Early Release Copies Of The 2010 Percentage Method Income Tax Withholding And Advance Earned Income Credit Payment Tables Worksheet

ADVERTISEMENT

Department of the Treasury

Notice 1036

Internal Revenue Service

(Rev. November 2009)

Withholding Adjustment for Nonresident

Early Release Copies of the 2010

Aliens

Percentage Method Income Tax

For 2010, a new procedure applies for figuring the

Withholding and Advance Earned

amount of income tax to withhold from the wages of

nonresident alien employees performing services within

Income Credit Payment Tables

the United States. This procedure requires use of a new

chart and new tables in addition to the withholding tables

used to figure income tax withholding on other

Attached are early release copies of tables that will

employees. The new chart appears below and the new

appear in Publication 15 (Circular E), Employer’s Tax

tables are on the next to last page of this notice.

Guide (for use in 2010). Publication 15 (Circular E) will

be mailed to employers and available at IRS offices in

Instructions. To figure how much income tax to

December.

withhold from the wages paid a nonresident alien

employee performing services in the United States, use

Percentage Method Income Tax

the following steps.

Withholding Tables

Note. Nonresident alien students from India and

The wage amounts shown in the Percentage Method

business apprentices from India are subject to special

Income Tax Withholding Tables are net wages after the

rules. See Publication 15 (Circular E) for more details.

deduction for total withholding allowances. The

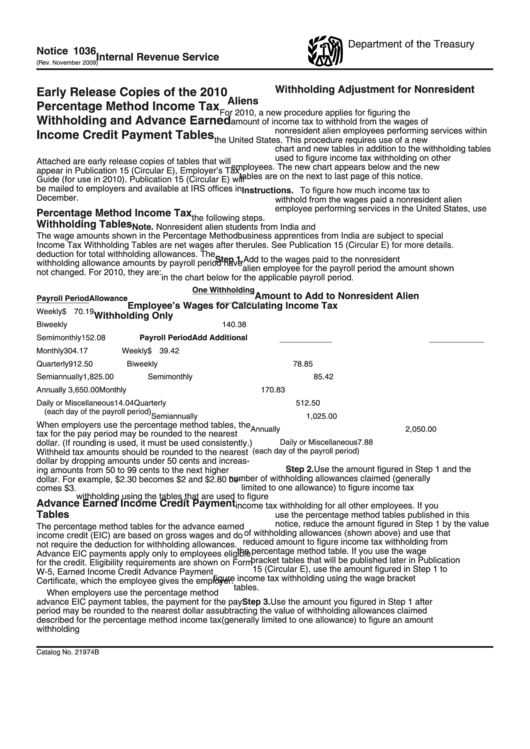

Step 1. Add to the wages paid to the nonresident

withholding allowance amounts by payroll period have

alien employee for the payroll period the amount shown

not changed. For 2010, they are:

in the chart below for the applicable payroll period.

One Withholding

Amount to Add to Nonresident Alien

Payroll Period

Allowance

Employee’s Wages for Calculating Income Tax

Weekly

$ 70.19

Withholding Only

Biweekly

140.38

Semimonthly

152.08

Payroll Period

Add Additional

Monthly

304.17

Weekly

$ 39.42

Quarterly

912.50

Biweekly

78.85

Semiannually

1,825.00

Semimonthly

85.42

Annually

3,650.00

Monthly

170.83

Daily or Miscellaneous

14.04

Quarterly

512.50

(each day of the payroll period)

Semiannually

1,025.00

When employers use the percentage method tables, the

Annually

2,050.00

tax for the pay period may be rounded to the nearest

Daily or Miscellaneous

7.88

dollar. (If rounding is used, it must be used consistently.)

(each day of the payroll period)

Withheld tax amounts should be rounded to the nearest

dollar by dropping amounts under 50 cents and increas-

Step 2. Use the amount figured in Step 1 and the

ing amounts from 50 to 99 cents to the next higher

number of withholding allowances claimed (generally

dollar. For example, $2.30 becomes $2 and $2.80 be-

limited to one allowance) to figure income tax

comes $3.

withholding using the tables that are used to figure

Advance Earned Income Credit Payment

income tax withholding for all other employees. If you

Tables

use the percentage method tables published in this

notice, reduce the amount figured in Step 1 by the value

The percentage method tables for the advance earned

of withholding allowances (shown above) and use that

income credit (EIC) are based on gross wages and do

reduced amount to figure income tax withholding from

not require the deduction for withholding allowances.

the percentage method table. If you use the wage

Advance EIC payments apply only to employees eligible

bracket tables that will be published later in Publication

for the credit. Eligibility requirements are shown on Form

15 (Circular E), use the amount figured in Step 1 to

W-5, Earned Income Credit Advance Payment

figure income tax withholding using the wage bracket

Certificate, which the employee gives the employer.

tables.

When employers use the percentage method

advance EIC payment tables, the payment for the pay

Step 3. Use the amount you figured in Step 1 after

period may be rounded to the nearest dollar as

subtracting the value of withholding allowances claimed

described for the percentage method income tax

(generally limited to one allowance) to figure an amount

withholding tables.

from the Tables for Withholding Adjustment for

Catalog No. 21974B

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8