Draft Excerpts From Form 1040 Family Of Instructions (Including Schedule Instructions) Page 24

ADVERTISEMENT

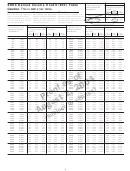

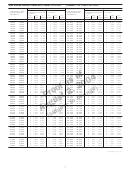

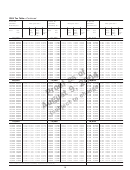

Form 1040A — Line 28

Alternative Minimum Tax Worksheet—Line 28

Keep for Your Records

Before you begin:

Figure the tax you would enter on Form 1040A, line 28, if you do not owe this tax.

1. Enter the amount from Form 1040A, line 22 . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

2. Enter the amount shown below for your filing status.

•

Single or head of household — $40,250

}

•

Married filing jointly or qualifying widow(er) — $58,000

. . . . . . .

2.

•

Married filing separately — $29,000

3. Subtract line 2 from line 1. If zero or less, stop here; you do not owe this tax . .

3.

4. Enter the amount shown below for your filing status.

•

Single or head of household — $112,500

}

•

Married filing jointly or qualifying

. . .

4.

widow(er) — $150,000

•

Married filing separately — $75,000

5. Subtract line 4 from line 1. If zero or less, enter -0- here

and on line 6, and go to line 7. . . . . . . . . . . . . . . . . . . .

5.

6. Multiply line 5 by 25% (.25) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

7. Add lines 3 and 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8. If line 7 is $175,000 or less ($87,500 or less if married

filing separately), multiply line 7 by 26% (.26).

Otherwise, multiply line 7 by 28% (.28) and subtract

$3,500 ($1,750 if married filing separately) from the

result . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

9. Did you use the Qualified Dividends and Capital Gain

Tax Worksheet on page 34 to figure the tax on the

amount on Form 1040A, line 27?

No.

Skip lines 9 through 20; enter the amount from

line 8 on line 21 and go to line 22.

Yes. Enter the amount from line 4 of that

worksheet . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

10. Enter the smaller of line 7 or line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10.

11. Subtract line 10 from line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.

12. If line 11 is $175,000 or less ($87,500 or less if married filing separately), multiply line 11 by 26%

(.26). Otherwise, multiply line 11 by 28% (.28) and subtract $3,500 ($1,750 if married filing separately)

from the result . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12.

13. Enter the smaller of line 7 or:

•

$58,100 if married filing jointly or qualifying widow(er),

•

$29,050 if single or married filing separately, or

•

$38,900 if head of household . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13.

14. Enter the amount from line 5 of the Qualified Dividends and Capital Gain Tax

Worksheet on page 34 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14.

15. Subtract line 14 from line 13. If zero or less, enter -0- . . . . . . . . . . . . . . . . . . .

15.

16. Enter the smaller of line 10 or line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16.

17. Multiply line 16 by 5% (.05) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17.

18. Subtract line 16 from line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18.

19. Multiply line 18 by 15% (.15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19.

20. Add lines 12, 17, and 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20.

21. Enter the smaller of line 8 or line 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21.

22. Enter the amount you would enter on Form 1040A, line 28, if you do not owe this tax . . . . . . . . . . . . .

22.

23. Alternative minimum tax. Is the amount on line 21 more than the amount on line 22?

No.

You do not owe this tax.

Yes. Subtract line 22 from line 21. Also include this amount in the total on Form 1040A, line 28.

Enter “AMT” and show the amount in the space to the left of line 28 . . . . . . . . . . . . . . . . . .

23.

24

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25