent place of abode in New York who

year not previously reported and paid. For more information,

do not spend more than 183 days a year in the state, college

see the instructions applicable to the personal income tax return

students, and military personnel may all be residents for sales

being filed.

and use tax purposes even if they are not residents for income

Businesses, such as corporations, partnerships, limited liability

tax purposes. For sales and use tax purposes, an individual

companies and limited liability partnerships operating in

is a resident of the state and of any locality in which he or she

New York State that are not registered or required to register for

maintains a permanent place of abode. A permanent place of

sales tax purposes must report their sales and use tax liability by

abode is a dwelling place maintained by a person, or by another

filing Form ST-130, Business Purchaser’s Report of Sales and

for that person to use, whether or not owned by such person,

Use Tax.

on other than a temporary or transient basis. The dwelling may

be a home, apartment or flat; a room including a room at a

When do you owe sales or use tax?

hotel, motel, boarding house, or club; a room at a residence

hall operated by an educational, charitable or other institution;

Deliveries into New York State

housing provided by the armed forces of the United States,

You owe state and local sales or use tax if you:

whether the housing is located on or off a military base or

•

purchase property or a service which is delivered to you in

reservation; or a trailer, mobile home, houseboat, or any other

New York State without payment of New York State and local

premises. This includes second homes. Therefore, you can be a

tax to the seller, such as through the Internet, by catalog, from

resident of more than one locality and state for sales and use tax

television shopping channels, or on an Indian reservation.

purposes.

An individual doing business in New York State is a resident

Purchases outside New York State with subsequent

for sales and use tax purposes of the state and of any county

use in New York State

or city in which the individual is doing business, with respect to

You may also owe state and local sales or use tax if you are

purchases of taxable property or services used in the business.

a resident of New York State at the time of purchase and you

Therefore, if an individual is engaged in business in New York

purchase any of the following outside the state:

State but has no permanent place of abode in New York State,

•

the individual will owe use tax only on taxable purchases made

property you bring into New York State for use here;

with respect to the business operated in New York.

•

a service performed on property outside New York State and

you bring that property into New York State for use here; or

An estate or trust that is carrying on a business, trade,

•

profession, or employment in New York State is a resident of

a service (such as an information service) you bring into

the state and of any county or city in which the estate or trust

New York State for use here.

is carrying on these activities, with respect to purchases of

property or services used in these activities.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4