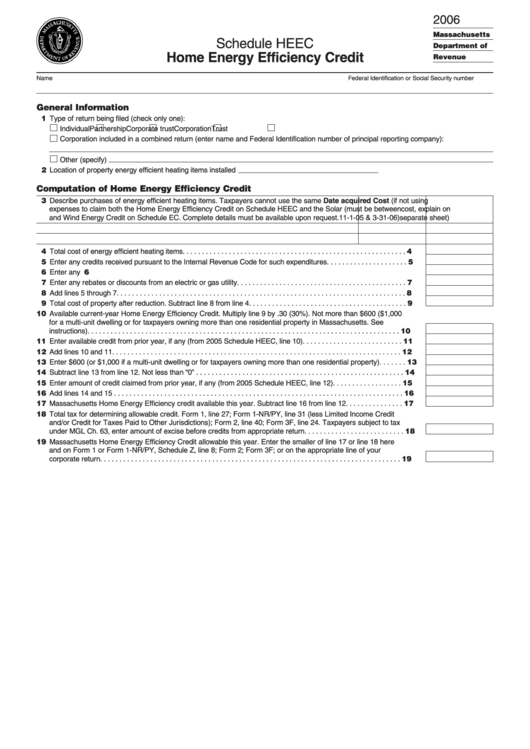

Schedule Heec - Home Energy Efficiency Credit Form - Massachusetts Department Of Revenue

ADVERTISEMENT

2006

Massachusetts

Schedule HEEC

Department of

Home Energy Efficiency Credit

Revenue

Name

Federal Identification or Social Security number

General Information

11 Type of return being filed (check only one):

Individual

Partnership

Corporate trust

Corporation

Trust

Corporation included in a combined return (enter name and Federal Identification number of principal reporting company):

Other (specify)

12 Location of property energy efficient heating items installed

Computation of Home Energy Efficiency Credit

13 Describe purchases of energy efficient heating items. Taxpayers cannot use the same

Date acquired

Cost (if not using

expenses to claim both the Home Energy Efficiency Credit on Schedule HEEC and the Solar

(must be between

cost, explain on

and Wind Energy Credit on Schedule EC. Complete details must be available upon request.

11-1-05 & 3-31-06)

separate sheet)

14 Total cost of energy efficient heating items . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

15 Enter any credits received pursuant to the Internal Revenue Code for such expenditures . . . . . . . . . . . . . . . . . . . . . 5

16 Enter any U.S. HUD grant or rebate for such expenditures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

17 Enter any rebates or discounts from an electric or gas utility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

18 Add lines 5 through 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

19 Total cost of property after reduction. Subtract line 8 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Available current-year Home Energy Efficiency Credit. Multiply line 9 by .30 (30%). Not more than $600 ($1,000

for a multi-unit dwelling or for taxpayers owning more than one residential property in Massachusetts. See

instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Enter available credit from prior year, if any (from 2005 Schedule HEEC, line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Add lines 10 and 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Enter $600 (or $1,000 if a multi-unit dwelling or for taxpayers owning more than one residential property) . . . . . . . 13

14 Subtract line 13 from line 12. Not less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Enter amount of credit claimed from prior year, if any (from 2005 Schedule HEEC, line 12) . . . . . . . . . . . . . . . . . . 15

16 Add lines 14 and 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Massachusetts Home Energy Efficiency credit available this year. Subtract line 16 from line 12 . . . . . . . . . . . . . . . 17

18 Total tax for determining allowable credit. Form 1, line 27; Form 1-NR/PY, line 31 (less Limited Income Credit

and/or Credit for Taxes Paid to Other Jurisdictions); Form 2, line 40; Form 3F, line 24. Taxpayers subject to tax

under MGL Ch. 63, enter amount of excise before credits from appropriate return . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Massachusetts Home Energy Efficiency Credit allowable this year. Enter the smaller of line 17 or line 18 here

and on Form 1 or Form 1-NR/PY, Schedule Z, line 8; Form 2; Form 3F; or on the appropriate line of your

corporate return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1