Form Tc-763 - Surety Bond For Fuel Taxes 1999

ADVERTISEMENT

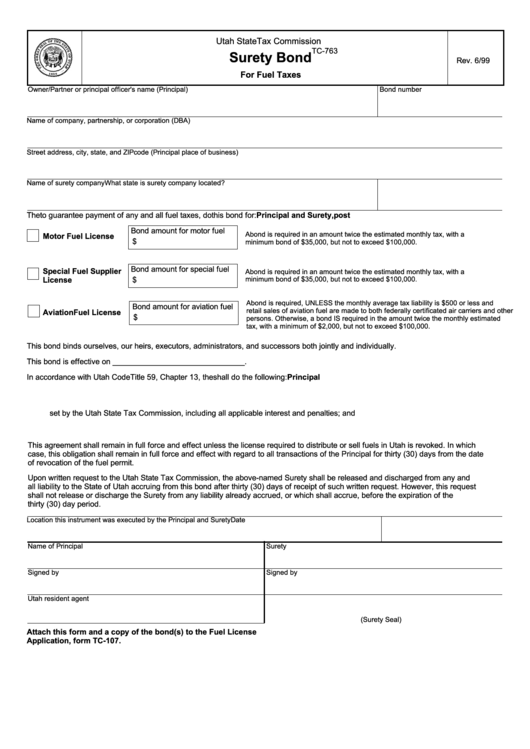

Utah State Tax Commission

TC-763

Surety Bond

Rev. 6/99

For Fuel Taxes

Owner/Partner or principal officer's name (Principal)

Bond number

Name of company, partnership, or corporation (DBA)

Street address, city, state, and ZIP code (Principal place of business)

Name of surety company

What state is surety company located?

The

Principal and Surety,

to guarantee payment of any and all fuel taxes, do

post

this bond for:

Bond amount for motor fuel

A bond is required in an amount twice the estimated monthly tax, with a

Motor Fuel License

$

minimum bond of $35,000, but not to exceed $100,000.

Bond amount for special fuel

Special Fuel Supplier

A bond is required in an amount twice the estimated monthly tax, with a

License

$

minimum bond of $35,000, but not to exceed $100,000.

A bond is required, UNLESS the monthly average tax liability is $500 or less and

Bond amount for aviation fuel

retail sales of aviation fuel are made to both federally certificated air carriers and other

Aviation Fuel License

$

persons. Otherwise, a bond IS required in the amount twice the monthly estimated

tax, with a minimum of $2,000, but not to exceed $100,000.

This bond binds ourselves, our heirs, executors, administrators, and successors both jointly and individually.

This bond is effective on _______________________________.

In accordance with Utah Code Title 59, Chapter 13, the

Principal

shall do the following:

1. File true and timely reports as required of suppliers and/or distributors of fuels as specified by law.

2. Pay to the Utah State Tax Commission all taxes specified by the fuel tax laws of Utah in the manner

set by the Utah State Tax Commission, including all applicable interest and penalties; and

3. Perform all the requirements of Utah law regarding the fuel tax laws and rules of the Utah State Tax Commission.

This agreement shall remain in full force and effect unless the license required to distribute or sell fuels in Utah is revoked. In which

case, this obligation shall remain in full force and effect with regard to all transactions of the Principal for thirty (30) days from the date

of revocation of the fuel permit.

Upon written request to the Utah State Tax Commission, the above-named Surety shall be released and discharged from any and

all liability to the State of Utah accruing from this bond after thirty (30) days of receipt of such written request. However, this request

shall not release or discharge the Surety from any liability already accrued, or which shall accrue, before the expiration of the

thirty (30) day period.

Location this instrument was executed by the Principal and Surety

Date

Name of Principal

Surety

Signed by

Signed by

Utah resident agent

(Surety Seal)

Attach this form and a copy of the bond(s) to the Fuel License

Application, form TC-107.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1