Form Pet 357 - Governmental Sales Claim For Refund - Tennessee Department Of Revenue - 2016 Page 2

ADVERTISEMENT

For additional information, contact the Taxpayer Services Division in one of our Department of Revenue Offices:

Chattanooga

Jackson

Johnson City

Knoxville

Memphis

Nashville

(731) 423-5747

(423) 854-5321

(865) 594-6100

(901) 213-1400

(615) 253-0600

(423) 634-6266

Suite 340

204 High Point Drive

3150 Appling Road

Andrew Jackson Building

Suite 203

Suite 209

Bartlett, TN

500 Deaderick Street

1301 Riverfront

Lowell Thomas Building

State Office Building

Parkway

225 Martin Luther King Blvd.

7175 Strawberry Plains Pike

Tennessee residents can also call our statewide toll free number at 1-800-342-1003.

Out-of-state callers must dial (615) 253-0600.

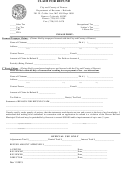

DATE

INVOICE

SOLD

NUMBER

AGENCY

PERMIT NO.

NO. OF GALLONS

Gasoline

Undyed Diesel All Other Fuels

Column A

Column B

Column C

______

___________

_____________________

____________

__________

____________

__________

______

___________

_____________________

____________

__________

____________

__________

______

___________

_____________________

____________

__________

____________

__________

______

___________

_____________________

____________

__________

____________

__________

______

___________

_____________________

____________

__________

____________

__________

______

___________

_____________________

____________

__________

____________

__________

______

___________

_____________________

____________

__________

____________

__________

______

___________

_____________________

____________

__________

____________

__________

Totals __________

____________

__________

DIRECTIONS FOR COMPLETION OF GOVERNMENTAL CLAIM FOR REFUND

GENERAL INFORMATION

Section 67-3-413 provides that a licensed wholesaler who has paid any taxes and fees due under 67-3-201, 67-3-202, 67-3-203, and 67-

3-204, may apply for a refund of taxes or fees paid on any petroleum products subsequently sold free of tax to a governmental agency

holding an exemption permit issued by the Commissioner. A licensed supplier or importer may claim a credit on the distributor report for

any taxes or fees paid on any petroleum products sold free of tax to a governmental agency, or may in the alternative file for a refund.

For sales of petroleum products made to governmental agencies from retail stations, the licensed wholesaler, supplier or importer may

apply for refund or claim a credit on behalf of a retail vendor.

An application for refund or credit shall be filed with the Commissioner, on forms prescribed by the Commissioner, on or before the

last day of the second month following the month in which the exempt sales were made. All sales in any month on which a refund is

due shall be included in one (1) application for refund. One omnibus claim may be filed after January 1 and before July 1 for any

exempt sales made during the previous calendar year for which a claim has not been made.

The account number blank on the front of the claim is generated by the Tennessee Department of Revenue. If you have filed a previous

Governmental Sales Claim for Refund and know the correct number, you may use it. Otherwise, leave this field blank.

Applications for refund or credit shall contain all information as required by the Commissioner. In addition, all applications must be

accompanied by copies of all invoices for sales on which the licensee is applying for refund or claiming a credit. The invoices submit-

ted with any such application shall each contain the exemption permit number for the governmental agency to which the sales were

made. The Commissioner may allow computer documentation instead of invoices.

INSTRUCTIONS

In the upper portion of the claim enter the date the product was sold, the invoice number, the name of the governmental agency, the

agency’s permit number, and the number of gallons sold by product type.

COMPUTATION OF REFUND

Line 1 Gasoline Tax - Multiply the gasoline gallons from Column A by the tax rate and enter result.

Line 2 Diesel Tax - Multiply the diesel gallons from Column B by the tax rate and enter result.

Line 3 Special Tax - Multiply the total gallons from Columns A, B and C by the tax rate and enter result.

Line 4 Environmental Assurance Fee - Multiply the total gallons from Columns A, B and C by the tax rate and enter result.

Line 5 Total Refund Due - Add lines 1, 2, 3 and 4.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2