Form Pet 354 - Specialized Equipment Claim For Refund - Tennessee Department Of Revenue

ADVERTISEMENT

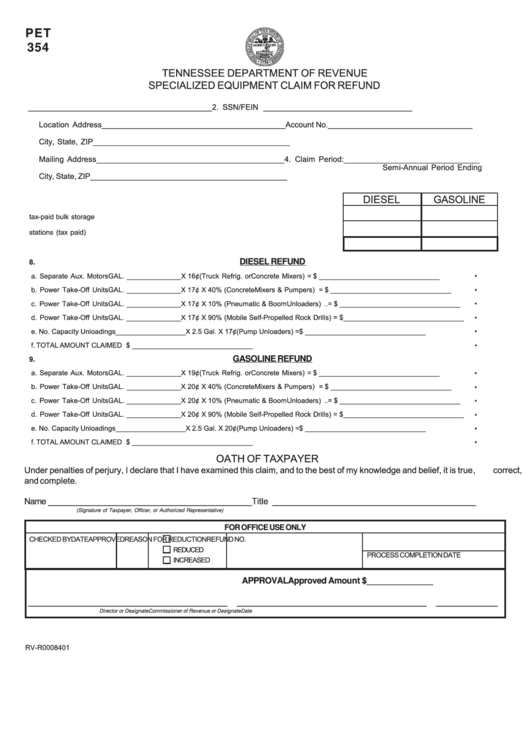

PET

354

TENNESSEE DEPARTMENT OF REVENUE

SPECIALIZED EQUIPMENT CLAIM FOR REFUND

1. Name of Claimant __________________________________________

2. SSN/FEIN __________________________________

Location Address __________________________________________

Account No. _________________________________

City, State, ZIP _____________________________________________

3. Date of Claim _______________________________

Mailing Address ___________________________________________

4. Claim Period: _______________________________

Semi-Annual Period Ending

City, State, ZIP _____________________________________________

DIESEL

GASOLINE

5. Total gallons from tax-paid bulk storage ..........................................................................................

6. Total gallons purchased from service stations (tax paid) ..............................................................

7. TOTAL GALLONS .............................................................................................................................

DIESEL REFUND

8.

.

a. Separate Aux. Motors GAL. ______________ X 16¢ ................ (Truck Refrig. or Concrete Mixers) ..... = $ _______________________________

.

b. Power Take-Off Units GAL. ______________ X 17¢ X 40% .... (Concrete Mixers & Pumpers) ............. = $ _______________________________

.

c. Power Take-Off Units GAL. ______________ X 17¢ X 10% .... (Pneumatic & Boom Unloaders) ........... = $ _______________________________

.

d. Power Take-Off Units GAL. ______________ X 17¢ X 90% .... (Mobile Self-Propelled Rock Drills) ....... = $ _______________________________

.

e. No. Capacity Unloadings __________________ X 2.5 Gal. X 17¢ (Pump Unloaders) ................................ = $ _______________________________

.

f. TOTAL AMOUNT CLAIMED ...............................................................................................................................

$ _______________________________

GASOLINE REFUND

9.

.

a. Separate Aux. Motors GAL. ______________ X 19¢ ................ (Truck Refrig. or Concrete Mixers) ..... = $ _______________________________

.

b. Power Take-Off Units GAL. ______________ X 20¢ X 40% .... (Concrete Mixers & Pumpers) ............. = $ _______________________________

.

c. Power Take-Off Units GAL. ______________ X 20¢ X 10% .... (Pneumatic & Boom Unloaders) ........... = $ _______________________________

.

d. Power Take-Off Units GAL. ______________ X 20¢ X 90% .... (Mobile Self-Propelled Rock Drills) ....... = $ _______________________________

.

e. No. Capacity Unloadings __________________ X 2.5 Gal. X 20¢ (Pump Unloaders) ................................ = $ _______________________________

.

f. TOTAL AMOUNT CLAIMED ...............................................................................................................................

$ _______________________________

OATH OF TAXPAYER

Under penalties of perjury, I declare that I have examined this claim, and to the best of my knowledge and belief, it is true, correct,

and complete.

Name ___________________________________________

Title ___________________________________________

(Signature of Taxpayer, Officer, or Authorized Representative)

FOR OFFICE USE ONLY

CHECKED BY

DATE

APPROVED

REASON FOR REDUCTION

REFUND NO.

REDUCED

PROCESS COMPLETION DATE

INCREASED

APPROVAL

Approved Amount $ ______________

__________________________________________

________________________________________

_____________

Director or Designate

Commissioner of Revenue or Designate

Date

RV-R0008401

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2