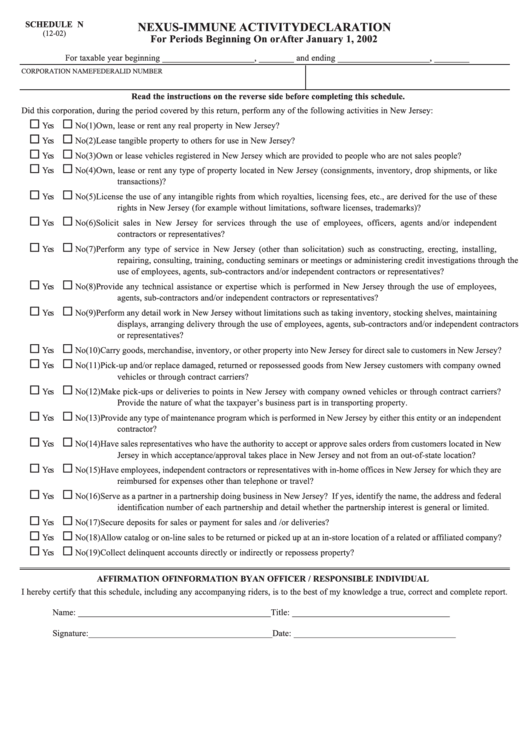

SCHEDULE N

NEXUS-IMMUNE ACTIVITY DECLARATION

(12-02)

For Periods Beginning On or After January 1, 2002

For taxable year beginning _____________________, ________ and ending _____________________, ________

CORPORATION NAME

FEDERAL ID NUMBER

Read the instructions on the reverse side before completing this schedule.

Did this corporation, during the period covered by this return, perform any of the following activities in New Jersey:

Yes

No

(1) Own, lease or rent any real property in New Jersey?

Yes

No

(2) Lease tangible property to others for use in New Jersey?

Yes

No

(3) Own or lease vehicles registered in New Jersey which are provided to people who are not sales people?

Yes

No

(4) Own, lease or rent any type of property located in New Jersey (consignments, inventory, drop shipments, or like

transactions)?

Yes

No

(5) License the use of any intangible rights from which royalties, licensing fees, etc., are derived for the use of these

rights in New Jersey (for example without limitations, software licenses, trademarks)?

Yes

No

(6) Solicit sales in New Jersey for services through the use of employees, officers, agents and/or independent

contractors or representatives?

Yes

No

(7) Perform any type of service in New Jersey (other than solicitation) such as constructing, erecting, installing,

repairing, consulting, training, conducting seminars or meetings or administering credit investigations through the

use of employees, agents, sub-contractors and/or independent contractors or representatives?

Yes

No

(8) Provide any technical assistance or expertise which is performed in New Jersey through the use of employees,

agents, sub-contractors and/or independent contractors or representatives?

Yes

No

(9) Perform any detail work in New Jersey without limitations such as taking inventory, stocking shelves, maintaining

displays, arranging delivery through the use of employees, agents, sub-contractors and/or independent contractors

or representatives?

Yes

No

(10) Carry goods, merchandise, inventory, or other property into New Jersey for direct sale to customers in New Jersey?

Yes

No

(11) Pick-up and/or replace damaged, returned or repossessed goods from New Jersey customers with company owned

vehicles or through contract carriers?

Yes

No

(12) Make pick-ups or deliveries to points in New Jersey with company owned vehicles or through contract carriers?

Provide the nature of what the taxpayer’s business part is in transporting property.

Yes

No

(13) Provide any type of maintenance program which is performed in New Jersey by either this entity or an independent

contractor?

Yes

No

(14) Have sales representatives who have the authority to accept or approve sales orders from customers located in New

Jersey in which acceptance/approval takes place in New Jersey and not from an out-of-state location?

Yes

No

(15) Have employees, independent contractors or representatives with in-home offices in New Jersey for which they are

reimbursed for expenses other than telephone or travel?

Yes

No

(16) Serve as a partner in a partnership doing business in New Jersey? If yes, identify the name, the address and federal

identification number of each partnership and detail whether the partnership interest is general or limited.

Yes

No

(17) Secure deposits for sales or payment for sales and /or deliveries?

Yes

No

(18) Allow catalog or on-line sales to be returned or picked up at an in-store location of a related or affiliated company?

Yes

No

(19) Collect delinquent accounts directly or indirectly or repossess property?

AFFIRMATION OF INFORMATION BY AN OFFICER / RESPONSIBLE INDIVIDUAL

I hereby certify that this schedule, including any accompanying riders, is to the best of my knowledge a true, correct and complete report.

Name: ____________________________________________

Title: ____________________________________

Signature:__________________________________________

Date: _____________________________________

1

1