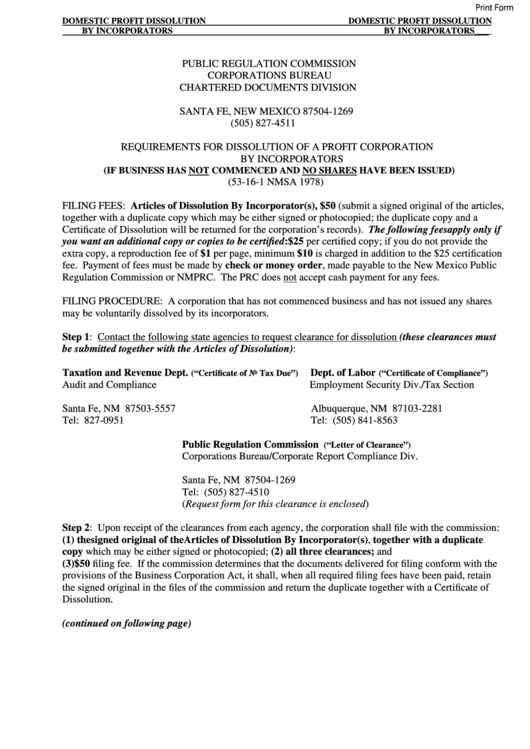

Print Form

DOMESTIC PROFIT DISSOLUTION

DOMESTIC PROFIT DISSOLUTION

BY INCORPORATORS

BY INCORPORATORS____

PUBLIC REGULATION COMMISSION

CORPORATIONS BUREAU

CHARTERED DOCUMENTS DIVISION

P.O. BOX 1269

SANTA FE, NEW MEXICO 87504-1269

(505) 827-4511

REQUIREMENTS FOR DISSOLUTION OF A PROFIT CORPORATION

BY INCORPORATORS

(IF BUSINESS HAS NOT COMMENCED AND NO SHARES HAVE BEEN ISSUED)

(53-16-1 NMSA 1978)

FILING FEES: Articles of Dissolution By Incorporator(s), $50 (submit a signed original of the articles,

together with a duplicate copy which may be either signed or photocopied; the duplicate copy and a

Certificate of Dissolution will be returned for the corporation’s records). The following fees apply only if

you want an additional copy or copies to be certified: $25 per certified copy; if you do not provide the

extra copy, a reproduction fee of $1 per page, minimum $10 is charged in addition to the $25 certification

fee. Payment of fees must be made by check or money order, made payable to the New Mexico Public

Regulation Commission or NMPRC. The PRC does not accept cash payment for any fees.

FILING PROCEDURE: A corporation that has not commenced business and has not issued any shares

may be voluntarily dissolved by its incorporators.

Step 1: Contact the following state agencies to request clearance for dissolution (these clearances must

be submitted together with the Articles of Dissolution):

Taxation and Revenue Dept.

Dept. of Labor

(“Certificate of No Tax Due”)

(“Certificate of Compliance”)

Audit and Compliance

Employment Security Div./Tax Section

P.O. Box 5557

P.O. Box 2281

Santa Fe, NM 87503-5557

Albuquerque, NM 87103-2281

Tel: 827-0951

Tel: (505) 841-8563

Public Regulation Commission

(“Letter of Clearance”)

Corporations Bureau/Corporate Report Compliance Div.

P.O. Box 1269

Santa Fe, NM 87504-1269

Tel: (505) 827-4510

(Request form for this clearance is enclosed)

Step 2: Upon receipt of the clearances from each agency, the corporation shall file with the commission:

(1) the signed original of the Articles of Dissolution By Incorporator(s), together with a duplicate

copy which may be either signed or photocopied; (2) all three clearances; and

(3) $50 filing fee. If the commission determines that the documents delivered for filing conform with the

provisions of the Business Corporation Act, it shall, when all required filing fees have been paid, retain

the signed original in the files of the commission and return the duplicate together with a Certificate of

Dissolution.

(continued on following page)

1

1 2

2 3

3 4

4 5

5