PRINT

CLEAR

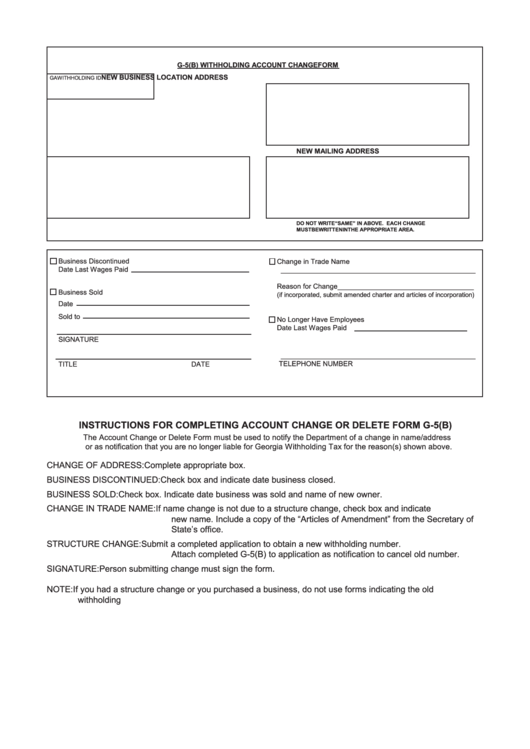

G-5(B) WITHHOLDING ACCOUNT CHANGE FORM

NEW BUSINESS LOCATION ADDRESS

GA WITHHOLDING ID

NEW MAILING ADDRESS

DO NOT WRITE “SAME” IN ABOVE. EACH CHANGE

MUST BE WRITTEN IN THE APPROPRIATE AREA.

Business Discontinued

Change in Trade Name

Date Last Wages Paid

__________________________________________________

Reason for Change ___________________________________

Business Sold

(if incorporated, submit amended charter and articles of incorporation)

Date

Sold to

No Longer Have Employees

Date Last Wages Paid

SIGNATURE

__________________________________________________

TELEPHONE NUMBER

TITLE

DATE

INSTRUCTIONS FOR COMPLETING ACCOUNT CHANGE OR DELETE FORM G-5(B)

The Account Change or Delete Form must be used to notify the Department of a change in name/address

or as notification that you are no longer liable for Georgia Withholding Tax for the reason(s) shown above.

CHANGE OF ADDRESS:

Complete appropriate box.

BUSINESS DISCONTINUED:

Check box and indicate date business closed.

BUSINESS SOLD:

Check box. Indicate date business was sold and name of new owner.

CHANGE IN TRADE NAME:

If name change is not due to a structure change, check box and indicate

new name. Include a copy of the “Articles of Amendment” from the Secretary of

State’s office.

STRUCTURE CHANGE:

Submit a completed application to obtain a new withholding number.

Attach completed G-5(B) to application as notification to cancel old number.

SIGNATURE:

Person submitting change must sign the form.

NOTE: If you had a structure change or you purchased a business, do not use forms indicating the old

withholding number. Doing so could cause incorrect posting of your payments.

1

1